Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future.

July 19, 2023

IMO Pursues Carbon Emissions “Deal of the Decade”

The IMO’s recently completed a meeting where it agreed to a revised GHG emissions reduction plan, reaching net zero by about 2050. We explored some of the actions and challenges facing the global shipping industry. Green fuel technologies remain immature and expensive. Their use will boost global shipping costs when other remedies exist. Slow steaming, adding sails to assist propulsion, and increased use of compliant fuels will help reduce emissions. This industry remains difficult to decarbonize. Yielding to the demands of climate activists to accelerate the pace of cutting may lead to expensive mistakes, not just for shipping but for the world’s economy. READ MORE

IMO Pursues Carbon Emissions “Deal of the Decade”

Having failed to get on board with the 2015 Paris Climate Agreement, the United Nations International Maritime Organization (IMO) came under severe criticism. Instead of chasing CO2 emissions, the IMO elected to attack the shipping industry’s sulfur emissions problem first, recognizing this as a far greater pollution problem for coastal nations. Putting CO2 emission second, however, was not popular, especially with climate activists.

Given the criticism, in 2018, the IMO embraced a greenhouse gas (GHG) emissions reduction plan calling for a 50% cut from 2008 levels by 2050. Even then, climate catastrophists demanded a 100% reduction by 2050. Forget whether such a target was or even is achievable. But in a world of virtue signaling, just saying you will get to net zero emissions by 2050 seems to be enough. Leave the details to others and ignore the costs until they bite the activists.

The relentless climate catastrophe talks of its boss, United Nations Secretary-General António Guterres, have driven the IMO’s actions. In July, it convened the 80th meeting of the Marine Environment Protection Committee (MEPC) with the mission to advance the IMO’s GHG reduction target. The committee agreed to reduce shipping’s GHG emissions to zero “by or around, i.e., close to, 2050.” The plan includes interim “checkpoints” ‒ cutting emissions by at least 20% but hopefully, 30% by 2030, and then by 70% if not 80% by 2040. Although cheered by some, the IMO’s agreement was called “wishy-washy,” “falls short of expectations,” and even “a great disappointment” by climate activists and their media friends.

Shortly after the meeting, we attended a webinar discussing various aspects of the IMO agreements plus the European Union’s (EU) ‘Fit for 55’ emissions reduction plan approved in 2021. The Fit for 55 plan, a template for the IMO’s new GHG strategy, includes various actions.

- Extending the EU Emissions Trading System (ETS) to maritime transport, thereby capping maritime transport emissions as part of the overall ETS cap, creating a carbon price signal that should foster the reduction of GHG emissions in a flexible and cost-effective manner, and generating revenues to tackle climate change and encourage innovation.

- Boosting demand for marine renewable and low-carbon fuels, by setting a maximum limit on the greenhouse gas content of energy used by ships calling at European ports and by encouraging zero-emission technology at berth (where boats stay in ports), with a technology-neutral approach.

- Boosting alternative fuel infrastructures, which would set, among others, mandatory targets for shore-side electricity supply at maritime and inland waterway ports.

- Accelerating the supply of renewables in the EU, through a revision of the Renewable Energy Directive, which increases the current EU target of at least 32% of renewable energy sources in the overall energy mix to at least 40% by 2030, with a focus on sectors where progress has been slower to date – including transport.

- Revising the existing Energy Taxation Directive, which aims to align the taxation of energy products with EU’s climate objectives and remove outdated exemptions, such as those for the intra-EU maritime transport sector.

The webinar included a panel consisting of an EU commissioner, an executive from a company trading EU emissions credits, a representative from the World Economic Forum, and the CEO of a European shipping company. While the first three panelists waxed eloquently about the various plans and the goals, we were amused at the looks on their faces when the shipping CEO outlined the challenges the plans presented, given the state of the new fuel technologies, the lack of adequate fuel distribution infrastructure, and the cost and capital investment implications. It was as if the other three panelists had never heard of or considered the reality the shipping CEO was outlining. His concerns were brushed aside with comments about how the technology and the fuel issues would be resolved. But how was never explained? Magic maybe?

In our Energy Musings of July 9, 2023, we outlined where the IMO before its meeting and the pressures being exerted on it to be more aggressive in cutting shipping emissions by 2050. The old 50% target was insufficient; it needed to be 100%. We discussed the relevant commentary and analyses of Dr. Martin Stopford, the head of shipping research at Clarksons and a man considered the dean of shipping’s operations and innovation history. Stopford concluded that the push to completely decarbonize shipping will drive freight costs up and potentially erase the 95% reduction the industry has delivered since the transition from sail to steam power. Such a future creates serious problems for global inflation and economic growth.

In Stopford’s decarbonization presentation, he tracked seven industry innovations that drove the 95% freight cost reduction.

- Fuel: wind, coal, cheap oil, expensive oil

- Speed: 3-6 knots average, 8-30 knots, 16-23 knots, 13-22 knots

- Propulsion systems: sail, steam engine, triple expansion steam, slow-speed diesel engine

- Ship size: 150GT, 1,400GT (10x), 36,000GT (240x)

- Logistics system: trade networks & ad hoc voyages, tramp shipping, cargo liner & passenger liner services, bulk shipping, specialized (vehicles, chemicals, etc.), containerization

- Information systems: letter and seafarer local knowledge, cable, 1927 telephone, GPS, Satellite

- Automation: automated shipping functions

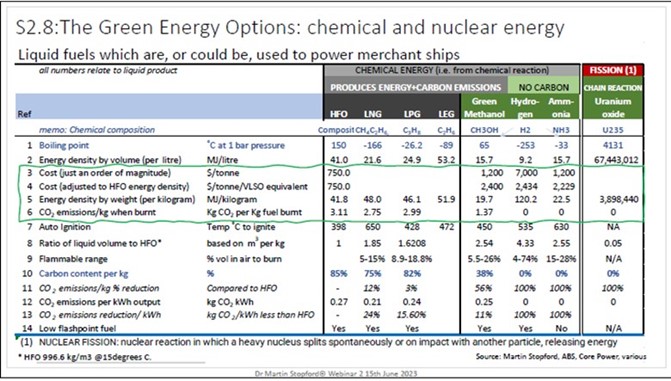

Stopford also had a table showing the comparison of green energy fuel options for shipping, excluding batteries and wind, and fossil fuels that power 98+% of the global shipping fleet. In the comparison, Stopford’s benchmark cost was heavy fuel oil (HFO), the dominant fuel. HFO’s price is listed at $750 per ton. HFO has been displaced by very low sulfur fuel oil (VLSFO). A recent Internet search showed a July 14 price of $634.50/ton. An accompanying graph showed VLSFO trading at $750/Ton in mid-February, making Stopford’s comparison still valid.

Exhibit 1. Expensive Green Fuels For Shipping Will Drive Up Freight Costs

Source: Dr. Martin Stopford

As the chart shows, based on dollars per ton, green methane, hydrogen, and ammonia are 1.6-9.3 times more expensive than HFO. When the fuels are measured on a cost adjusted for HFO energy density, the ratios are 3.0-3.2 times. This shows green fuels are expensive, which is and will continue to be a hurdle for shipping’s decarbonization effort. Why?

It is because of the 70/80/90 metric. Seventy percent of the world is covered by water. Eighty percent of the world’s population lives close to the water. And ninety percent of everything we consume is transported by water. The ships necessary to meet this challenge need fuel worldwide, and green fuels are immature both technologically, in availability, and energy density.

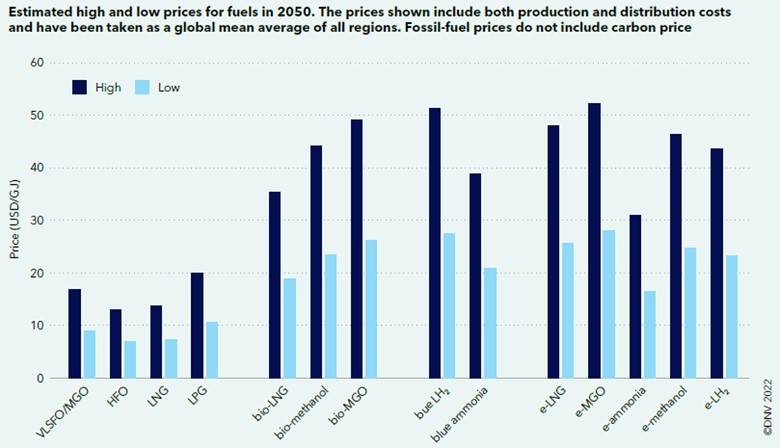

Therefore, as we transition to 100% green fuels, the cost of freight will go up, and up substantially unless some miracle technological breakthrough emerges. Although some might argue with Stopford’s fuel cost analysis, a late 2022 report prepared by energy consultant DNV for the IMO contained the following chart confirming Stopford’s conclusion.

Exhibit 2. DNV Study Confirms Stopford’s Conclusion About Expensive Green Fuels

Source: DNV

If we use the least costly of DNV’s alternative fuel options and compare their high-price estimates to the high-cost HFO, green fuels are 2.4 to 3.0 times more expensive, in line with Stopford’s calculations. Interestingly, several green alternatives are not available commercially. Therefore, we do not know what the cost of building the infrastructure to ensure availability globally, or when they could be available.

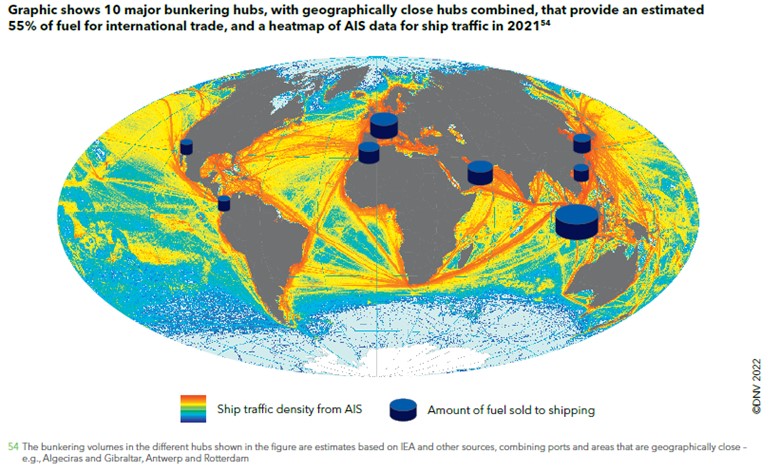

A chart from DNV’s report provides an interesting perspective on the geographic challenge of meeting the shipping industry’s fuel needs. It shows 10 major ship bunkering (refueling) locations around the world, as well as a density heat map of shipping voyages. The 10 bunkering locations supply 55% of the shipping industry’s fuel. That points to the challenge of supplying the new fuels to the other locations accounting for the remaining 45% of shipping’s fuel needs. Vessels trading between the ports associated with the 10 bunkering locations will have no issue securing the green fuels they require. However, vessels following charterer instructions may have refueling problems forcing them to detour or carry extra fuel to complete their voyages. Operational changes may help these vessels but with higher freight costs.

Exhibit 3. Where Bunkering Locations Support Shipping Voyage Density

Source: DNV

DNV discussed the commerciality of ammonia and hydrogen. It believes its technologies will be available in three to eight years, 2025-2030. The consultants see 2-stroke and 4-stroke engine technologies for ammonia developing on parallel paths, which will allow the fuel to be used in deep-sea and regional short-sea shipping.

Hydrogen fuel has a more challenging development outlook. Key to its development in shipping will be short-sea shipping because of supply logistics. Smaller vessels using fuel cells and 4-stroke engines will be key and today they are ahead of other hydrogen engine developments.

Methanol fuel technology is more ready than ammonia and hydrogen, as exemplified by the new ships being ordered using this fuel. Both Maersk and Evergreen Marine have ordered methanol-fueled vessels to begin their fuel transition and gain experience in operating them. According to DNV, 35 methanol-fueled vessels were ordered in 2022, making the fuel the second most favored choice behind LNG, and representing 13% of the total number of new vessels ordered.

An issue requiring intense focus is safety rules for handling these new fuels. The IMO has identified this as a major issue needing to be addressed. Both methanol and ammonia have high toxicity. Hydrogen brings the challenge of extreme flammability to safety rules.

Surprisingly, interest in capturing carbon and sequestering (CCS) onboard ships is growing. This technology was discussed at length during the webinar we watched. While carbon can be captured from the fuel being burned and injected into onboard tanks, some ship space is lost and there are questions about where and how the offloading of the stored carbon will take place. Because the EU has a carbon credit scheme, the ships can earn money from the carbon captured. CCS is being viewed as a cheaper alternative to using carbon-neutral fuels, which are also gaining attraction.

Another issue explored by DNV was the investment needed in the coming decades to reach net zero emissions. DNV estimates an additional annual investment in ships during the fuel transition phase will be between $8-$28 billion. The larger number reflects the additional costs associated with upgrading to handle ammonia and methanol fuels. Those numbers would increase by about 2.5 times if the target for decarbonization is 100% rather than 50%.

About $28-$90 billion per year will be required for production, fuel distribution, and bunkering infrastructure to supply carbon-neutral fuels for 100% of the shipping industry’s needs. Again, a larger investment will be needed for those paths that focus on the electro-fuels.

The DNV report stated that choosing the more expensive energy sources and the necessary onshore investments could increase the shipping industry’s annual fuel bill by more than $100-$150 billion a year at full decarbonization. Such an ongoing expense represents a 70% to 100% increase in global shipping fuel costs. We have found estimates of fuel costs ranging between 47% and 60% of the cost of operating a ship. If we use 50% for fuel’s share of total operating expenses, a ship’s daily operating costs would increase by 35% to 50%, assuming all other expenses remain unchanged.

When DNV prepared its report, these cost estimates were best guesses. Last year, the Global Maritime Forum suggested that reaching the IMO’s 50% decarbonization target would cost the industry $1.0-$1.4 trillion over the 20 years of 2030-2050. If the goal was to reach net zero, the cost would rise to $1.4-$1.9 trillion, a figure frankly we question. In every other analysis of reaching 100% of something the cost of the last few percentage points is much higher than for the earlier eliminations. Additionally, studies suggest that between 83% and 87% of the total cost must be spent onshore.

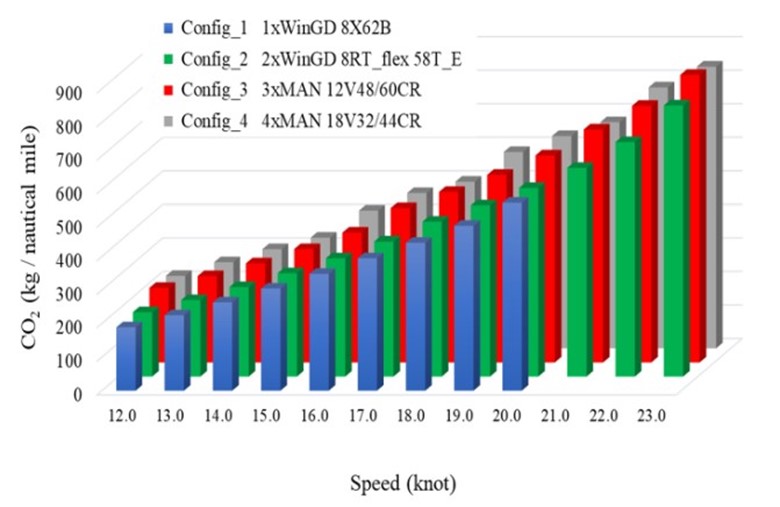

Initial actions by ships to cut emissions will be to slow down and add wind power to assist ship propulsion. A March 2023 article in the Journal of Marine Science and Engineering, titled “The Impact of Slow Steaming on Fuel Consumption and CO2 Emissions of a Container Ship,” contained the following chart demonstrating the direct relationship between the amount of carbon emissions and a ship’s speed. Cargo ships are designed for speeds exceeding 20 knots, which makes them ideal candidates for studying the speed and emissions relationship. The study utilized four different engine configurations to test the emissions/speed relationship. The engine choice appeared to have only a marginal impact on the emissions at each speed.

Exhibit 4. Direct Relationship Between Slow Ship Speed And Lower Emissions

Source: Journal of Marine Science and Engineering

The authors of the paper cited examples from other reports documenting how slow-steaming reduced carbon emissions. The following three extracts (numbers in brackets refer to the specific studies listed in the appendix) from the report are representative of the strong linkage.

“Reducing the sailing speed of a RO-RO ship by 10% compared with the planned speed leads to a 27% reduction in CO2 emissions (fuel consumption), and a 40% reduction in speed leads to a 78.4% reduction in CO2 emissions (fuel consumption) [20].”

“The analysis of the reduction of container ship sailing speed by 10%, 20% and 30% [21] has shown reduction of CO2, NOX, SOX and PM by 21%, 34% and 45%, respectively.”

“In [18], an example of 55% reduction in fuel consumption is achieved by reducing the sailing speed from 24 to 17–18 knots for a container ship.”

The downside of slow steaming is that voyages will take longer, which means more vessels will be needed to handle the same volume of cargo. How will that impact freight costs, let alone the operation of global supply chains?

The second recommendation for ships to reduce their carbon emissions is to employ wind to assist propulsion. A recent CNN article discussed wind for ships. As we know from the long history of shipping during the sailing era, there are serious limitations to the assistance wind can provide to a traditional ship. As Dr. Richard Pemberton, a lecturer in Mechanical and Marine Engineering Design at the University of Plymouth, in the UK, says, “there’s an absolutely no question that it’s technically possible” for the technology to work. But he points out the major problem. “The issue with any wind-assisted shipping, it really comes down to which way is the wind blowing, and where do you want to go?” He noted that “If the wind is directly on your nose, and that’s the direction you want to go, there isn’t a wind system out there that that works well enough for that.” Of course, if the wind isn’t blowing you also have a problem.

Exhibit 5. Seawing Test Sail Assisting Propulsion Of Cargo Ship

Source: Maxime Horlaville/polaRYSE/Airseas

Airseas, the developer of Seawing (pictured above), was co-founded by current CEO Vincent Bernatets. He is high on the potential for wind to help ships cut their fuel use and thus their carbon emissions especially on cross-Pacific and Atlantic routes and for any north-south routes. Those are routes where ships may be sailing with the wind and not into it. He suggests sails could reduce fuel consumption by 20% for “70 to 80% of the world’s shipping trade.” Currently, Airseas is testing a model about a quarter of the size of the sail he expects shipowners to buy.

Curiously, the most interesting aspect of Seawing according to Bernatets is its economics. Although he wouldn’t reveal the cost of installing the technology, he estimates it will take 2-5 years to earn back the cost in fuel savings. The savings time shrinks as ships transition to green fuels because they are much more expensive than traditional HFO or LVSFO.

“It’s also a huge enabler for future green fuels,” argues Bernatets. “We allow green fuels to be introduced sooner, both because we save some of the cost, making them more competitive, but also because we reduce the amount of green fuel needed on a ship — which today is a main hurdle because when you have larger tanks [to hold the green fuel], you can carry less load.” That becomes an economic problem since reduced ship carrying capacity cuts revenues at the same time green fuel costs are boosting operating expenses. The solution? Raise cargo prices.

Bernatets said, “Wind is really the next big thing that will radically change and maybe revolutionize shipping.” Is this another Back to the Future invention like wind turbines?

The triumvirate of solutions for the shipping industry to cut emissions until green fuels and green engine technology mature is to slow steam, add wind propulsion, and burn compliant fuels made from bio-matter. Fuels such as biodiesel, bio-LNG, bio-methanol, and possibly even Sustainable Aviation Fuel (very light oil) will be in greater demand, especially if they can be blended into conventional fuels or burned in existing ship engines, negating the need for new engines. Ship owners will be working hard to find low-cost fuel alternatives until the green fuels and technologies are more mature. They want to minimize capital investment mistakes and extend the time before having to make investments.

Climate activists are unhappy with the outcome of the IMO’s revised GHG strategy because it doesn’t reach net zero emissions before 2050 and it doesn’t begin until 2025-2027. They will continue to pressure the organization to be more aggressive. Those webinar panelists promoting the current aggressive IMO policies were shocked when hearing from the shipowner about the challenges of fuel selection, meeting artificially established dates for emissions reductions, and the cost of the effort. As time goes on and more studies examine the cost and challenges of this new strategy, maybe the panelists will become more understanding of the potential economic damage these policies may cause, not just for the global shipping industry, but for global inflation, economic growth, and poverty, too. Although shipping accounts for only 3% of global emissions, it remains one of the hardest sectors to decarbonize, at least without significant costs. Whether the IMO’s revised GHG strategy is the “Deal of the Decade” remains to be seen, but it is a start, but a challenging start.

Contact Allen Brooks:

gallenbrooks@gmail.com

www.energy-musings.com

EnergyMusings.substack.com