Download a PDF of this Newsletter.

| Note: Musings from the Oil Patch reflects an eclectic collection of stories and analyses dealing with issues and developments within the energy industry that I feel have potentially significant implications for executives operating and planning for the future. The newsletter is published every two weeks, but periodically events and travel may alter that schedule. As always, I welcome your comments and observations. Allen Brooks |

| Summary:

Could 2021 Bring Another Oil Price Crash? Will 2021 Be The Year Of The Electric Vehicle? The Temperature Conundrum Of The Climate Change Debate |

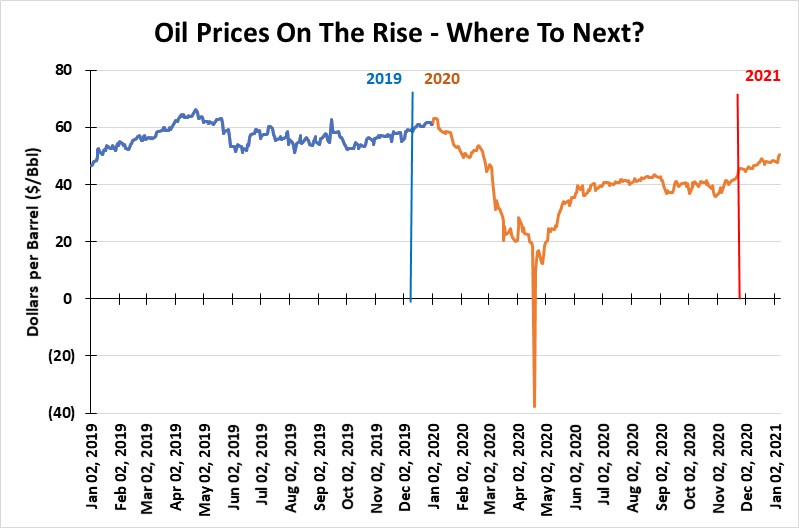

Could 2021 Bring Another Oil Price Crash?The oil price forecasts for 2021 are rolling out, with virtually everyone expecting prices to go higher. The “bullish” 2021 views reflect the dismal average oil price recorded for 2020. The low price was helped by the crash to a negative $40 a barrel for the West Texas Intermediate (WTI) May 2020 futures contract on April 19, even though the price snapped back to about $20 a barrel almost immediately. That was the first time ever for oil prices to trade at negative prices. To demonstrate how bad the oil market was, on the day the May contract fell into negative territory, the following month’s (June) contract price was barely over $20 a barrel representing the largest spread in monthly contract values ever. To say last spring was an extraordinary time for crude oil would be an understatement. To refresh memories, the price crash was caused by the unprecedented collapse in oil demand due to the economic shutdowns mandated by governments around the world in response to fighting the Covid-19 pandemic. The problem was that the oil industry cannot stop production as rapidly as demand can collapse. The logistical structure of the global oil industry works on yearly or monthly time-tables, not weekly or daily ones. We see this often when storms disrupt normal life and consumers stop using oil products literally on a dime. The logistical issue highlighted another oil industry challenge, which was the amount of oil storage space available at Cushing, Oklahoma, the main pricing point for WTI. Even today, oil traders are questioning whether WTI should remain the primary oil price marker, given its structural issues. With growing oil exports, oil pricing on the Gulf Coast is becoming a more important driver of industry actions than WTI. Exhibit 1. Saudi Arabia And OPEC Helping Oil Recover Source: EIA, PPHB Despite all the gnashing of teeth over the relevancy of WTI (much like Brent on the world stage), one can view it much like how the Dow Jones Industrial Index (DJIA) is viewed by people. Although it no longer reflects the structure of the U.S. economy, its long history provides a perspective for people to judge current movements. An historic relic? Maybe. But it is an easy way to assess conditions. Last spring, as oil prices crashed, a market standoff began among the three major suppliers – the United States, Russia and Saudi Arabia, representing OPEC – that appeared intractable. The oil price collapse sent U.S. producers scurrying to find storage for their flowing output, while also attempting to choke off production and get out of supply agreements with refiners who no longer needed the oil. The high point of frustration was the day-long hearing by the Texas Railroad Commission (TRC) over whether it should reinstitute pro-rationing in the state’s oil fields to help control the overproduction of crude oil relative to demand. Big producers, small producers, royalty owners, oilfield service companies, academics and consultants, and even politicians representing educational interests in royalty payments all weighed in. The conclusion was that as much as everyone thought the TRC could resurrect its 1930s success in controlling overproduction of crude oil in Texas, the state now accounts for a much smaller portion of U.S. output, making its efforts potentially destructive for local operators who would lose market share, while failing to see prices rise. In such a situation, Texas oil producers and the TRC commissioners were caught between the proverbial “devil and the deep blue sea.” As America struggled to figure out what it could do to help reduce the oil oversupply of oil that was killing prices, OPEC, led by Saudi Arabia, was wrestling with its new partner – Russia – over what it should do about output. Everyone was being hurt by collapsing oil prices, but some countries were faring better than others, so those less impacted were not in a rush to cut output and choke off their income, although it was shrinking rapidly. U.S. President Donald J. Trump jumped in and began an international mediation effort to get Russia and Saudi Arabia (OPEC) to agree to an historic cut. A month earlier, Saudi Arabia proposed a cut of 1.5 million barrels per day (mmb/d) to combat weak demand, but Russia rejected it. This set off a price war, with Saudi Arabia cutting oil prices to its customers in Asia, while also announcing plans to boost production to 12 mmb/d in order to increase exports. Russia also planned to lift its exports and match Saudi’s oil price cut. This was the oil landscape as Covid-19 was crushing demand and oil prices. By engaging both Russian President Vladimir Putin and Crown Prince Mohammed bin Salman, President Trump facilitated a compromise that led to a 10 mmb/d production cut. Since it had been rumored that the agreement could be as large as a 15-20 mmb/d cut, the announced agreement was met with disappointment and falling oil prices, although they began to recover shortly thereafter. The OPEC+ agreement called for a 10 mmb/d cut for May and June, and then for it to taper off to 8 mmb/d for the remainder of 2020. Beginning in January 2021, the cut would be reduced to 6 mmb/d, which would continue until 2022, if not reduced further during 2H21. As we approached year-end and Covid-19 staged another global outbreak that forced governments to reinstitute economic lockdowns, OPEC+ debated the fate of the 2 mmb/d supply restoration programmed in the April 2020 agreement. With Russia wanting to push forward, but Saudi Arabia worried about another oil glut dropping prices, a compromise was reached. It called for adding 500,000 barrels per day (b/d) in January, and for the OPEC market monitoring group to meet monthly and determine when to add more supply to the group’s output. This is where we were as 2021 opened. After the first day of meetings, the group failed to reach an agreement about February’s supply. The second day’s discussions produced an agreement to hold supply steady for February and March before considering adding another 500,000 b/d to supply. While Russia argued that world oil demand would quickly return as the vaccine was rolled out, Saudi Arabia was more concerned that the recent re-implementation of economic lockdowns and the slower rollout of the vaccine would depress the demand recovery. Based on how quickly the two sides reached their agreement, one is left with the feeling that Russia was less confident in its argument than Saudi Arabia was in its. The market’s reaction was swift with WTI passing $50 a barrel for the first time since February 2020, before slipping slightly under that mark. Brent crude oil nearly reached $53/b, the highest price it has attained since late February 2020. Then, Saudi Arabia unilaterally announced a 1 mmb/d production cut. Saudi officials said that Russia was aware of the planned move when their production agreement was announced. The move raises many questions. Answers will only become clear in the future. Did the cut reflect Saudi’s concern about Russia abandoning the OPEC+ group? That would have precipitated another oil war, something that would devastate all producers. Maybe Saudi Arabia is much more concerned about oil demand in early 2021, or possibly long-term. Is it possible there are concerns about the sustainability of Saudi production after having produced at such a high rate for a long time? Could the kingdom have progressed in developing alternative energy sources such that it doesn’t need to burn as much oil to generate electricity? The oil market is treacherous. As OPEC+ navigates the market during 2021 – at least in the early months – it has to gauge the actions of American oil producers who are motivated by oil prices and their own profitability. On the other hand, Russia and OPEC can control its supply better because there are fewer major swing producers. What neither Russia or Saudi Arabia, let alone anyone else, knows is how much lower American oil producers’ breakeven levels are today versus a couple of years ago. Last year’s disastrous oil pricing environment forced companies to cut staff, negotiate lower service costs, restructure balance sheets, all in an effort to lower breakeven prices to generate profits in a world of low- to mid-$40s per barrel prices. Late in the year, with oil prices between $45 and $50, many producers were announcing that they were starting to generate positive cash flows. If that is truly the new world for American oil producers, they will become an anchor against substantially higher oil prices in 2021. An interesting question is whether oil at $50 marks a new ceiling or floor? We will only know the answer in hindsight, but depending on how producers view the answer to that question may dictate how rapidly the drilling rig count rebounds. Overhanging the pricing dilemma for oil companies is the fate of crude oil in a world increasingly racing toward net-zero carbon emissions. The oil-pricing turmoil of the past five years has upset the measured pace of exploration and development for new oil reserves. The argument for substantially higher oil prices in the future rests on the assumption that developing these new supplies requires much higher than current oil prices. Defining “much higher” is impossible because we don’t know how much additional oil supply will be needed due to the unsettled long-term demand outlook, as a result of Covid-19 behavioral changes, the rate of population vaccinations, and the pace of the transition to renewable energy. The world’s major oil exporters are walking through a field of mines where any misstep could send oil prices crashing. Clarity on demand will not improve until this spring, and even then, confidence about future oil demand will remain tenuous. Even though the outlook will improve, it will remain cloudy. This year should be a better year for the oil and gas industry than 2020. How much better is impossible to predict now, but the fundamentals support healthy oil prices and increased demand with somewhat limited supply growth. However, geopolitics, greed and Black Swans are always lurking around this industry. An interesting tid-bit is that 2021 is the Year of the Ox in the Chinese zodiac. We noted the list of prior Ox years: 1925, 1937, 1949, 1961, 1973, 1985, 1997, and 2009. Three of those years – 1973, 1985 and 1997 – marked pivotal times for the global oil market. Each of the Arab Oil Embargo, the OPEC price war and the OPEC Asian oil output misstep contributed to significant changes in the then current direction of the industry. Importantly, none of the events were anticipated. Will there be a surprise in 2021? What might the surprise be? We’d just as soon pass on the drama, but the fates will not allow that to happen. Let’s hope we can avoid missteps to the downside, and that 2021 marks the start of an extended positive cycle for the oil business. Wouldn’t that be a surprise! |

Will 2021 Be The Year Of The Electric Vehicle? |

| On January 2nd, Tesla released its fourth quarter and full year 2020 sales and production figures. The company set a sales record in the fourth quarter with 180,570 cars, although it fell 450 vehicles short of its goal of selling half a million cars in 2020. Tesla’s sales last year represented a significant achievement, but 2020 was a much better year for electric vehicles (EV) than most expected once Covid-19 exploded on the scene. Tesla also announced that it had begun production of its Model Y SUV in its Chinese plant in Shanghai, and that it expects to deliver its first cars soon.

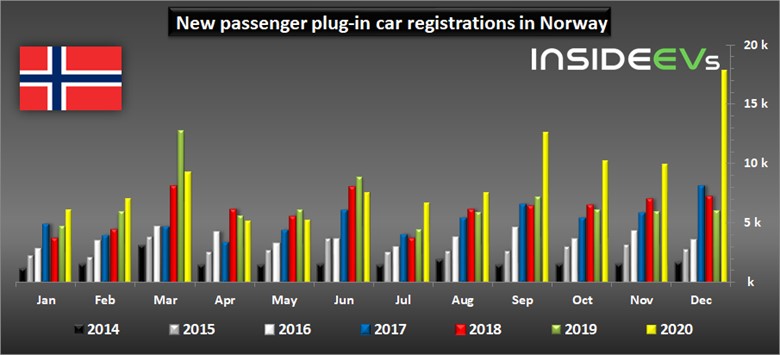

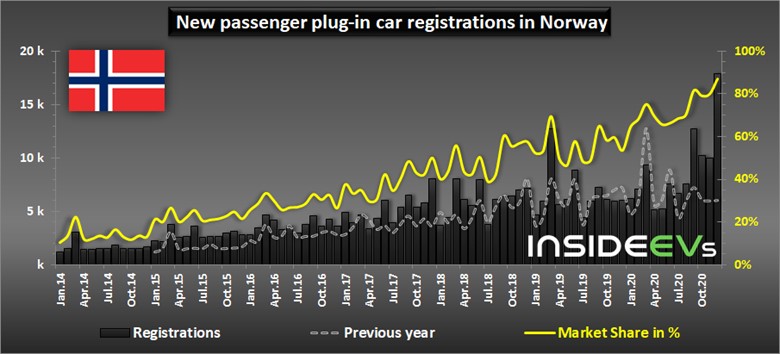

InsideEVs.com reported on a study by Industrial Securities about the output from the new Giga Shanghai Tesla plant. According to the study, Tesla’s current production is around 8,000 cars per week, including 5,000 MIC (made in China) Model 3 and 3,000 MIC Model Y. At that rate, Tesla will produce roughly 400,000 cars in 2021, nearly the output of its two plants in 2020. Plans call for Tesla to gradually increase the production rate to 15,000 cars per week, or about a 750,000 annual production rate. Reportedly, the plan calls for Tesla to sell 425,000 MIC cars, composed of 180,000 Model 3 and 245,000 Model Y, while also exporting an additional 100,000 Model 3/Y. Since Tesla has said that all the locally made Model Y vehicles will be sold in China, the export figure would represent all Model 3 units. That suggests production of around 525,000 cars, which would exceed the 2020 output from the company’s existing California and Chinese plants. Only a couple of days later, Norway, Europe’s leading EV market, reported its auto sales data. For the month of December, EV sales totaled 17,910 units, up 198% year-on-year, and represented an 87% market share of new car sales. The EV sales were split 77/23% between all electric (BEV) and plug-in hybrids (PHEVs). For the preliminary annual statistics, 76,800 BEVs and 28,904 PHEVs were sold, roughly a 73/27% split. EV sales for the year represented a 74.8% market share When we examine the monthly EV sales data for Norway, it is interesting to see that sales were up year-over-year in January and February, but then trailed during March through June, during the height of the Covid-19 pandemic. Starting in July and continuing every month for the balance of the year, EV sales exceeded prior years. As seen from the chart (next page), the final four months, and especially in December, the outperformance of 2020 EV sales was significant. Exhibit 2. Norway Leads World In EV Sales Percent Source: insideEVs.com Another interesting chart shows the history of EV sales in Norway since 2014. Monthly sales are represented by black bars, with the prior year sales in the grey dashed-line. At the far right of the chart, one can see the strong 2020 fourth quarter sales outperformance. The more telling line is the yellow one showing EV market share by month. It appears that 2020’s pace of market share accretion accelerated from the pace of 2014-2019. Exhibit 3. EV Share Of Sales Soared Last Year Source: insideEVs.com The latest development in European EV sales, as reflected by Norwegian data, is the rapid increase in the number of EV models available for purchase. We have listed the models and the December and year-to-date sales total for the leading models in Norway. This increase in models available is believed to mark an inflection point in the evolution of the EV market in Europe, and eventually worldwide. As people have more models with a wider price-range to choose from, it is believed more buyers will become interested in EVs. Of course, seldom does the discussion focus on the importance of subsidies, which is critical for expanding the range of potential buyers. Exhibit 4. EV Model Choice Helps Boost Market

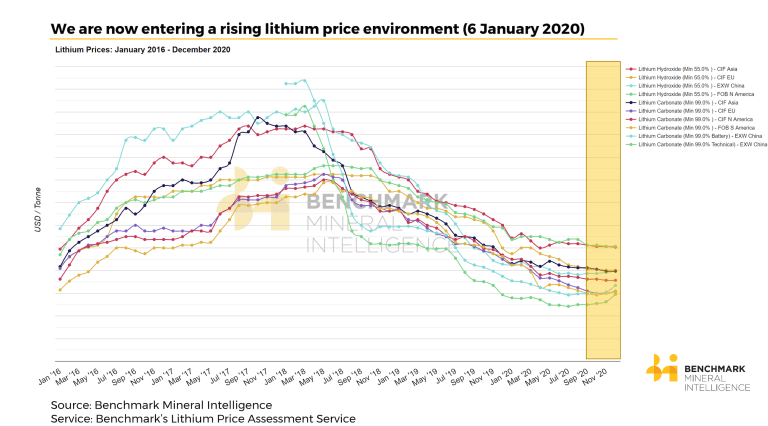

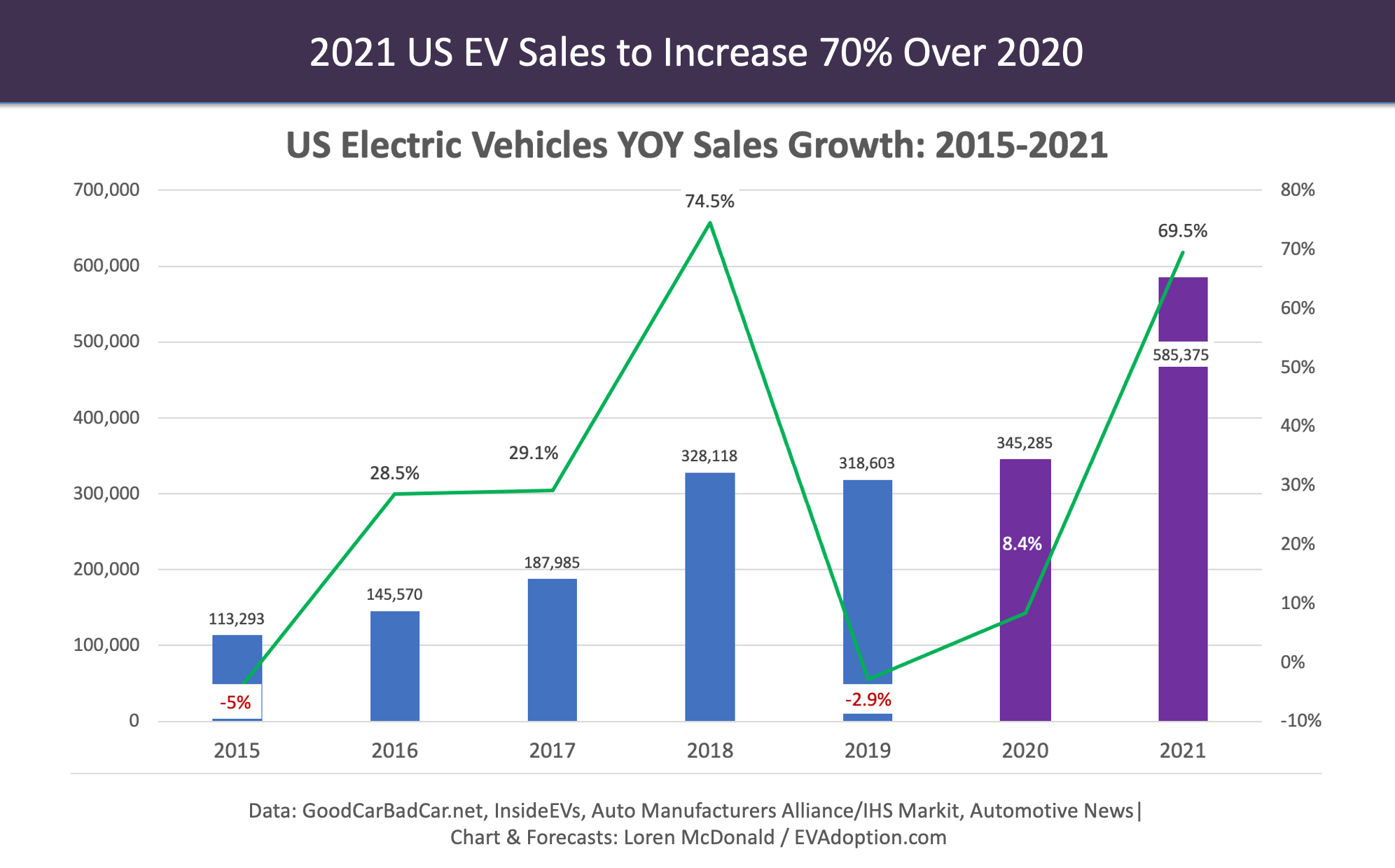

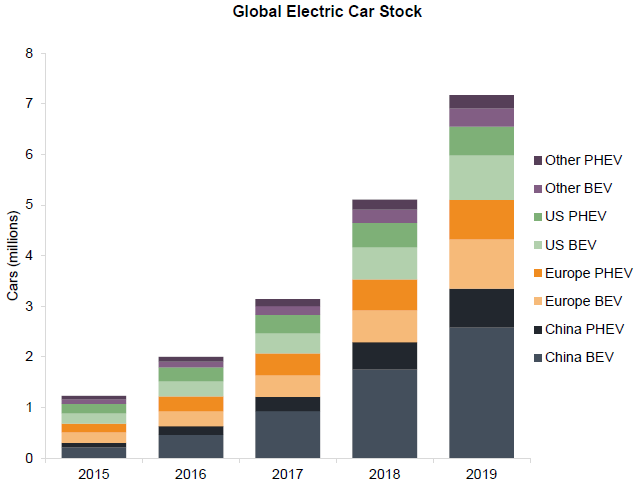

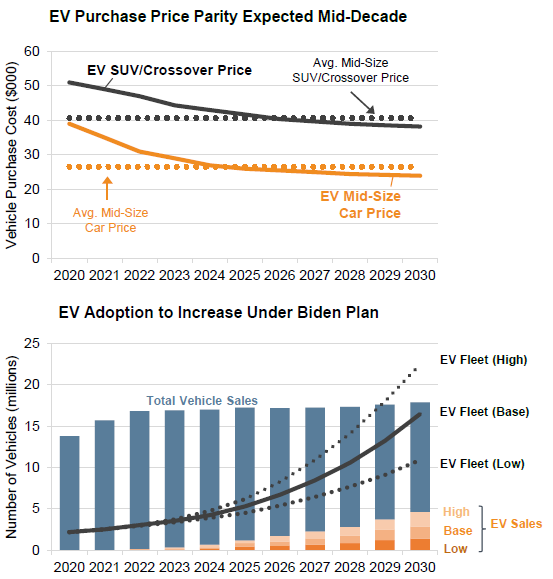

Source: insideEVs.com, PPHB Automobile writers are ecstatic about the 2021 EV market, as they see the plethora of new models entering the market as the primary driver for sales. Almost every existing auto manufacturer has one or more EV models coming to market. In addition, a handful of start-ups and Chinese companies will be producing EVs, although some models will only be available in China. We were intrigued with two new models in particular when we perused the write-ups of new arrivals this year. The Lightyear One comes with solar panels covering all of its upper portion, which will help keep the battery charged. We have no idea how well that will work, but it is an interesting idea. Importantly, the car is estimated to have a range of 450 miles on a single charge, but we don’t know if that anticipates some solar recharging. Exhibit 5. Lightyear One With Embedded Solar Panels Source: inside-EVs.com For the sport car aficionado, Lotus is introducing its EV. The initial production run of 130 vehicles is already spoken for, with the first deliveries scheduled for later this year and then into 2022. The Lotus Evija comes with a price tag of between $1.8 and $2.35 million, depending on options selected, although it looks like the basic model has all the necessary accoutrements one would want. The 2021 Lotus Evija is built around a single-piece carbon fiber monocoque chassis, which significantly reduces the overall weight. The car tips the scale at only 3,700 pounds. The key to the Evija’s performance is four separate electric motors – one for each wheel. Combined with a 70-kWh lithium-ion battery pack, the four motors generate a whopping 1,973 horsepower, which makes this Lotus supercar the most powerful production car in the world. It can race from zero to 60 miles per hour (mph) in under three seconds and max out north of 200 mph. Despite that performance, the Evija is only one of the fastest cars in the world. That honor belongs to the Hennessey Venom F5, with a top speed of 301 mph. Exhibit 6. The 2021 Lotus Evija – One Of The Fastest Cars Source: autowise.com Although unique and racing car EVs draw much media attention, for automakers, the global market share battle depends on vehicle cost, performance and styling (models). Performance has improved, as measured by the average distance EVs can travel on a single battery charge. Costs are improving slowly, as battery costs decline, but these vehicles still require subsidies and remain out of the reach of much of the world’s car buyers. With all the major automakers delivering new EV models this year, the selection issue is rapidly becoming a non-issue. What was interesting is reading how a California politician wants to inject styling into the regulations for vehicles including EVs. He is upset so many cars today all look alike. We understand he was upset in trying to find his car in a shopping mall’s parking lot. However, as engineers will tell him, there are only so many ways vehicle designs can be tweaked without sacrificing drag ratios and fuel efficiency, an area where regulators continue to pressure auto companies to improve. While the 2021 global economic outlook remains cloudy due to the recent uptick in Covid-19 cases, most forecasts call for a better sales year than last. Some forecasts are calling for even greater increases in EV sales this year compared to last. Investment firm Morgan Stanley projects global EV sales to rise by more than 50% this year, compared to internal combustion engine (ICE) vehicle sales that will only grow 2% to 5%. Of course, we are talking about dramatically different market sizes. Last year, U.S. auto sales are likely to have fallen by about 15% from 17 million units to only about 14.4-14.6 million. That is the lowest U.S. sales have been since 2012. Around the world, results are mixed, with China recovering as its economy is snapping back from the virus lockdown. In the United Kingdom, 2020 sales fell to 1.63 million units, a 30% decline from 2019, and the worst annual sales decline since 1943. EVs represented about 10% of sales, or roughly 160,000 units. As the country plans to ban ICE vehicle sales in 2030, the country has only nine years to shift from EVs representing one in ten vehicles sold to 10 in 10. Can that happen; more importantly, will it happen? We are inclined to take the under in this bet, but always recognize the power of the state to shutdown anything, as we have seen with respect to responses to the coronavirus. One reason for our caution about EV projections is that most forecasts in business and commodity markets prove wrong. While a few beat the projections, most fall short due to a variety of factors. Mostly, it is due to misreading the pace of consumer behavior and the rate of technological change. A critical assumption underlying EV forecasts is the projection for continued declines in battery costs. (The topic of battery technology is worthy of a deep dive in a future article.) While battery costs have fallen in recent years, and rather sharply, it has largely been due to increases in volumes that reduce per-unit costs, but also falling lithium chemicals prices. We are now seeing the first uptick in lithium prices as the mining industry is pressured to expand capacity to meet projected demand increases. Benchmark Mineral Intelligence, who tracks the lithium chemicals market and EV battery technology, remarks that for the last six months of 2020, all the lithium chemicals prices it was collecting were flat-lining. On the other hand, China was showing upticks in prices. China is considered the bell-weather for lithium chemicals pricing. This pricing upturn is the first time in over two years that prices have increased. Is it possible that the projections for falling battery costs are derailed? The price rise may also push automakers to opt for newer battery technologies, assuming they can be perfected, which could lead to safer, more powerful and cheaper batteries. But that is not a given at the moment. Is China’s lithium chemicals price trend a potential Black Swan for EVs? Exhibit 7. Bell-Weather China Sees Lithium Price Hikes Source: Benchmark Minerals A new forecast from one EV watcher calls for U.S. sales to increase by over 70% in 2021. As impressive as that increase is, it still represents less than 600,000 vehicles. If we assume that auto sales recover half of their lost sales in 2021, the EV sales projection equates to a 3.8% market share. That would be a slight market share reduction from 2020, but not a surprise assuming overall auto sales rebound in 2021. Exhibit 8. 2021 Projected To Be Record EV Sales Year Source: cleantechnica.com The reception of the new 2021 EV models, baring a dramatic cost reduction, will tell us much about whether the industry in on a rapid-growth or a moderate-growth trajectory. As forecasts from EV and traditional automakers suggest, dramatic battery cost reductions will not come until about the middle of this decade. That will leave a relatively short time period for the industry to reach the market share targets politicians are putting in place now for the transformation of the domestic vehicle sales market to one that is totally electric. Regarding global vehicle sales, China remains the dominant market. It is interesting that after boosting subsidies for ICE vehicles in 2019, while reducing them for EVs, as the government was attempting to stimulate its economy, it was forced to announce a shift in April 2020. The government announced it was extending its subsidy scheme without cuts until the end of 2022 to boost EV sales. It had originally planned to cut EV subsidies by 10% in 2020, and by a further 20% in 2021 and 30% in 2022. The stimulus shift helped China sell 1.109 million EVs in the first 11 months of 2020, an increase of 3.9% from the same period in 2019. This year will provide an interesting window into the industrial business strategy of the Chinese government with respect to clean energy technology and EVs. These are areas that China has identified that it wants to dominate globally. That will be the topic of a future article. It is estimated that there are roughly 1.2 billion vehicles (passenger cars, light-, medium- and heavy-duty trucks, and buses) on the world’s roads today. It is further estimated that about 95% of them are light-duty vehicles. With the three million EVs sold in 2020 added to the total in the fleet as of 2019 (~7 million), there are roughly 10 million EVs on the road. That represents 0.9% of the global light-duty vehicle fleet. That is a far cry from the number of EVs that will impact transportation’s carbon emissions. It also demonstrates why the oil business is not going away for decades. Exhibit 9. China Dominates Global EV Market Source: Sproule/Boost Energy Ventures Two charts from a report by Sproule and Boost Energy Ventures focusing on the incoming Biden administration and its potential to impact green energy in the U.S highlight some challenges for EVs. The first chart shows the projected purchase price parity between EV SUV/Crossover and EV Mid-Size Cars and similar ICE vehicle models. In both cases, the forecasters expect the parity to be achieved mid-decade, assuming battery costs continue to decline, as they expect. Exhibit 10. Forecast Looks Promising For EVs Source: Sproule/Boost Energy Ventures The second chart shows a projection of EV sales under three scenarios and their impact on the U.S. EV fleet. In the forecast, even using the high case, in 2030 there would be about 22 million EVs in the fleet. Again, the reality is that there are 260 million light-duty vehicles in the U.S. fleet, so in 2030, EVs will still only account for 8.5% of the fleet. To achieve that number, the automobile market will be in turmoil for years, something EV supporters accept as a necessary evil in order for EVs to become a much more significant percentage of the domestic light-duty vehicle fleet by 2050, which will aid in reducing carbon emissions. Just don’t look for significant reductions over the next decade. The headline of this article asked whether 2021 will be the year of the EV. Based on the number of new models being introduced, the likelihood that the Biden administration and other foreign governments will support EVs with broader incentives, and the prospect of additional mandates by various governments restricting ICE vehicle sales and even use, 2021 will be an important year in the evolution of the EV market. It will also mark a pivotal year for the energy business. |

The Temperature Conundrum Of The Climate Change Debate |

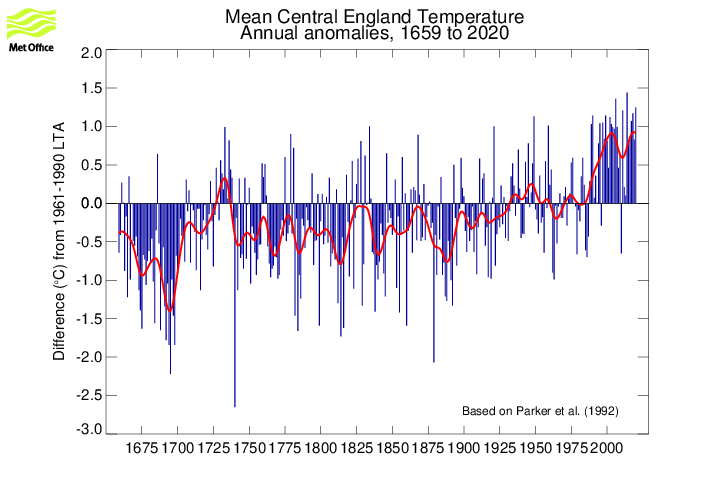

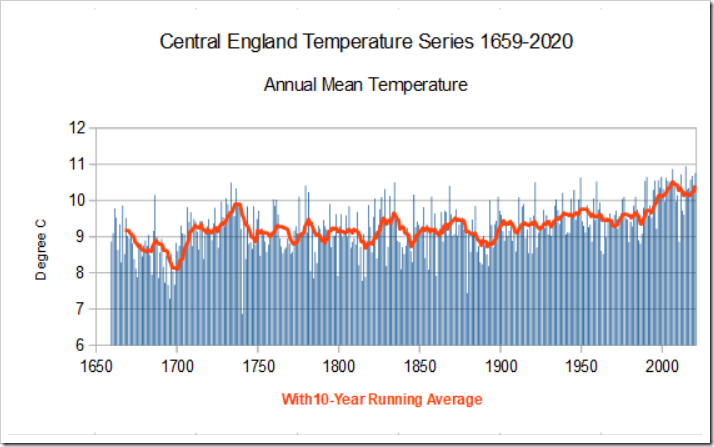

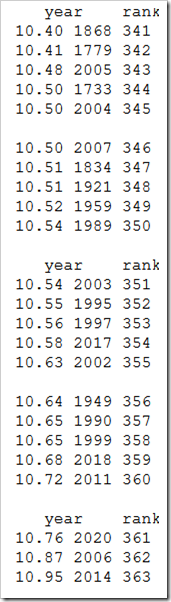

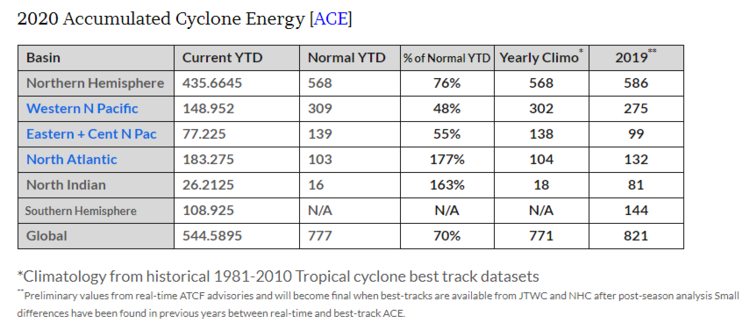

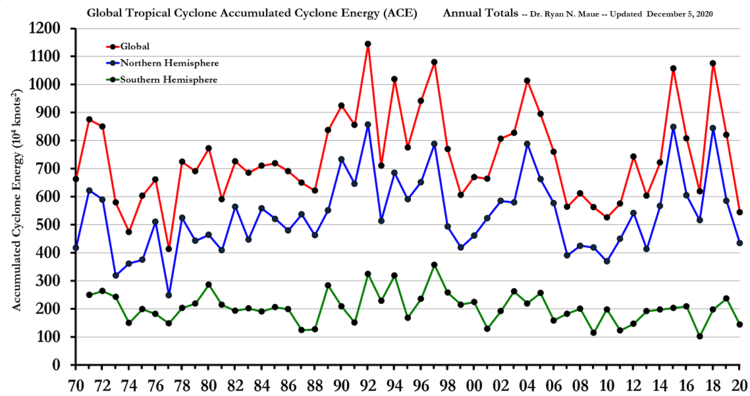

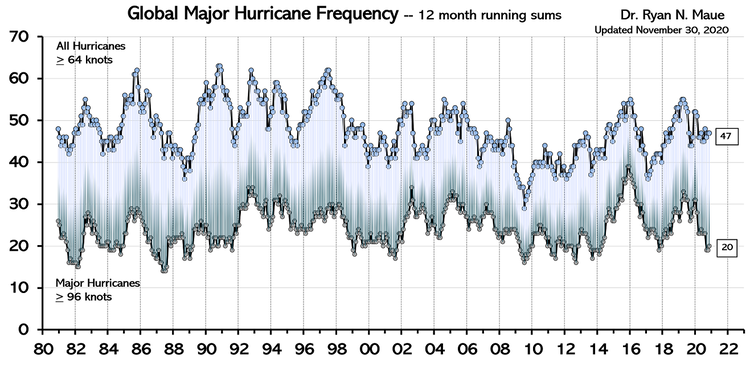

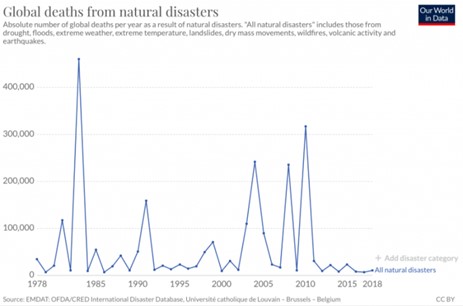

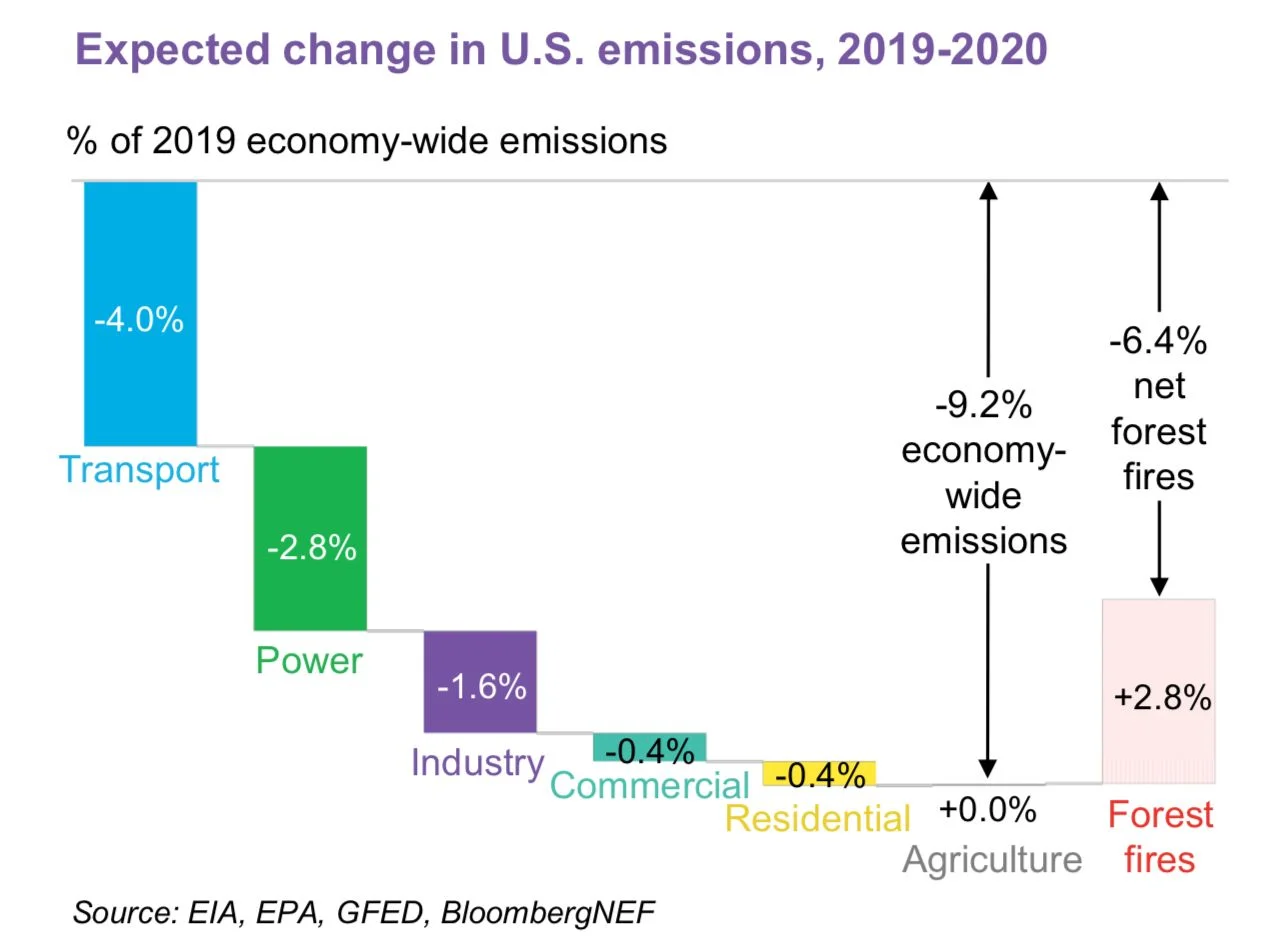

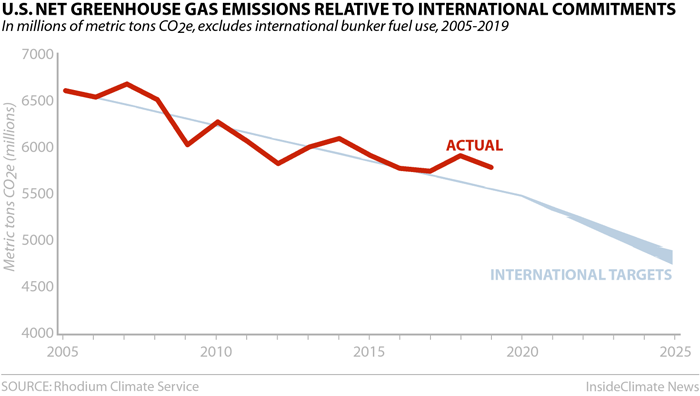

| Welcome to the year climate debate is outlawed and the emergency dictates harsh and mandatory actions. Just as the language about climate changed in recent years from global warming to climate change to now climate emergency, so too have government actions to address the problem ramped higher. What once were aspirations for a clean energy future have become requirements. A green energy future in 2050 is no longer acceptable; it needs to happen sooner, regardless of the cost or disruption. Bans on the sale of fossil fuel-powered internal combustion engine (ICE) vehicles are now spreading across the world, as this is perceived as the only way in which we can reduce carbon emissions sufficiently to keep the planet from overheating. The problem is that we may merely be substituting the carbon emissions of ICE vehicles for those coming from electricity generating stations. Moreover, we may be inflicting meaningful cost increases on lower income people, who can least afford it, through the mandatory substitution requirement.

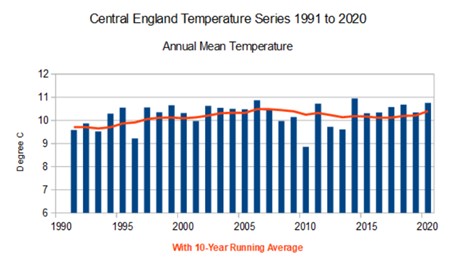

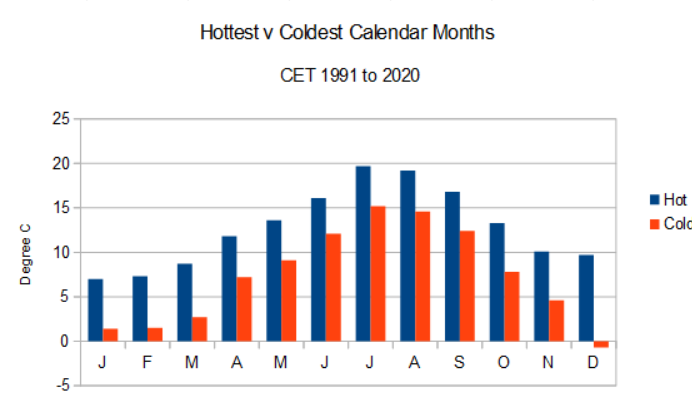

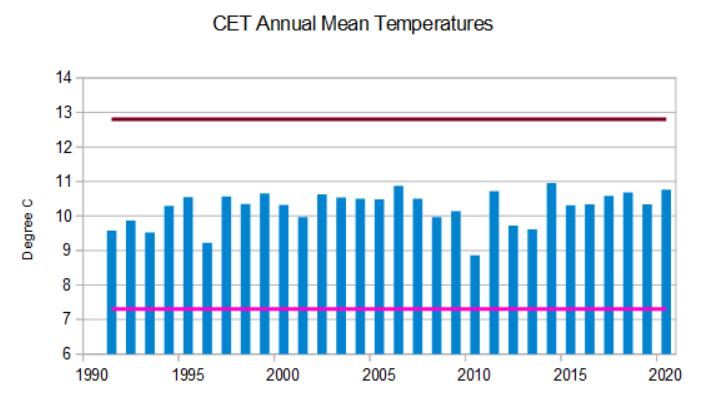

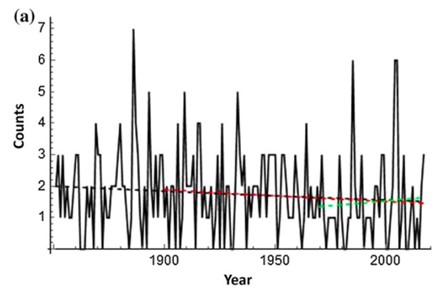

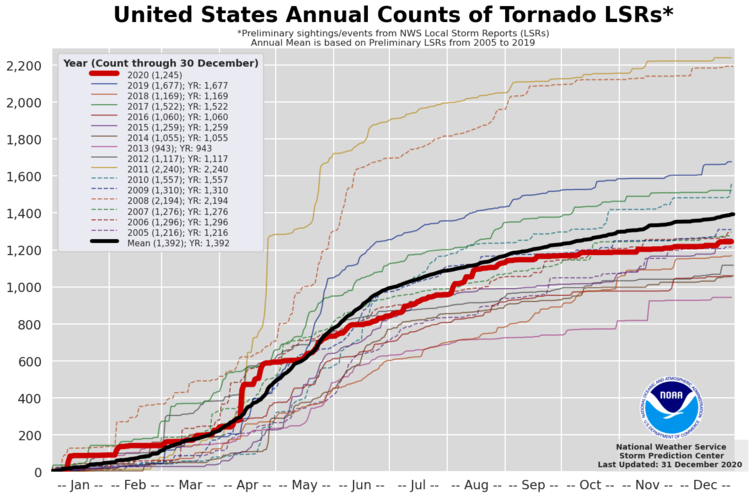

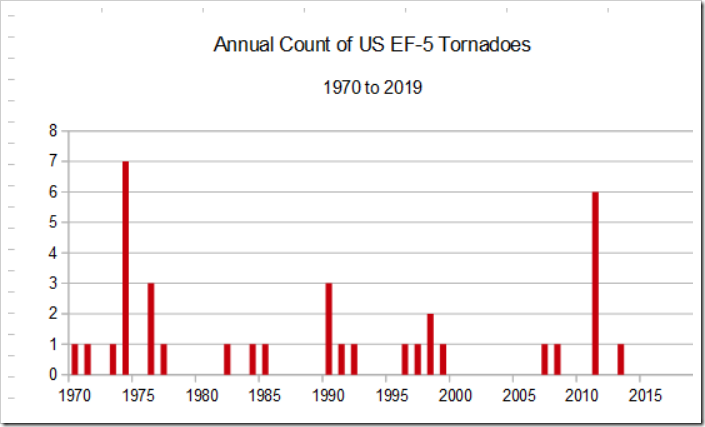

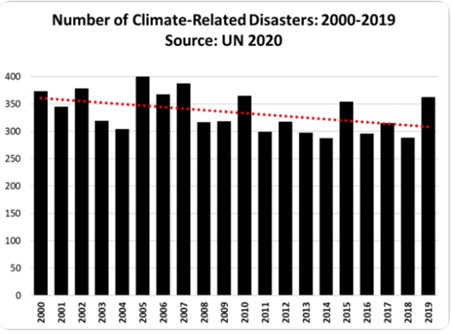

The issue of how best to address the world’s carbon emissions has transitioned from the responsibility of the market and the private sector to governments at all levels. For those political leaders with a free market economic bent, they see nudging the market to price preferred solutions as the least disruptive and economically repressive path to cleaner energy. On the other hand, those politicians who believe the population is incapable of making the right choices despite market signals, mandates and financial incentives are their tools, even though they inflict hardship on the general public for the benefit of a privileged few. There is a fine line between targeted investment to foster research and development of new, untested but promising, clean energy technologies and crony capitalism. The former has led to many socially- and economically-altering technologies – think of all the products that came from our space program, the military’s development of the Internet, or even the aid to develop hydraulic fracturing. Unfortunately, our history is replete with crony capitalism failures, as government demonstrates, time and again, it is not good at picking industry winners and losers. As we have progressed from crawling to walking to running, and now driving at 100 miles per hour down a road to a less carbon-intensive economy, the idea we might want to take time to reassess our speed seems out of the question. But as every successful explorer has demonstrated, it is important to not only know where you are heading, but also to assess the path to the destination. Stopping periodically to check where you are and whether the path you are on is still the most desirable one for getting to your destination is a sound strategy. A recent analysis from several British climate data purveyors provides an interesting perspective on the state of the path to controlling climate change in the United Kingdom. The release of the annual temperature record for Central England happened at the turn of the year. The temperature record is compiled by the Met Office’s Hadley Centre. The Met Office web site has a brief description of the Central England Temperature (HadCET) dataset, which highlights its significance. “These daily and monthly temperatures are representative of a roughly triangular area of the United Kingdom enclosed by Lancashire, London and Bristol. The monthly series, which begins in 1659, is the longest available instrumental record of temperature in the world. The daily mean-temperature series begins in 1772. Manley (1953, 1974) compiled most of the monthly series, covering 1659 to 1973. These data were updated to 1991 by Parker et al (1992), who also calculated the daily series. Both series are now kept up to date by the Climate Data Monitoring section of the Hadley Centre, Met Office. Since 1974 the data have been adjusted to allow for urban warming: currently a correction of -0.2 °C is applied to mean temperatures.” To help people unfamiliar with the U.K. to understand where the temperature data originates, we have included a map of Britain (next page). London is the star on the map, and directly west is Bristol. Lancashire is a small town, but also the region surrounding Parsons north of Liverpool and close to Blackpool on the coast of the Irish Sea. That triangle covers a healthy portion of central England. Exhibit 11. England’s CET Covers Much Of Central U.K. Source: Vidiani.com Paul Homewood, an avowed U.K. climate data watcher, assessed the latest CET data and arrived at a somewhat different conclusion than the people hammering on the hottest day/month/year phenomenon for the country. At times, the handling of the temperature data by the Hadley Centre has been controversial. Researchers at the center were also involved with climate researchers at the University of East Anglia in a scheme to have studies submitted to scientific journals refuting the climate orthodoxy rejected. This was a major scandal within the climate scientific community, but has largely been erased from history. While the CET data is adjusted to reflect urban warming, there are still occasions when temperature instrument locations make them susceptible to extreme readings. If one goes to the Met Office web site, there is a graph of temperature anomalies relative to the 1961-1990 average. The red line on the chart is actually a 21-point binomial filter, which is roughly equivalent to a 10-year running average. As can be seen, other than for a brief period around 1725, the large positive temperature deviations have occurred in recent years. Moreover, the largest concentration of negative deviations occurred prior to 1700. From that point forward, the negative deviations became fewer and with reduced magnitude. The positive deviations began to dominate the reported data starting after 1900, which coincides with the beginning of the Industrial Revolution. This chart would certainly support the argument that the world is in a warming trend, which has grown even warmer over the past 25 years. Exhibit 12. U.K. Long-Term Temperature Anomalies Source: Met Office All the historical data is publicly available on the Met Office web site. As a result, Mr. Homewood created the following chart (next page) showing the actual average temperature for each year and a 10-year average (red line). If one looks at the red line, it is clear how dramatic was the warming experienced between about 1700 and 1740. In fact, the average temperature in 1698 was 7.67° C, which jumped to 8.83° C the following year. For the six previous years, the annual average temperature ranged between 7.29° C and 8.52° C. For earlier years, the average annual temperature ranged from the 7’s to 10.15° C (1686). That peak temperature actually stands out in the chart. Exhibit 13. Recent U.K. Warming Ceased In 2006 Source: Paul Homewood As we look at 1700 to 1740, the 10-year average temperature rises by nearly 2° C. From roughly 1815 to 1835, we see another period with a nearly 1° C increase. Another period when the 10-year average temperature rose by about 0.7-0.8° C was in the late 1800s. The rate of increase in these earlier periods compare with the average temperature increase of about 1° C from 1990 to 2006. It is interesting that the 10-year average temperature trend declined after 2006 and has only turned up in recent years. We do note that between 1990 and 2020, 22 years out of the 30-year span had annual average temperatures above 10° C. This is shown in the chart of annual temperatures for the years of this time span. Exhibit 14. Recent 30 Years Show Moderate U.K. Warming Source: Paul Homewood Mr. Homewood asks what is the “normal” climate for England? He wrote: “The Met Office would say this is the 30-year average, but this is only an artificial construct for convenience. Currently the 10-year average on CET is 10.40C, which is barely above the 1991-2020 average of 10.25C. The difference is well within any margin of natural variation.” To demonstrate that reality, Mr. Homewood points to the fact that annual average temperatures rose from 8.86° C in 2010 to 10.72° C the following year, which he suggests would reflect “weather” and not climate. To address the weather issue, Mr. Homewood plotted the highest and lowest monthly average temperature for each month since 1991. He used this to show how variable English weather can be. Exhibit 15. Highlighting England’s Variable Weather Source: Paul Homewood He then had some fun. What if all the hottest and coldest months occurred in the same year, he asked? In that case, the annual average high temperature would be 12.8° C. Likewise, the coldest monthly average would be 7.3° C. Superimposing these averages on the record of annual temperatures for 1991-2020 produces the following chart. As the actual annual averages appear to be somewhere in the middle of the hottest and coldest range, does this suggest that current temperatures are more or less a reflection of natural climate conditions? Exhibit 16. Recent U.K. Temperatures Are Moderate Source: Paul Homewood Further to the point about normal temperatures and/or weather in England, the Met Office data in one presentation sorts the annual average temperatures from the coldest to warmest year. Mr. Homewood copied part of that table and presented it along with his other charts. As one can see at the bottom of the chart, 2020’s temperature marginally trails 2006 and trails by a greater margin the 2014 temperature. Interestingly, 2020 is not much warmer than 1949. Moreover, if one looks at temperatures that are about a quarter of a degree cooler, there is a wide range of years: 1733 (10.50), 2004 (10.50), 2007 (10.50), 1834 (10.51), 1921 (10.51), and 1959 (10.52). There are also a number of years when the annual average temperature either increases or decreases by a wide margin, suggesting that weather plays a greater role in the temperature data than many climate scientists wish to acknowledge. Exhibit 17. Ranking U.K. Yearly Temperatures Source: Met Office But just as temperature data creates challenges for the climate emergency argument, the question of extreme weather events also plays havoc with the accepted narrative that our climate is getting worse. Long-term data series for wildfires, hurricanes and tornadoes show declining trends. Yes, the amount of damage from storms has increased, but that is largely a function of population migration and economic growth in coastal states. Everyone wants to live where they can see the water. That means, not surprisingly, by living on the coast, you are at increased risk from storm damage. The latest figures from Munich Re, an insurance company that reinsures other insurance companies, shows that property damage from natural disasters in the United States doubled in 2020 to $95 billion. An official with the insurer told The New York Times that climate change “plays a role in this upward trend of losses,” but he also pointed out that continued building in high-risk areas has also contributed to the growing losses. This is an important point because governments can reduce this trend through revised building codes and land-use restrictions. Yes, these steps will boost building costs and inflate real estate values for existing structures, but that may be cheaper than current insurance losses. Here are charts showing trends for these various extreme weather events. While 2020 was an active tropical storm year in the North Atlantic, the accumulated cyclone energy (ACE) was substantially higher than in 2019. The 2020 Atlantic hurricane season was the fifth consecutive season with above-normal activity. Twelve of the 30 named storms made landfall on the U.S. coast, breaking the record of nine set in 1916. However, that was not the case in the Pacific Ocean. There were only 17 tropical storms in the region, making it the least active year since 2010. Combined the ACE for all of the Northern Hemisphere was well below normal and last year. Exhibit 18. Global Storms In 2020 Below 2019 Pace Source: GWPF A long-term chart (next page) of ACE for the Northern and Southern Hemispheres shows significant variation over time. Again, it is difficult to find a pattern of recent years being worse than earlier. Exhibit 19. Long-Term Record Of Global Storm Energy Source: GWPF Based on the work of Dr. Ryan Maue, the following chart shows a 12-month running sum of all hurricanes and major hurricanes. The top time series is the number of global tropical storms reaching at least hurricane-force (maximum wind speed exceeds 64 knots). The bottom time series is the number of storms that reached major hurricane strength (96 knots or greater). Except for the spikes in 2016 and 2019, since the early 1990s the trend in global and major hurricanes has been lower. Exhibit 20. Hurricane Frequency Shows Downward Trend Source: GWPF The trend in the total number of hurricanes through roughly 180 years of history also shows a declining trend. (Chart on next page.) Exhibit 21. L-T Number Of Hurricanes Shows Lower Trend Source: GWPF When it comes to the annual count of tornadoes, 2020 started out above the average of 2005-2019. After April, the count began trailing the average and ended up substantially below. Based on the preliminary data reported by National Oceanic and Atmospheric Administration (NOAA), the number of tornadoes in 2020 was 1,245 compared to a normal value of 1,392 for the 2005-2019 period. Exhibit 22. 2020 Tornadoes Showed Below Average Year Source: NOAA Importantly, the 2020 U.S. tornado season experienced no EF-5 tornadoes, which are the most powerful tornadoes. It has now been seven years since the last EF-5 tornado struck in the U.S., which occurred in Oklahoma in May 2013. According to NOAA, there have been a total of 36 EF-5 tornadoes in the U.S. since 1970, with 14 occurring in the 1970s. Only nine have occurred in the past 20 years. Exhibit 23. No Powerful Tornadoes For Seven Years Source: GWPF If one listens to the mainstream media, the world is in the midst of an incredible period of climate disasters. That argument is built by focusing on one or two visually spectacular events, but it requires ignoring the bulk of the data from the rest of the world. According to data from the United Nations, while there was an uptick in the number of climate-related disasters in 2019, the trend for the past 20 years has been downward as shown in the accompanying chart. Exhibit 24. Climate-Related Disasters In Downtrend Source: GWPF Equally significant, and actually the best news possible, is that the number of deaths from natural disasters has reached historically low levels. Deaths in the past several years have been below even the least-deadly years of the late 1980s and 1990s. This is certainly good news, and much better than what was experienced during the 2000-2010 period. The argument of the climate emergency promoters is that things are getting so bad that we have only a handful of years to stop carbon emissions before the planet’s climate is destroyed. The recent period of extremely low death tolls would seem to belie that argument. Exhibit 25. Natural Disaster Deaths At Record Low Source: GWPF Weather events make for newsworthy stories, and are something the media and fearmongers are happy to grab onto. We should be careful, however, not to confuse weather with climate. The world is in a global warming period, primarily because we are in an inter-glacial period of geologic time. During such a time, we are moving from one ice age to the next, so gradual warming is to be expected. It will, in time, also lead to gradual cooling as we move toward the next ice age. That is a natural phenomenon and not necessarily driven by carbon emissions and their warming power. It doesn’t mean that carbon emissions are not contributing to the rise in overall global temperatures, but the warming trend has not been shown to be driving storm frequency or severity, as long-term trend analysis of the data confirms. Nothing in the data negates the argument that as a society we should be working to reduce our carbon emissions. Clean air and clean water are goals for which we should be constantly striving. But as we work to reduce carbon emissions, our actions should be weighed against the positive social and economic contributions fossil fuels are making in the lives of the billions of people in developing economies. Improving their lives should remain a high priority in assessing government policies. Mitigating climate-related risks should be a part of the calculations undertaken by all governments as they assess the risk/reward of policy actions. It is distressing to see that the new Congress will operate without the traditional mandate to assess the cost of climate-related policies it is considering legislating. We can reduce carbon emissions at a reasonable cost without destroying industries with misguided policy prescriptions. In fact, the commodity market has helped achieve such progress. In the U.S., low-cost natural gas has displaced coal, sharply lowering our carbon emissions without dramatically altering the functioning of our energy and electricity markets. Last year, Covid-19 helped U.S. carbon emissions to drop by 9.2%. Importantly, this has put the U.S. back on track to meeting its Paris Agreement commitment, something we are soon to re-engage. Exhibit 26. Covid-19 Helped Cut Emissions In 2020 Source: greentechmedia.com By allowing market forces to work, our energy revolution not only allowed the U.S. to become more energy self-sufficient, but it enabled us to have greater influence in the geopolitics of the Middle East that has led to the improved relationships between Israel and its various Arab neighbors. Market forces have also enabled the U.S. to become an exporter of natural gas, which has helped facilitate the development of a global gas market. That has enabled other countries around the world to make a similar coal-to-gas conversion and reduce their carbon emissions. Exhibit 27. Getting The U.S. Back On Paris Commitment Source: insideclimatenews.org Twenty-twenty’s carbon emissions improvement continues the downward trend in U.S. carbon emissions that began in 2005. In fact, the U.S. has demonstrated the most successful improvement in reducing carbon emissions of any major country, and especially one that accounted for a substantial portion of the globe’s emissions. As the 2020 data shows, the greatest share of the emissions reduction came from the transportation sector, which is largely due to the lockdowns and restrictions on travel, especially air travel. Electric vehicles (EV) will reduce pollution in this sector, but eliminating all transportation sector emissions will be impossible without some new technologies for planes, trains, ships and heavy-duty vehicles. EVs represent AN answer to carbon emissions, but not THE answer. Recognizing that the solution will entail employing multiple technologies is the mature approach. The climate emergency movement will not let that happen. Such an outcome will prove more costly, disruptive and repressive than many can yet imagine. |

| Contact PPHB: 1900 St. James Place, Suite 125 Houston, Texas 77056 Main Tel: (713) 621-8100 Main Fax: (713) 621-8166 www.pphb.com |

| Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success. |

Download a PDF of this Newsletter.