Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future.

Download the PDF

May 3, 2023

Like UConn’s WBB, Our Luck Ran Out

For years, our reporting on our drive from Houston to our summer home in Rhode Island has been of keen interest to readers of Energy Musings because it provides a critical glimpse into current economic conditions. Turmoil is the best description of what we experienced on the drive. READ MORE

A Good April For Energy Quickly Reversed In May

Higher oil prices in April drove the Energy sector in the S&P 500 Index to a strong performance. The sector finished third, the first time this year it has been at the top of the sector rankings. May has started with falling oil prices and the Energy sector has followed the commodity lower. READ MORE

‘The Unpopular Truth’ Tells The Truth About Clean Energy

This is a review of a sobering book looking at the limitations of the energy transition and the misunderstandings of policymakers that produce bad rules and mandates. We recommend the book by an experienced energy economist and commodity trader for his insights. The review was previously published on MasterResource.org. READ MORE

Like UConn’s WBB, Our Luck Ran Out

Geno Auriemma, the University of Connecticut women’s basketball coach, described the 2022-23 season that ended with the team losing in the Sweet Sixteen, short of its goal of reaching the Final Four for the 15th time, as challenging. He lauded the successes the team achieved given the rash of injuries sustained. He noted that during the prior decade, UConn never experienced so many injuries. The team played shorthanded all season, having lost its star player and top freshman before the season began. Injuries forced constant line-up changes and even a postponement since there were not seven healthy players. Auriemma said their luck had run out.

As UConn alumni and avid WBB supporters, my wife and I felt like Auriemma during our annual drive from Houston to Rhode Island. It was the worst trip we have experienced in years. We spent hours sitting in traffic, dealt with downpours and slowing speeds, had unusual food experiences, were challenged to find our hotel, and even had to sit in the car until the rain let up when we arrived in Rhode Island.

Twice Saturday morning we were forced to exit I-10 due to weekend construction. Those interruptions cost over two hours of driving. Later that night, we encountered the clean-up from a truck accident that forced all traffic to move into one lane. Another 45-minute delay. Sunday, in northern Virginia, a truck accident shut down the entire highway. We sat and crawled the 10 miles to the accident site. When we reached it, one and a half hours later, we were surprised to find no emergency workers or vehicles after such an accident. There was less damage than we imagined, and it was just the time needed to drag the truck off the road.

On the Texas/Louisiana stretch of the trip, there were few trucks, however, they showed as we exited the freeway. Truck traffic began building as we headed north on I-59, and the truck traffic became heavier the further north we traveled. On Sunday, as we left Knoxville, Tennessee, there were many trucks early in the morning. We noticed the Tennessee truck stops were largely full, and those in Virginia were overflowing. The greatest shock was how many trucks were parked along the freeway before and after a New Jersey truck stop, which was full. By then it was late on Sunday night, so the congestion was not a complete surprise.

Another surprise was how heavy Sunday’s traffic was. Where did everyone come from? We did not think it was graduation time, and certainly not a football weekend, but a large number of travelers impacted our hotel selection. As usual, we pick our stopping point at dinner. We chose Knoxville, as we were trying to cover as much distance as possible on the first day, knowing we were never going to reach our normal stopping point. We chose the Hampton Inn in north Knoxville but were offered a single room choice. It turns out the hotel was full and closer Hampton Inns were already booked by 7 pm.

Because of highway route changes on the way to the hotel, our navigation system kept us in a loop, forcing us to make several U-turns. We finally called the hotel and got directions. As a result of our delays, we did not arrive until 1 am Central time Sunday, or 2 am Eastern time. We were back on the road at 7:45 am. With the truck traffic, the accident backup, and torrential rains periodically, we did not reach our Rhode Island home until midnight.

We were confused by the highway traffic and our other travel experiences. The heavy truck traffic from Mississippi to Connecticut was a surprise given the news stories about diesel demand being down. Every truck stop appeared to be full. However, whenever we stopped for gasoline or food, there were no crowds. Labor was the bigger problem. At our McDonald’s stop on Saturday, the cooks could not get the order right, even with it written in large type and attached to the food carton. We wondered if a robot would have been more accurate.

The labor problem complicated our dinner that night. We stopped at a Cracker Barrel in Tuscaloosa, Alabama, at 6 pm and saw numerous people sitting on chairs outside and one family playing baseball in the parking lot. Inside, half the restaurant was empty, but the hostess told us it would be a 35-40-minute wait to be seated. Lack of staff? We jumped into the car and headed to Bessemer where we ordered dinner 40 minutes later at another Cracker Barrel. Unfortunately, the cooks needed training as the food was below the quality we usually experience. We did, however, have a colorful waiter that made up partially for the disappointing meal. We also discovered that a gift card we had been given at Christmas had been hacked and was $8 short of the advertised value.

On Sunday, McDonald’s was out of soft ice cream, ending our milkshake lunch plans. That night, the Cracker Barrel cooks did a better job with our dinner food. Again, the restaurant was mostly empty, although it was 6 pm. The three Cracker Barrels we visited did not have many people shopping, another interesting point since that is where the chain makes a lot of money. We did not notice any alcohol promotions and wonder if the restaurant chain has phased out that experiment as too costly because few people drink and drive.

The weather was a constant worry. We knew before leaving that it was going to be a rainy weekend both along the Gulf Coast portion of the route and then in the mid-Atlantic and Northeast regions. We were not disappointed. When we exited I-12 onto I-59 at Slidell, Louisiana, the sky to the north was black and blacker. Within minutes we were in a white-out from the downpouring rain. The further north we drove, the intensity of the rain diminished, but we were constantly accompanied by rain showers, some heavy at times. Sunday was no different, especially the closer we got to Pennsylvania. The rain intensity built the further we drove through the state, and into New Jersey, New York, Connecticut, and Rhode Island.

We certainly hope we do not experience another drive like this one. For many of our prior trips, trip time was shortened as we encountered less construction and fewer accidents. Truck traffic has often been heavy, and traffic slowed when one truck decides to pass another.

Maybe our luck changed just as did the UConn WBB team’s luck, or possibly this trip was a sign of the economic turmoil we are in. Just like the economy, we will not know if things are better until we drive home in five months.

A Good April For Energy Quickly Reversed In May

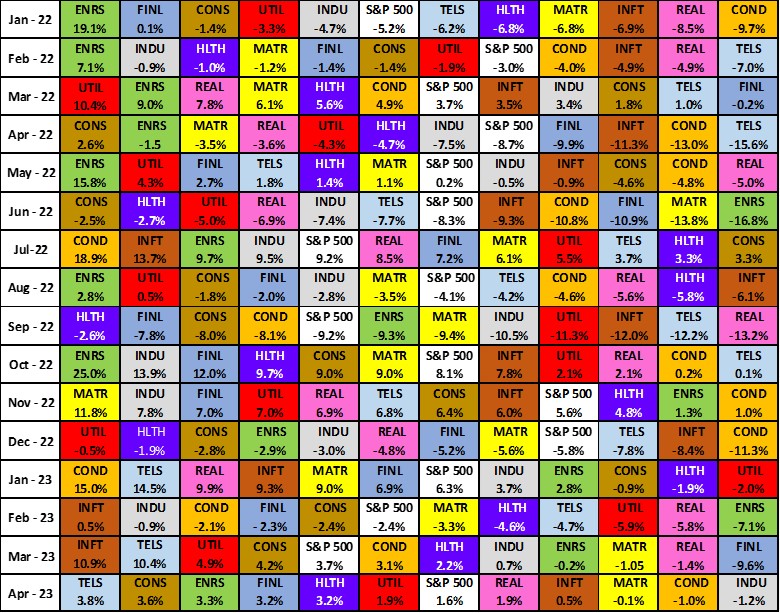

April was a welcome positive month for the Energy sector of the S&P 500 Index. Energy was the third-best performing sector of the index’s 11 sectors with a 3.30% gain, twice the performance of the S&P 500 Index, which gained 1.56%. Energy trailed Communication Services, which was the best-performing sector for March with a gain of 3.77%.

This was Energy’s second positive monthly performance in 2023 and its largest gain. Possibly more significant was that Energy was in the top three sectors after finishing in the bottom four during the first quarter months. This month’s performance was helped by a meaningful improvement in global oil prices. For April, the WTI oil price averaged $79.44 a barrel, more than a $6 per barrel increase over March’s $73.37 average. Such a large gain was driven by multiple days of $80+ per barrel oil prices. That all changed when the calendar flipped to May.

The Energy sector of the S&P 500 Index in April looked more like the performer it was in 2022. However, it is off to a bad start in May.

Oil prices had started sliding from the middle of April, with daily volatility increasing as we approached the end of the month. Concerns about another banking crisis were increasing during those days, which culminated with federal regulators seizing California’s First Republic Bank, the nation’s 14th largest bank, which became the third largest bank failure in history and the third bank to fail in March. Not surprisingly, the emerging banking crisis, despite public statements that the financial system is sound, was magnified by economic data showing further global economic weakening and fears we were on the cusp of a recession.

The fears contributed to Monday’s $1.12 a barrel drop, which was followed Tuesday with a $4 drop as economic data worsened and the Federal Reserve Board began meeting amid a debate over whether it should raise interest rates to continue the fight against inflation or pause to help prevent a worsening banking crisis and a recession. On Tuesday, Energy fell by slightly over 4% as oil prices were dropping by more than 5%. The decline continued on Wednesday as oil fell to $68, nearly a 5% drop, and Energy was the largest market laggard, falling almost 2%. What does the rest of May portend for Energy? We will be watching and maybe holding our breath.

‘

The Unpopular Truth’ Tells The Truth About Clean Energy

We recently finished reading The Unpopular Truth: about Electricity and the Future of Energy by Dr. Lars Schernikau and Professor William Hayden Smith. The authors address how the energy market works rather than how the mainstream media, environmental activists, and policymakers portray it. Not surprisingly, the book explores the misunderstandings of policymakers and their advisors about the workings of the electricity and energy systems. These misunderstandings have led, and if not changed, will continue leading to expensive and less reliable power. At the same time, these policies do less to decarbonize the world’s economy than policymakers believe, while reducing the future wealth and living standards of the world’s population.

Schernikau is an energy economist and commodity trader focused on energy raw materials, while Smith is a Professor of Earth and Planetary Sciences at the McDonnell Center for the Space Sciences at Washington University. At one point in his career, Schernikau worked for the Boston Consulting Group in Europe and North America, so he has been a strategic advisor to companies and governments. His training and real-world experience (trading commodities) provides him with the background to understand the weaknesses of the policies that are revamping our electricity system. By viewing the energy system transition exclusively through the prism of carbon emissions, policymakers embrace more expensive renewables that use more land and resources and leave the electricity system less reliable. Those weaknesses harm the policymakers’ constituents.

We were introduced to Schernikau via an early March Close of Business Tuesday podcast “Truth in Energy” conducted by Veriten, a knowledge and media platform focusing on energy, technology, and environmental trends hosted by Maynard Holt. As Veriten says on its website, “A central theme to all of Veriten’s efforts will be an evergreen analysis of ‘What will the energy world look like in ten years?’ In other words, how will today’s decisions and policies shape our future? For those interested in energy and its evolution (transition), the firm’s conversations prove enlightening because they dig into the numbers and technology challenges.

What we learned from Veriten’s conversation with Schernikau spurred us to order and read his book as well as read the scientific papers that provide the foundation for the book. Those papers deal with the full cost of electricity (FCOE) and energy returns on investment (eROI). These are key issues in building an energy system that is affordable, reliable, and clean – the primary concerns of consumers and policymakers.

Understanding Energy Misunderstandings

To understand the massive misunderstanding of the fundamentals of energy and electricity, Schernikau discussed the conclusions reached from 70 interviews over three years with various ministries, governmental economic organizations, universities, industrial conglomerates along with energy think tanks like the International Energy Agency (EIA), the Institute of Energy Economics, Japan (IEEJ), the International Monetary Fund (IMF), the ASEAN Center for Energy (ACE), and leading strategy consulting firms. “The overarching theme from these interviews was a lack of understanding of the true full cost of electricity and the continued misuse of the marginal cost measure LCOE to compare the cost of variable ‘renewables’ with conventional sources of power,” he wrote.

Schernikau also pointed out that the “overarching desire – especially in developing nations – was to support a sustainable yet economically viable energy policy to transition away from fossil fuels over time. The costs and downsides associated with this transition – limited by today’s technologies – were rarely understood or researched.” This is a huge indictment of energy advisors and the policymakers they are advising. Why? Because the energy system is more complex than people appreciate.

For most people, the power in their home comes from a wall plug or a light switch. How that power arrived and was immediately available when the switch was flipped, or a device was plugged in is unknown. Yet, the details behind the power are crucial to the decisions about what fuels are used and how they are employed. In the effort to make electricity simple to understand, the physical realities of energy generation, transmission, and storage are ignored, and popular solutions are based on fantasies. Moreover, no one ever asks those proposing revamps to our energy and electricity systems what the cost will be, how long it will take, and what are the downside risks in their recommended solutions. It is no surprise that in places like California or Germany that have embraced renewable energy as the only choice for their new power systems, consumers face the highest and fastest rising electricity costs. Moreover, this strategy has made power less reliable. Addressing these failures is what Schernikau and Smith explore in the book. With a 2023 publication date, it is the most up-to-date analysis of energy challenges. Ignoring the realities of energy and electricity will perpetuate the economic disasters we are experiencing.

Contact Allen Brooks:

gallenbrooks@gmail.com

www.energy-musings.com

EnergyMusings.substack.com