Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future.

August 8, 2023

Aspirational CAFE Policy To Disrupt U.S. Auto Market

The Transportation Department plans to boost the CAFE standards to levels that will force the auto industry to only build EVs by 2032. The proposed standards will be impossible for automakers to reach without shifting their entire output to EVs, especially after the mpg of EVs are downgraded. GM’s latest financial results highlight the power and profitability of its ICE vehicle franchise. The EV transition will depend on the successful introduction of price-competitive EVs such as Chevrolet’s Equinox EV being introduced this fall. Examining the challenges impacting this transition includes reviewing the latest Anderson Economic Group’s EV versus ICE vehicle fueling cost study. READ MORE

Aspirational CAFE Policy To Disrupt U.S. Auto Market

Dreamers in the Transportation Department, under the spell of White House social engineers, unveiled a nearly 700-page plan to boost the Corporate Average Fuel Economy (CAFE) standards for U.S. passenger cars, as well as trucks and SUVs. By 2032, the government wants cars to average 66.4 miles per gallon, up from 44.1 mpg set last year. Trucks and SUVs will need to average 54.4 mpg, up from 32.1 mpg.

In an additional debilitating move for the auto industry, the Energy Department is proposing to reduce the “miles per gallon equivalent” for electric vehicles (EV). For example, it would cut the rating for Ford Motor Company’s F-150 Lightning from 237 mpg-e to only 67. This means even more EVs will need to be sold if the auto companies are to avoid penalties for failing to meet the government’s CAFE standards.

The EV became the Obama administration’s ‘golden calf’ and was foisted on the public and auto industry as the solution for global warming. Money for EVs was abundant, and with the help of the United Auto Workers union, became the carrot to drive the transportation industry transition. The stick was handed to the bureaucrats in the Energy, Environment, and Transportation Departments to create ‘aspirational’ standards to ensure EVs’ success regardless of the environmental and economic costs.

As Obama’s policymakers began implementing their environmental and energy plans, the domestic automobile and electricity industries were targeted. Remember when Obama told the San Francisco Chronicle in an interview during his 2008 presidential campaign:

“You know, when I was asked earlier about the issue of coal, uh, you know — Under my plan of a cap and trade system, electricity rates would necessarily skyrocket. Even regardless of what I say about whether coal is good or bad. Because I’m capping greenhouse gases, coal power plants, you know, natural gas, you name it — whatever the plants were, whatever the industry was, uh, they would have to retrofit their operations. That will cost money. They will pass that money on to consumers.”

The policymakers from Obama’s administration are now alive and well and in control of the Biden administration’s environmental policies. Their bureaucratic supporters control the key enforcement agencies and understand the goals and objectives of these policymakers. Thus, we should not be surprised by what the Editorial Board of The Wall Street Journal called “Biden’s Summer Regulatory Onslaught.”

The WSJ pointed to a General Motors presentation to the White House that estimated the auto industry’s penalties for failing to meet the CAFE standards could total $300 billion, or about $4,300 per vehicle between 2007 and 2031. GM estimates the standards will reduce carbon emissions through 2050 by 885 million metric tons. That sounds impressive until you realize it will be about half of the emissions projected to be released this year from Canada’s wildfires.

“According to Kelley Blue Book data, new car average transaction prices (ATP) held steady in June at $48,808, an increase of $150 from revised May numbers. Manufacturer incentives increased to an average of $2,048, the highest level in a year.” Given the latest Kelley Blue Book transaction data, GM’s estimated penalty cost for the auto industry is about 8% of the new car ATP adjusted by adding back the manufacturer incentives.

Aspirational economic policies are often based on flawed understandings of the technological developments necessary, the speed with which transitions can occur, and their costs. That doesn’t mean we should not hold aspirations for improvements, but rather that our assumptions for what it will take and how long it will take to effect changes should be given greater weight in the projections. Modesty, however, seldom garners the headlines or Internet clicks that reward bureaucrats.

Besides the recent Transportation Department proposed rule, we have several data points about the current automobile market transition that may shed light on whether the aspirational plans will or can be realized. First, Cox Automotive reported in July that EV inventories had built to 92-days’ supply, roughly three months’ worth of sales. That is nearly twice the auto industry’s average inventory reflected by internal combustion engine (ICE) vehicle inventories at 54 days’ worth of sales. Cox suggested that normal auto dealer inventories are about 70 days’ supply. Cox’s EV data didn’t include Tesla because it sells directly to consumers. But Tesla’s days’ inventory stood at 64, or higher than the ICE inventory. Additionally, some of the most expensive EVs in the luxury category have inventory levels greater than 100 days of sales.

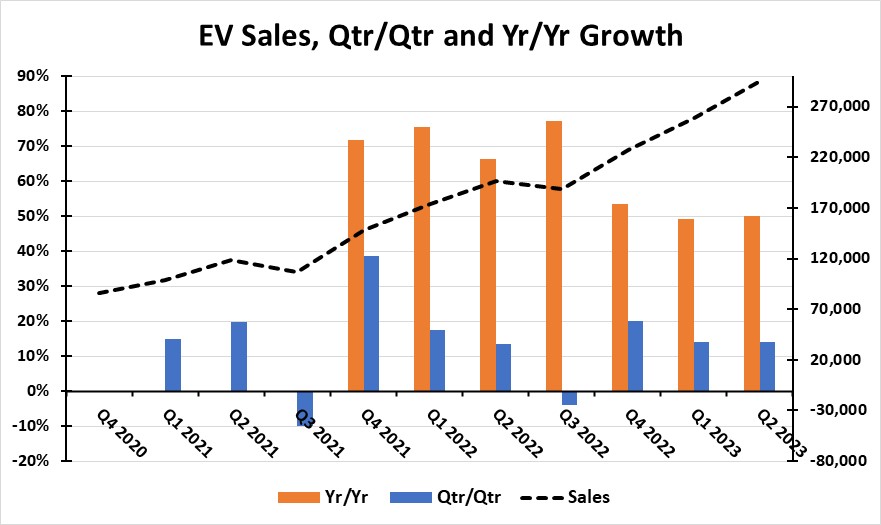

When second-quarter EV sales were reported, we learned that the industry sold almost 300,000 units. Predictions are that the industry will sell one million or more EVs in 2023. However, it seems this year is experiencing a slowing in the sales rate, which has contributed to the increase in inventories. Production has outpaced demand, which is troubling. It is troubling because the growth rate in sales is moderating as shown by both quarter-over-quarter and year-over-year changes in EV sales.

Exhibit 1. The Slowing Of EV Sales Is Troubling

Source: Cox Automotive, author

The issue of the EV revolution and the transformation of the American automobile fleet came into focus when Mark Fields, formerly a Ford CEO, was interviewed on CNBC about GM’s 2Q 2023 earnings. As Fields noted, GM beat analysts’ estimates for both revenues and earnings and the company’s management raised its guidance for full-year 2023 earnings. The driver behind GM’s earnings results and its guidance was its pricing and ICE vehicle sales being stronger than expected. But the same could not be said for the company’s EV sales. After three consecutive quarters of rising EV sales (3Q 2022 – 15,156; 4Q 2022 – 16,150; and 1Q 2023 – 20,670), sales declined in the second quarter, according to Cox Automotive data. The most recent three-month sales at 15,652 units were back at 3Q 2022’s level, down 25% from the first quarter peak. And GM’s EV inventory at the quarter’s end rose like all other EV sellers.

GM does not break out its EV sales and profits like its competitor Ford. However, Ford reported that it is expected to lose $4.5 billion this year, up from its prior projection of a $3 billion loss. Since Ford has reduced prices on its Lightening 150 truck, that has added to the losses projected earlier before the price cut.

When questioned about the EV business, Fields commented that “We’re in a ‘make-or-break’ moment for the EV industry.” He went on to describe why this was the case. With demand not keeping up with production, he reasoned that the key test for the universality of EVs was at hand. EVs continue to be more expensive than ICE vehicles, but that problem will be solved by the automakers in Fields’ judgment. The introduction this fall of Chevrolet’s Equinox EV SUV with 300 miles of driving range will be the test. That’s because the Equinox EV is scheduled to be priced around $30,000, competitive with comparable ICE vehicles.

Fields said the problem is that once price is off the table as an objection, then other customer concerns – principally the charging infrastructure – become key. Charging is an issue – takes too long, there is a lack of commercial charging points, they are often broken or inoperable, the need for apps to link to charging supplies – because it presents hurdles customers do not face with ICE vehicles. For the Equinox EV with a Level 2 (home) charger, you add 34 miles per hour. A fast charger (commercial) will add 70 miles of range per hour. If you want to add 200 miles of driving range, it takes either nearly six hours or three hours depending on the charger option. Therefore, in Fields’ opinion, “When faced with challenges, customers will take the path of least resistance when making big purchases such as cars.” If GM is not successful in selling its Equinox EVs in the second half of 2023, then the industry and analysts will need to reassess the timetable for transitioning the fleet to EVs. Maybe the government will have to reassess its view of reaching 100% EVs by 2032 or even California’s 2035 date.

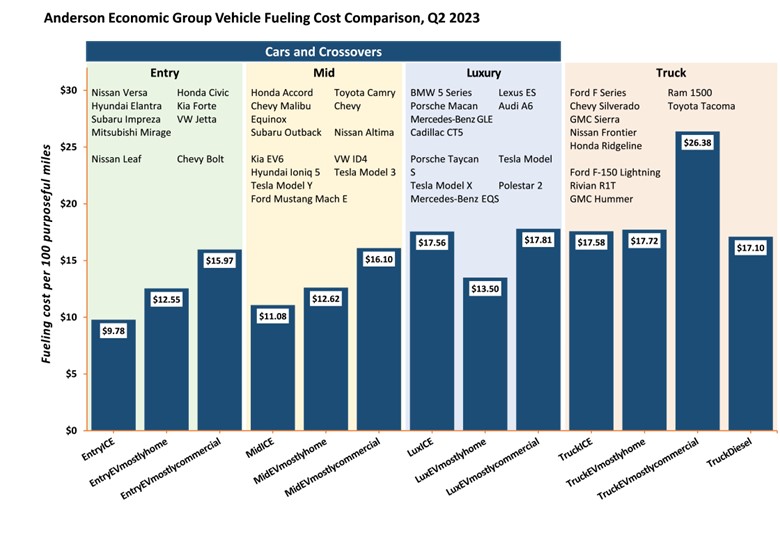

Adding to Detroit’s EV challenge is the latest data from the Anderson Economic Group’s (AEG) analysis of the cost to fuel EVs versus ICE vehicles. This is a continuation of a study the firm initiated in 2021. The latest data shows that in most cases it is cheaper to fuel an ICE vehicle than a comparable EV charged mostly at home.

The AEG calculates four categories of costs for fueling EVs and ICE vehicles. Their detailed methodology is designed to capture real-world U.S. driving conditions, as opposed to an estimated cost or by surveying personal experiences. The four cost categories include:

The cost of underlying energy (gas, diesel, electric).

State excise taxes charged for road maintenance.

The cost to operate a pump or charger.

The cost to drive to a fuel station (deadhead miles).

AEG explained that state excise taxes and the cost to pump are embedded in the retail fuel price for ICE vehicles. Each segment’s calculation reflects the cost per 100 ‘purposeful’ miles, which are miles driven after considering the cost of driving to a commercial gasoline or electric charging station if not charging at home. By adjusting assumptions about the frequency of using commercial charging locations that impacts costs for EVs, AEG develops 24 fueling cost scenarios.

These costs are compiled and compared. There are three groupings of passenger cars reflecting price levels, fuel efficiencies, vehicle sizes, etc. There is also a comparison grouping for trucks. The conclusions of the 2Q 2023 analysis are shown in the accompanying chart published by the AEG, along with representative models for each category.

Exhibit 2. ICE Vehicles Are Often Cheaper To Fuel Than EVs

Source: Anderson Economic Group

For Entry and Mid vehicles, ICE vehicles were cheaper to fuel than charging mostly at home, and much cheaper compared to mostly commercial charging. For the Luxury category, ICE vehicles were more expensive to fuel than comparable EVs charged mostly at home, but slightly cheaper than those EVs charged mostly at commercial charging stations.

One wonders how this fueling analysis might change in the second half of 2023 if oil prices remain elevated or go higher. For the first six months of 2023, the average Weekly U.S. All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon) reported by the Energy Information Administration was $3.59. For July and the first week of August, the average price is 5% higher. For the Entry and Mid categories, ICE vehicles were 22% and 12% cheaper than EVs charged mostly at home, so higher gasoline prices do not suggest a complete erosion of their fueling cost advantage. We also assume that residential electricity prices will increase in the second half of the year. While Rhode Island is not a needle-mover for U.S. electricity demand and prices, its residential customers will be paying 24% more for their power this fall and winter than during last spring and summer. We know other states also have seasonal pricing and are going through periodic rate increase determinations, too.

Auto manufacturers are investing billions to transition their production capacity to EVs in response to government pressures and mandates. Currently, Detroit’s car companies are losing billions of dollars on the EVs they are producing, and most of them are targeting the luxury category that has been successfully exploited by Tesla. With slowing EV sales, one wonders whether we are running out of virtue-signaling and early adopters of new technology buyers. If so, then Mark Fields’ observation of the EV industry being at a “make-or-break” moment is more apt.

Contact Allen Brooks:

gallenbrooks@gmail.com

www.energy-musings.com

EnergyMusings.substack.com