Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future. While published every two weeks, events and travel may alter that schedule. I welcome your comments and observations. Allen Brooks

Download the PDF

June 28, 2022

When All Else Fails, Return To Proven Technology

The energy crisis has European countries scrambling to find replacement gas supplies for the Russian gas it previously used. To prevent power shortages, coal use is experiencing a rebirth. READ MORE

Will Offshore Wind Deliver The Power Economically?

The government’s push for offshore wind is roaring ahead driven by environmentalists. Reviews for approval of the projects suggest there may be downsides not being properly considered. READ MORE

Who Cares If Miami Is Six Meters Underwater In 100 Years?

Miami faces two issues – rising sea levels and higher water tables. Miami Beach has been working on an adoption plans despite some homeowners objecting. We can save the city. READ MORE

Random Energy Topic Thoughts

Updating The Block Island Wind Farm Performance

Gasoline Tax Suspension Gimmick Game

Renewable Energy Piggy Banks Pour Out Money For Players

When All Else Fails, Return To Proven Technology

The European energy crisis continues to worsen. The reason is simple – the repercussions from the sanctions against Russia over its invasion of Ukraine. Without those sanctions, Russian energy flows to Europe would have continued, which would have left only renewables’ poor output performance as the energy supply challenge. Europe’s energy crisis stems from its decades-long dependence on Russian fossil fuels – crude oil, natural gas, and coal. Based on 2021 data from the Directorate-General for Energy for the European Union (EU), the 27-country organization that includes most of the countries on the continent imported 27% of its oil use, 41% of its natural gas supply, and 47% of its coal consumption from Russia. Because the EU requires unanimous approval from the members to enact policies, getting an agreement to ban Russian fossil fuel imports has proven difficult to secure and the agreements reached necessitated numerous accommodations including when bans would start and how much of the fuels would be banned. The delays in the starting dates for the various bans were designed to allow countries time to secure alternative supplies, an ongoing story.

Last week, the International Energy Agency (IEA) warned that European countries should prepare for a complete ending of Russia’s natural gas flows, which it says will force gas rationing. The scramble to secure adequate winter gas supplies has driven prices to levels six-times what they were a year ago. The high prices are forcing utilities to operate at losses, which jeopardizes their financial stability. Germany has extended a €15 ($15.7) billion line of credit to its utilities to buy natural gas to fill their storage facilities. A problem emerging in this search for more gas supply is that exporters are demanding buyers sign long-term contracts, which means they will be committed to gas in conflict with their governments’ green energy agendas.

As renewable energy continues to fall short of delivering the power anticipated, the green revolution is proving disappointing given the amount of money invested. With July’s arrival, Europe’s window to ensure sufficient energy for the upcoming winter will shrink to four months, assuming cold weather does not arrive early. Germany’s gas storage is currently 58% full, above where it was a year ago at the same point. France and Italy are at about the same level, while Spain is at 77%. However, since the EU has ordered all countries to be 80% full by November 1, further disruptions or a total loss of Russian gas flows has politicians worried about a winter gas crisis and forcing them to take steps including ordering customers to cut consumption.

Another problem for Germany and others in their efforts to secure more gas supply is the disruption of Europe’s electricity output from problems with its nuclear power plants. The state-run Electricite de France SA (EDF), Europe’s largest producer of atomic energy, is struggling with lengthy maintenance of its aging plants. This boosts the EU’s dependence on natural gas and especially its imports of liquefied natural gas (LNG) to offset the loss of nuclear power.

According to Bloomberg, France’s nuclear plants are operating at less than half their rated capacity. This is a serious problem for a country where nuclear power provides 70% of its electricity. Additionally, it has driven retail electricity prices to record levels. As of last week, French nuclear production was at its lowest level since 1993, generating less than half the 61.4 GW of capacity it can produce. This has forced France to import 3 GW of electricity from the U.K., historically the recipient of 3 GW of surplus French power. That is a net 6 GW swing, which has U.K. utilities worried about their winter electricity supplies. The need for France to import power, and the knock-on effect of other European countries being forced to do the same thing will upset the traditional operation of the continent’s power grid. Given the market’s disruption due to the nuclear power plant problems, and estimates that this will take years to correct, the European energy market is pricing in a large risk premium for electricity early in 2023 according to Sabrina Kernbichler, a power analyst at S&P Global Commodity Insights.

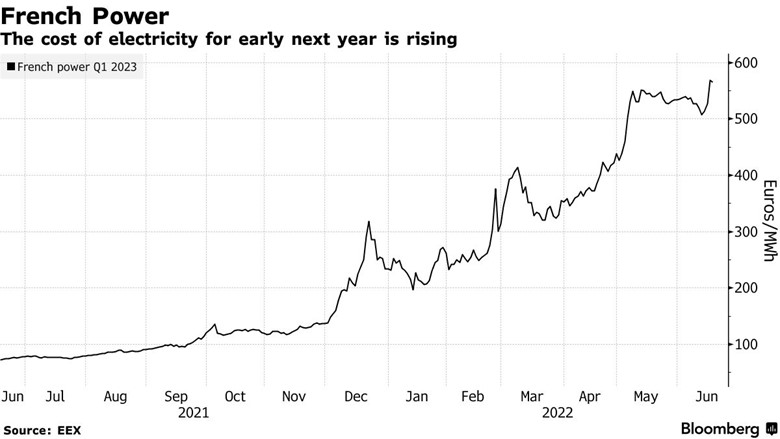

The chart below shows the cost of French power for the past 12 months. Last week, the price of French power jumped to 243 euros ($256) per megawatt-hour (MWh). Longer term, French power for the first quarter of 2023 is up to 570 euros ($601)/MWh. Last Tuesday afternoon, wholesale power prices in Texas, according to the ERCOT website, were around $83/MWh.

Exhibit 1. French Nuclear Reactor Issues Driving Power Prices Up

Source: Bloomberg

Part of the French nuclear problem stems from the financial condition of EDF, the 84% government owned utility. During the winter, as electricity prices climbed toward €500 ($527)/MWh, French President Emmanuel Macron ordered the company to increase the power it sells to third-party providers at a capped price of just €46 ($49)/MWh to protect French households from inflation. The problem was that as the nuclear power plants began to experience operational problems that took some of them offline, EDF was forced to purchase electricity supply in the open market at high prices that is projected to cost the company €10 ($11) billion this year. As a result, a frustrated EDF CEO made a formal appeal to the government for help. The government responded with a €2 ($2) billion capital lifeline, but of questionable value for a company with €45 ($47) billion in debt at the start of 2022.

Not only is the French electricity market in turmoil, but so too is all of Europe’s. To meet power demand, and especially to have sufficient power for the upcoming winter, Europe is turning to coal. Burning coal will reduce the use of natural gas for generating power and allow that supply to be put in storage for the winter. According to media reports, Austria, the Netherlands, Slovakia, and Germany are restarting mothballed coal-fired power plants. In Austria, Bloomberg last week reported: “State-controlled Verbund AG, Austria’s biggest utility and most valuable company, was ordered late Sunday to prepare its mothballed Mellach coal-fired station for operation.” That plant has been closed for two years after Austria moved to phase out all coal use. Austria has also moved to allow the conversion of a large gas-fired power plant to coal.

In the Netherlands, “[t]he cabinet has decided to immediately withdraw the restriction on production for coal-fired power stations from 2002 to 2024. This means that coal-fired power stations can run at full capacity again instead of the maximum of 35 percent,” according to energy and climate minister Rob Jetten. It is also encouraging residents and businesses to save gas, including providing financial incentives to large industrial gas users to cut their consumption. The government has also told Shell and Exxon Mobil, the operators of the huge Groningen gas field, scheduled to be shut down eventually to prevent more earthquakes that have damaged buildings, to not shut down any wells this year.

Germany faces greater challenges. Last year, it imported half its gas supply from Russia, but now has reduced that dependency to about 35%. However, the country is behind in refilling its gas storage for the upcoming winter, which is crucial for preventing human suffering. Therefore, Germany has authorized utilities to restart up to 10 GW of retired coal-fired generation capacity, as well as to institute other measures to limit the use of natural gas for generating electricity. Germany also plans to start a natural gas auction program to limit consumption. The mechanics of how this auction plan will work have not be disclosed. The legislation for coal use is to be voted on July 8 and will expire March 31, 2024. “This is bitter but, in this situation, essential to lower the use of gas,” said German economic minister Robert Habeck, a member of the Green party.

RWE, Germany’s largest energy company, has halted early retirement of employees in reaction to the government’s decision to allow the restarting of coal-fired power plants and extending the operations of three lignite power plants. Those are the three 300-MW power plants currently on security standby. To keep these lignite-fired power plants running longer than previously expected, RWE will also use trained and external workers to cover personnel requirements, involving hundreds of jobs. That will be an extra cost for generating electricity.

Other countries in Europe such as the U.K., Italy, Denmark, and Poland have taken actions to respond to the growing gas supply crisis as Nord Stream 1, the gas pipeline connecting Russia with Germany, has reduced its volumes. Normally, the pipeline pumps 167 million cubic meters per day (mcm/d). In mid-June, Gazprom, the operator of the pipeline, reduced volumes to 100 mcm/d, citing a problem with a compressor that is undergoing repair but is a victim of Canadian sanctions against Russia. These sanctions are preventing Siemens, who is repairing the compressor, from getting necessary parts from Canada, according to Gazprom. Most analysts and government officials do not buy that explanation, rather seeing the cutback as part of commercial campaign by the Russian government to pressure European governments for their sanctions and continued support of Ukraine in the ongoing war. Weaponizing fossil fuels has always been a potentially powerful tool Russia could use to pressure European countries to alter their support for Ukraine. Political experts believe the current Nord Stream 1 supply curtailment is merely a reminder of that powerful tool.

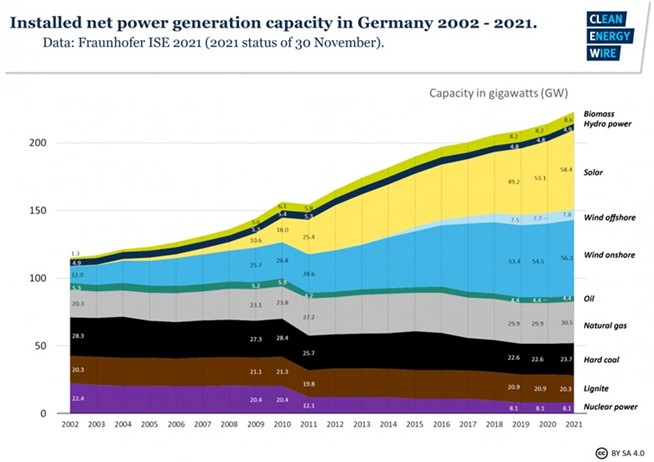

Germany’s huge investment in renewable energy is showing a poor return. Of the 219.11 GW of installed generating capacity in Germany as of 2022, 57.4% is represented by wind and solar. These figures are through May 2022, although the chart below shows net power generation capacity only through November 2021.

Exhibit 2. Germany Is A Leader In Renewable Energy But Not Renewable Power

Source: Clean Energy Wire

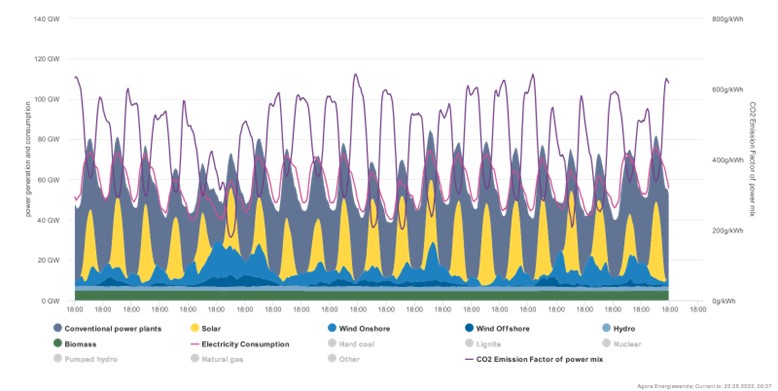

The next chart shows daily electricity generated by fuel versus demand for the month of June through June 21. The chart shows the variability of wind and solar. As seen, there are times when onshore and offshore wind’s (light and dark blue, respectively) contribution is very low, while the daily solar contribution not only spikes but also shows limits.

Exhibit 3. June German Electricity Daily Demand And Supply By Fuel

Source: agora-energiewende.de

Based on day-ahead figures for June 21, total wind supply was 5.3 GW, or 8.3% of demand, while solar supply was 13.3 GW, or 23.5%. However, combined, the 18.6 GW of renewable energy supply equaled only 8.5% of total installed generating capacity. Despite days of such little power output, renewable energy remains the primary focus of German politicians. Building more wind turbines, even if that means cutting down historic forests, is the preferred policy. The government’s backtracking on its energy policy by ordering utilities to restart coal-fired power plants, a proven technology that delivers reliable electricity supply, should be a wake-up call to reexamine its entire energy and environmental approaches. If the previous policies were not ready for prime time, then a course correction would appear in order. This winter may force politicians to realize that energy security trumps (pardon the pun) climate change fanaticism.

Will Offshore Wind Deliver The Power Economically?

When President Joe Biden announced his goal of having 30 gigawatts (GW) of wind power generation installed off the U.S. coasts by 2030, his administration revved up its work to get more offshore wind lease sales in motion and to accelerate the approval of proposed projects. From New England to the Middle Atlantic to the Carolina Outer Banks, and now to the West Coast and even the center of the offshore oil and gas industry in the Gulf of Mexico, offshore wind projects are being targeted.

Last week, Biden, along with Secretary of the Interior Deb Haaland and other top administration officials, met with East Coast governors, wind industry officials, and labor leaders to announce a new federal-state partnership to advance the offshore wind initiative. The meeting was focused on how important support segments for the offshore wind industry can be expanded. The 11 states attending included Massachusetts, Connecticut, Delaware, Maine, Maryland, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, and Rhode Island. Virginia was absent. Although Governor Glenn Youngkin (R) supports offshore wind, he has withdrawn the state from a regional carbon-limiting initiative, which we surmise made his appearance uncomfortable.

There are several reasons behind this push – the wind is stronger offshore, there is no “not-in-my-backyard” (NIMBY) objections, there is much more space available, and this nascent industry will create jobs and positively stimulate economic activity in coastal regions. These are all positives. What is not considered or is dismissed are the negative impacts and costs.

A recent 1,408-page draft environmental impact statement (DEIS) from the Bureau of Ocean Energy Management (BOEM) that approves offshore wind farms contains some critical points with respect to a proposed New Jersey project. The Ocean Wind 1 project involves potentially as many as 98 wind turbines to be positioned about 15 miles southeast of Atlantic City. This wind farm would have nameplate generating capacity of 1,100 megawatts (MW). That is an impressive number given that the largest operating U.S. offshore wind farm is the 30 MW, 5-turbine Block Island Wind. The wind farms under construction will have hundreds of MWs and turbines. However, the electricity generated by offshore wind turbines only generates about 45% of the nameplate capacity. Moreover, the power is intermittent ‒ stronger at night and during winter months rather than when the power is most needed – mid-day and during summer months.

BOEM’s DEIS says Ocean Wind 1 is expected to generate $1.2 billion in economic benefits and create about 15,000 jobs, which would be highly paid union jobs under the Biden administration’s plan. The release of the draft report starts the public comment period on the project that will end August 8 and will include three virtual public hearings.

BOEM’s report addressed concerns from officials of some New Jersey beach towns that the turbines would spoil the ocean views and discourage tourists from coming. BOEM said the impact of the wind farm would be moderate on tourism due to noise from construction and the new structures. But it countered those concerns with the wind turbines by saying they might attract tourists eager to see them, much like the small tourist business viewing the turbines off Block Island. The DEIS also said there should be little impact on marine life.

However, BOEM’s DEIS said the wind farm could significantly affect local fisheries and boat traffic. That judgement is consistent with other reports that show meaningful impacts on the fishing industry, in some cases forcing the industry to abandon historical fishing grounds when turbines are installed.

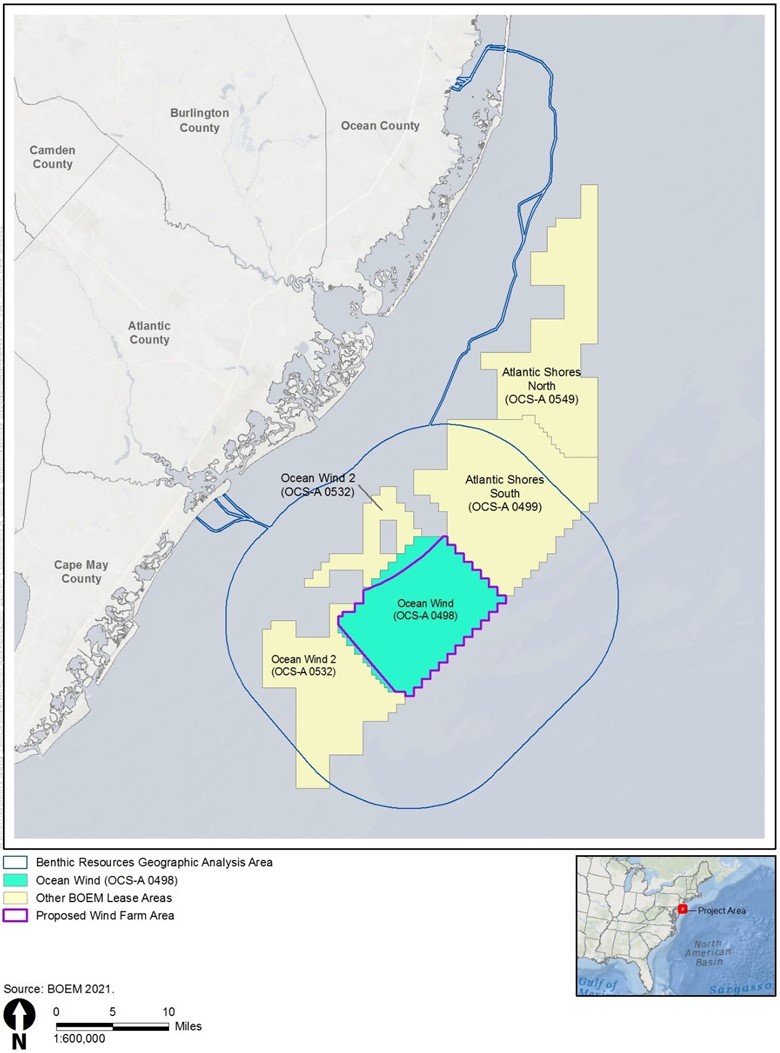

The State of New Jersey regulators have already approved Ocean Wind 1, Ocean Wind 2, and Atlantic Shores’ South projects that will have a combined capacity of 3,700 MW. The state-approved projects are shown in the map below. These three projects are located within nine offshore leases off the New Jersey coast that could eventually contain 1,410 turbines, standing 900-feet to over 1,000-feet tall. New Jersey Governor Phil Murphy (D) has set an aggressive goal for the state of building 7,500 MW of offshore wind by 2035.

Exhibit 4. Location Of Proposed New Jersey Offshore Wind Farms

Source: BOEM

What was new in BOEM’s Ocean Wind 1 DEIS were conceptual pictures of what the horizon off New Jersey will look when the projects are built. While difficult to see in the picture below, these hundreds and potentially thousands of little white wind turbines can be seen lining the entire horizon. How will tourists react? We have people on both sides of that question, but the answer will only be known after the billions of dollars are spent building the wind turbines.

Exhibit 5. Illustration Of New Jersey Ocean Horizon With Wind Turbines

Source: BOEM

Further down the East Coast is North Carolina where the state and federal governments are planning for an offshore wind lease sale. Five months after the Biden administration’s day-one announcement of the goal of building offshore wind farms, North Carolina Governor Roy Cooper issued an executive order promoting an equally aggressive offshore wind goal. Cooper’s order stated: “The State of North Carolina will strive for the development of 2.8 gigawatts (“GW”) of offshore wind energy resources off the coast of North Carolina by 2030 and 8 GW by 2040.” Cooper’s justification for the order is that “clean energy resources create North Carolina jobs, grow our economy, and help reduce climate change pollution.”

The John Locke Foundation in Raleigh, North Carolina, retained economists associated with the Center of the American Experiment to utilize their energy model to examine the plusses and minuses of this order for the state’s economy and its citizens. It should be noted that there is a rush to establish North Carolina offshore wind facilities because there is a looming federal moratorium on “any leasing for purposes of exploration, development, or production.” The moratorium was initially targeting oil and gas leasing, but under the Outer Continental Shelf Act, the ban is also applied to offshore wind leases. The moratorium will take effect on July 1, 2022, and last for 10 years. Therefore, the rush is driven by political and not market considerations.

In the fall of 2021, the North Carolina General Assembly passed House Bill 951, a “stakeholders” energy bill, putting into law Cooper’s arbitrary 2030 goal of reducing by 70% the state’s CO2 emissions from 2005 levels. Among other provisions, the law directed the North Carolina Utilities Commission to “take all reasonable steps” to achieve the goal. The law also included some other potential electricity consumer protections, depending upon how strictly its text is followed concerning the “least cost mix” of generating sources. It also requires the Commission protect consumers from being “unreasonably harmed” and “unreasonably” subject to “rate shock.” The “least cost mix” issue is like restrictions placed on regulators in Virginia and Rhode Island limiting their ability to fully weigh the economics of proposed utility energy projects. In fact, Rhode Island legislators eliminated regulators’ ability to use “cost-benefit” analysis in evaluating the power purchase contract for the Block Island Wind farm following its initial rejection for being “too expensive.” This modification of the law was what allowed the project to go forward. We will not be surprised to find that other states have restricted how state regulators can evaluate the cost of clean energy projects.

The John Locke Foundation report, “BIG BLOW: OFFSHORE WIND POWER’S DEVASTATING

COSTS AND IMPACTS ON NORTH CAROLINA,” examines a series of questions and issues. The list includes:

How much would it cost North Carolina electricity consumers to build and operate 8 GW of offshore wind energy capacity?

How would those costs impact electricity consumers, and are they worth it?

What is happening in North Carolina regarding climate change and pollution?

How would offshore wind energy development affect the state’s contribution to carbon dioxide (CO2) pollution?

Inasmuch as energy-based CO2 pollution is a problem in North Carolina, is offshore wind a viable solution?

How is North Carolina doing regarding job creation?

How is North Carolina doing regarding economic growth?

How would offshore wind energy development affect job creation and economic growth in North Carolina?

Inasmuch as job creation and economic growth are problems for North Carolina, is offshore wind energy development a viable solution?

Are there other impacts of — or questions surrounding — offshore wind energy development worth considering, and if so, what are they?

This is an excellent set of questions but getting answers in detail will take time and require substantial debate about the assumptions used in any analysis. That is the conclusion of the report – policymakers need to explore these issues before committing to disrupting, potentially significantly, North Carolina’s energy sector and the state’s economy.

The report urges policymakers to take “a measured approach, studying and collecting data and experiences from the new offshore wind farms off the Eastern Seaboard, and waiting for more comprehensive research into expected impact of the facilities, such as on coastal tourism, commercial fishing, marine habitats and creatures, endangered animals, seabirds and migratory birds, hurricanes, and more. It requires taking full consideration of the tradeoffs between energy-based emissions and energy costs as well as people’s quality of life and seeking the most optimal balance.”

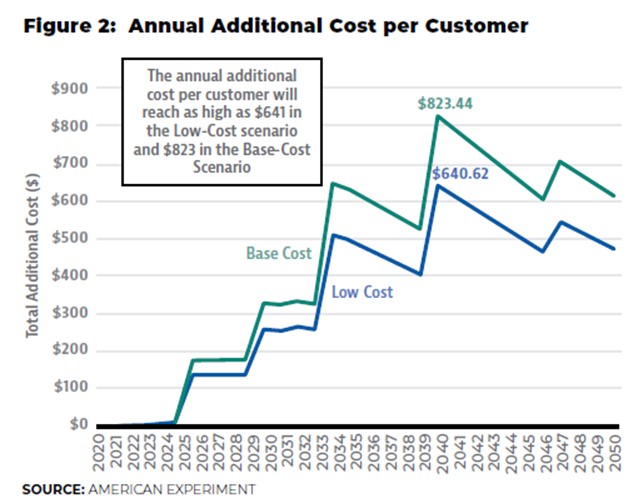

According to the report, the cost of building 8 GW of offshore wind capacity ranges between $55.7 billion in the Low-Cost scenario to $71.5 billion in the Base-Cost scenario. That will result in electricity rates increasing by 28% to 36% by 2040 in the Low-Case and Base-Case scenarios, respectively. Rates would rise to 12.09 cents per kilowatt-hour (/kWh), with residential rates at 14.59/kWh in the Low-Cost scenario, to 12.85 cents/kWh, with residential rates at 15.51 cents/kWh in the Base-Cost Scenario. With these increases, the average annual cost increase per customer would peak in 2040 at $641 to $823, respectively, in the two scenarios. These increases could go higher if more power is consumed like for charging electric vehicles since electrification of transportation was not assumed in the report’s analysis. The stairstep rise in utility costs reflects the scheduled dates for adding new capacity toward the 8 GW total.

Exhibit 6. Range Of Electricity Cost Increases For Ratepayers With Offshore Wind

Source: American Experiment

New offshore wind energy generating facilities are very costly to build, ranging from $137.00 to $164.39 per megawatt-hour (MWh). North Carolina’s nuclear plants, in contrast, generate electricity at a small fraction of that cost ‒ $21.71 per MWh. North Carolina’s natural gas plants generate electricity for $35.83 per MWh.

Governor Cooper cited CO2 emissions and climate change as reasons for building offshore wind farms. However, BOEM has acknowledged that “regional climate impacts are a function of global emissions” and that “there would be no collective impact on global warming as a result of offshore wind projects.” That is because North Carolina occupies only 0.00027 percent of the Earth’s surface, thus it can make no measurable impact on the planet’s climate, especially given the volume of emissions being injected into the atmosphere from all the coal-fired power plants China is building.

The report concludes that “no dispassionate analysis” finds offshore wind to be a viable solution to energy-based CO2 pollution in North Carolina. Focusing on zero-emissions energy sources that favor lower costs, higher capacity factors, high reliability and dispatchability would lead to nuclear energy. If one is only interested in focusing on lowering emissions and costs, while retaining reliability and dispatchability, then the focus should be on natural gas generation.

On the issue of job creation and economic growth, North Carolina regularly ranks at or near the top in state economic and business climate rankings. That achievement comes from years of North Carolina policymakers cutting taxes and regulations, keeping state budgets in line with inflation and population growth, and adding to the state’s rainy-day fund (Savings Reserve), which produced dramatic improvements in North Carolina’s employment and economic growth. All of which contributed to the state posting large budget surpluses since 2014-15. That put the state in a better position than most other states for the economic disruptions from the Covid-19 pandemic and governmental responses to it.

With respect to the rush to justify the 8 GW of offshore wind projects, the American Experiment analysis estimated that building and operating the projects could cost 45,000 to 67,000 jobs from electricity price hikes and their downstream effects on the state’s economy. North Carolina has not demonstrated a need to rush to justify offshore wind farms based on the state’s job creation and economic growth record in their opinion.

A potentially major issue for North Carolina will be the increase in electricity prices on the poor. Electricity price hikes function like regressive taxes. The upper limit for home energy prices to be considered affordable is 6% of household income. A significant number of North Carolina residents already spend between 6% and 9% of their incomes on energy. A 2021 study showed that the poorest families in the state devoted as much as 29% of their income to energy costs at the expense of food, clothing, medical care, and housing costs. The magnitude of the electricity cost increases projected in the analysis says many more North Carolina residents will be thrown into energy poverty, thereby having to make difficult family decisions on spending.

On the issue of tourism, the report pointed to a 2016 survey of North Carolina beach tourists that found them highly sensitive to “viewshed” disruption from wind turbines. Over half of those surveyed said they would not rent a vacation home if wind turbines were visible at all, while the rest would want some discount. Such a reaction would have large negative impacts on affected communities’ tourism economies and property values.

The foundation’s report also explored the impact of offshore wind turbines on commercial fishing, sensitive habitats, and endangered whales, fish, turtles, and birds. The report cited the 1,665 members of fishing communities in every coastal U.S. state warning BOEM about offshore wind energy’s threat to their industry and the offshore habitat. Even BOEM’s decision approving the Vineyard Wind project offshore Massachusetts anticipated commercial fishing abandoning the sites and losing income. That was justification for the wind farm developer to negotiate a fund for payments to the fishing community, although that has not prevented lawsuits.

A unique problem for wind farms offshore North Carolina is hurricanes. Research has estimated that nearly half the turbines in a wind farm located in the most vulnerable offshore areas would be destroyed by hurricanes within a 20-year period. North Carolina waters are second only to the southern tip of Florida in frequency of hurricane visits. The National Oceanic and Atmospheric Administration (NOAA) published the map below of hurricanes impacting the offshore waters of North Carolina.

Exhibit 7. U.S. Wind Farms Have Yet To Meet A Cat 4 Hurricane

Source: American Experiment

The report also examined the issues of “forever waste” from retired and damaged turbine blades. This is already creating an environmental problem for landfills. Since blades are not recyclable, they must be hauled to landfills. Given that offshore wind turbines are much larger than onshore wind turbines, moving the blades to landfills will be a major issue, especially when these large wind farms are shut down and the ocean seafloor needs to be restored to its original state as required by U.S. offshore energy regulations.

There is also the interesting issue of mechanical issues with the latest generation of offshore wind turbines. Four of the five turbines in the Block Island Wind farm developed stress cracks necessitating their closure for inspection and repair. If blades fail, or are destroyed by hurricanes, the impact on the ocean from waste and pollution from lubricating oils, and requirements to reroute shipping traffic and commercial fishing operations due to the hazard could be costly. We have seen recent episodes of this impacting European offshore wind farms.

The report provides plenty of ammunition for critics of the rush to build offshore wind farms along the coast of North Carolina. We still lack convincing evidence that offshore wind is cost effective without expensive subsidies. They are an additional cost for ratepayers, but importantly for all Americans since the subsidies are supported from federal tax revenues or by tax credits. Hopefully, people will read the John Locke Foundation report as it is well done and points out critical questions that need analysis and answers, not just for North Carolina.

Who Cares If Miami Is Six Meters Underwater In 100 Years?

The global head of responsible investing at HSBC Asset Management, Stuart Kirk, asked the question in the title of this article when speaking at the FT’s Moral Money conference. He went on to comment, “Amsterdam has been six meters underwater for ages, and that’s a really nice place. We will cope with it.” That was not the correct answer, nor were some of his other comments that day despite his presentation’s title and slides having been approved by his bosses. Within two days of being on the podium, Kirk was suspended by his HSBC bosses. We have yet to see any updates on his employment status.

We wrote about Kirk’s presentation within the context of a discussion of environmental, social, and governance (ESG) measures and their impact on investors and companies, especially fossil fuel companies. The point Kirk was addressing in his question and subsequent comment was whether we should be more focused on adaption steps in dealing with climate change’s impacts rather than allowing apocalyptic futures drive everything about our future lives. In that regard, he cited a comment from an earlier conference speaker who said, “there are no jobs on a dead planet,” in reference to the need to stop burning fossil fuels.

Kirk’s discussion came to mind when reading a recent article in The Wall Street Journal on “Flood-Control Efforts Spark Complaints.” The article addressed responses by local governments to rising sea levels impacting the Miami area. The city is always cited as the climate disaster awaiting us if we do not stop burning fossil fuels and emitting CO2. Some of what those making such claims miss is an understanding of the geology of South Florida. Flooding in the streets of Miami is not only an issue of rising sea levels, as the WSJ article points out.

Part of the unique challenge faced in Miami Beach is the geology of the bedrock, which is made up of porous limestone that allows the water table to come up from beneath the ground when the tide rises. That means that parts of the city can flood even on sunny days.

This reality is what undercuts commentators that say Miami is sinking due to rising sea levels. Eric Carpenter, Miami Beach deputy city manager was quoted in the article stating: “Unfortunately we have to plan for rainfall falling from the sky, plus the water that’s coming up from underneath. The only way to combat that water coming from underneath is to build higher over time.” That is a complicating factor beyond building walls to prevent rising sea water from inundating the city. But notice, Carpenter did not say anything about rising sea levels.

Exhibit 8. Miami Beach Already Suffers From Rising Sea Levels And Water Tables

Source: Financial Times

Building higher has been an answer for Miami’s solution to rising sea levels and increasing water tables underneath the city. Amy Knowles, the chief resilience officer for Miami Beach made the point that “Coastal cities in our country face flood risk and face difficult questions.” She went on to say, “Our city has made the decision to address our flooding challenges and adapt.” That would cheer HSBC’s Kirk, who was making that very point when he pointed out Amsterdam’s long history of dealing with its below sea level location. Miami Beach’s solution has not pleased all the residents and that was the subject of the WSJ article.

Miami Beach has raised 11 miles of roads from a few inches to 2.5 feet since 2017. Plans are to raise another 90 miles of roadway by 2050, when sea levels are expected to be higher than today. In one neighborhood, Sunset Harbour, roads were elevated as much as 2.5 feet in 2017. The neighborhood used to flood regularly, but since elevating the roads, the city says more than 130 flooding incidents have been avoided where the tides would have been higher than the roads.

Another aspect of Miami Beach’s flood-control effort has been installing pumps. They are part of a complex stormwater system the sucks up rainfall accumulations in low-lying areas, filters the water, and then pumps it into neighboring Biscayne Bay. The system has been lauded by some but criticized by others. In one high-end home neighborhood, a $125 million project planned in 2017 to raise roads and install pumps was cancelled after residents pushed back.

Another project nearby, with a $105 million price tag, is five years behind schedule. The WSJ says the contractor is suing the city to terminate the contract. The issue is that 175 property owners along the road must sign “harmonization agreements” that allow contractors to connect the raised road with the private properties. It means constructing ramps, stairs, or other means, depending on the elevation. Miami Beach is obligated to pay some of the costs of the neighborhood project that could be as high as $15,000 per property, but there will also be some expense borne by the homeowners.

The city continues to ask residents for input as it designs projects to adapt to rising sea levels and water tables. That is key to getting people onboard with these projects. An important point from the article was a quote by Ms. Knowles, the resilience officer for Miami Beach. “It’s important to understand that this is a transition. We can’t wave a magic wand and elevate all of the city at once,” she said. We wonder what the early residents of Amsterdam thought about the efforts to tame the North Sea from swamping the city. We also believe HSBC’s Kirk would welcome Ms. Knowles’ statement, as it goes to his point that we can adapt to climate change and deal with its risks without destroying our economy. This is a reasonable response to the false apocalyptic choice presented by climate activists.

Random Energy Topic Thoughts

Updating The Block Island Wind Farm Performance

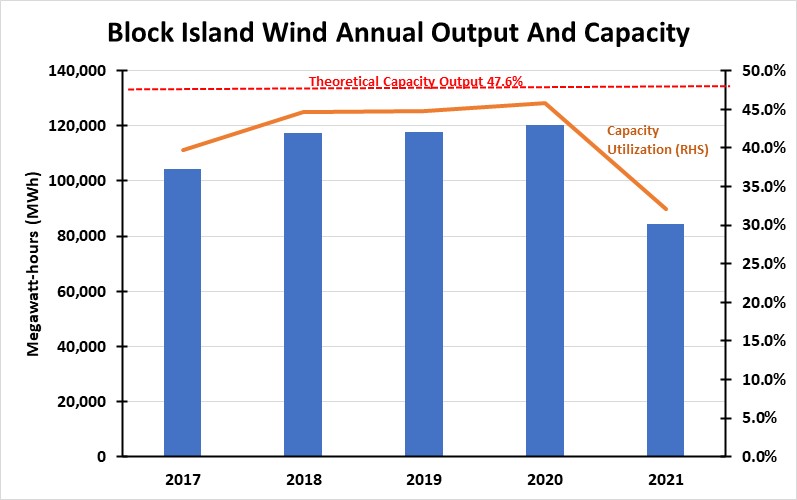

We updated our chart of annual wind output for the 5-turbine, 30-megawatt Block Island Wind farm after getting the December 2021 data. The wind farm generated 8,513 megawatt-hours (MWh) of electricity that month, bring full year output to 84,208 MWh. December’s output was the highest monthly total since May 2021 due to the scheduled maintenance and unscheduled downtime due to the need to inspect the wind turbines for cracks visible in the blades. Similar cracks had been observed previously in Europe where GE’s similar offshore wind turbines were first installed. There are no reports on the causes of the cracks or what remedies were needed, if any. Ørstad, the owner of the Block Island Wind farm and the others in Europe, reported that there were no structural problems with the turbines discovered.

Exhibit 9. Last Year Was A Bad Year For Wind Power In Rhode Island

Source: EIA, PPHB

December’s output was only 62% of the output from the same month in 2020. This December’s output, however, compared more favorably with earlier years: 72% in 2017; 74% in 2018; and 76% in 2019. Output was 35% higher than in December 2016, which marked the start-up month for the wind farm, so its output was limited.

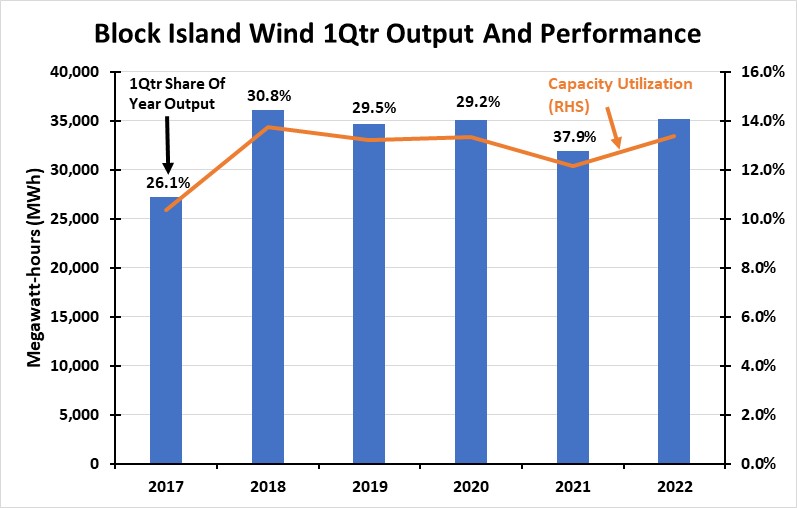

In January, the Atlantic winds arrived, and monthly electricity output from the Block Island Wind farm jumped by a third from December’s output. We know from various reports that winter is when offshore Atlantic winds are the strongest. We noticed steady winds blowing when we arrived at our Rhode Island summer home in early May. The winds continued blowing every day for the next several weeks. Our neighbor said the winds had been blowing all year. That conclusion was supported by the electricity output data for the first three months of 2022.

Our second chart shows how much electricity was generated during the first quarter of each year since 2017. We also calculated the percentage of the full year output represented by the first quarter volume. Every year’s first quarter saw electricity produced representing more than a quarter of the full year output, which supports the view that winter winds are the strongest during that time of the year. The outsized contribution of the first quarter in 2021 was helped by the summer shutdown of turbines for repair and maintenance.

Exhibit 10. Atlantic Ocean Winds Are Strongest In Winter Months

Source: EIA, PPHB

It remains a fact that in no year has the Block Island Wind farm generated the amount of electricity projected in the developer’s application for approval of the project by the Rhode Island Public Utility Commission. This is an important consideration as more offshore wind farms are being proposed and approved. There may not be as much electricity as being promised.

Gasoline Tax Suspension Gimmick Game

President Joe Biden just called on Congress to suspend the federal 18.4-cents a gallon gasoline and 24.4-cents diesel tax for 90 days to help consumers by lowering pump prices. That was one of his four points for easing the energy pain for consumers. Since the gasoline tax is embedded in our federal tax code, the change requires action by Congress. Almost immediately there was pushback from leaders in the House of Representatives. Some of those expressing skepticism about the impact of the gasoline tax holiday included representatives who had pushed similar proposals last March that went nowhere. Speaker of the House Nancy Pelosi (D-CA), at that time, expressed skepticism of the tax holiday idea, opting for a gasoline card or other direct payment to people instead. (It seems Pelosi likes the idea of sending money directly to voters after perfecting it during 2021 and early 2022.) This time, after the president’s speech, she said, “We will see where the consensus lies on a path forward for the President’s proposal in the House and the Senate.” Not a ringing endorsement.

Biden also called for states to suspend their gasoline taxes and for refiners to step up their output. He also leaned on the patriotic button, claiming that we are in a state of war because of the Russia-Ukraine war, therefore oil and gas companies should demonstrate their patriotism by sacrificing profits to help their customers. He did not suggest his administration might institute waivers for renewable fuel standards or ease restrictions on energy infrastructure plans or hold more lease sales, especially offshore where there have been no sales since Biden entered office.

House Transportation and Infrastructure Chairman Peter A. DeFazio (D-OR) came out immediately against Biden’s proposal, instead calling for support for his bill for putting an excise tax on the windfall profits of oil companies. DeFazio said in a statement: “Although well-intentioned, this policy would at best achieve only minuscule relief while blowing a $10 billion dollar hole in the Highway Trust Fund that would need to be filled if we want to continue to fix crumbling bridges, address the spike in traffic deaths, and build a modern infrastructure system.” Such opposition might be expected from a Congress that passed Biden’s $1.2 trillion infrastructure bill last November. That was a pillar of the Biden agenda, which was designed to boost the economy and fix supply chain issues. Biden acknowledged the impact of the tax holiday on the Highway Trust Fund, so he told Congress to find the money somewhere else or increase deficit spending.

In the Senate there was also pushback. Energy and Natural Resources Chairman Joe Manchin (D-WV) told ABC News he was concerned about putting a “hole” in the budget. Republican Minority Leader Mitch McConnell (R-KY) had lambasted the idea in February and was equally as dismissive after Biden’s recent speech. Even Biden’s former boss, Barack Obama, when campaigning in 2008, called a gasoline tax holiday a “gimmick.” Reportedly, Obama has not wavered from that view.

A handful of states already have suspended their gasoline taxes, some for 30-days periods, but others for longer times. Maryland and Georgia enacted month-long tax holidays in the spring. Florida has a one-month tax holiday planned for October. New York eliminated two separate taxes on gasoline, each one eight-cents a gallon. That reduction drops the state’s gas tax from 48-cents to 32-cents a gallon according to the API. As we wrote recently, Connecticut eliminated its gasoline tax from mid-April to mid-June, but then extended the suspension until December 31, 2022. What the state did not do was cut its 41-cents a gallon diesel tax, which is being raised, effective July 1, by nine-cents to 50-cents. The rationale for not cutting the diesel tax was that most of the trucks filling up in Connecticut come from out-of-state.

We recently learned that the deep blue-state of Rhode Island considered a gasoline tax holiday, but the legislature voted down the Republican proposal 11-56, with only one Democrat in support. Last Wednesday, the legislature passed the state’s budget that retained the gasoline tax. So much for loyalty to the President. For Rhode Island, the lost highway funding would have been offset by using Covid-related federal money provided the state. The politicians think there are better uses for this unspent money. Get the popcorn ready as we watch the fun of the Democrat-controlled Congress wrestling with the White House over the gasoline tax holiday.

Renewable Energy Piggy Banks Pour Out Money For Players

Recently, the Rhode Island legislature updated the state’s annual increases in the percentage of clean power utilities sell as mandated under its Renewable Energy Standard (RES). The standard now requires 100% of the state’s electricity sold by 2033 be provided by renewable production or offset by the purchase of renewable energy certificates. This legislation is thought to be the most aggressive RES of any state in the nation. The prior standard had mandated a 1.5% annual increase in the percentage of renewable energy utilities sold but that has now been updated to the following schedule of annual increases.

4% increase in 2023

5% increase in 2024

6% increase in 2025

7% increase in 2026 and 2027

7.5% increase in 2028

8% increase in 2029

8.5% increase in 2030

9% increase in 2031

9.5% increase in 2032 and 2033

In an ancillary bill, the legislature has mandated that the state’s primary electricity utility company, RI Energy PPL Corporation (formerly National Grid) should acquire 1,000 megawatts (MW) of offshore wind, up from a previous mandate to purchase 600 MW of offshore wind. In the initial bill, the utility was to be awarded a 2% annual fee for making this purchase, which The Providence Journal estimated, based on other contracts, would add $3.2 million a year to the electricity bills of the state’s 500,000 ratepayers. The fee provision was removed from the bill, but later it returned but this time with a cap of 1%.

The history of the fee is interesting. In 2019, when the contract for National Grid to purchase 400 MW of offshore wind from the Revolution Wind farm was up for approval by the Public Utility Commission (PUC), the company warned that taking on these long-term contracts could impact its balance sheet and result in a credit reduction that would boost the cost of borrowing and raise ratepayer bills. National Grid thought a 2% fee was too low and proposed a fee that would have earned it $88 million over the 20-year term of the contract, nearly 40% more per year than the 2% fee would have earned. The PUC concluded there was no justification for any fee.

Once again, it appears the Rhode Island legislature is willing to compromise the PUC by including a fee in its mandate, which would make it legally difficult for it to be rejected. Remember, the legislature rewrote the PUC law and outlawed the use of cost/benefit analysis when evaluating wind and renewable energy power purchase contracts in 2015. That rewrite forced the PUC to approve the Block Island Wind contract after rejecting it the first time as too costly for ratepayers.

The latest bill with the 1% annual cap on the fee, the amount subject to determination by the PUC, was approved by the legislature on Friday, the last day of its session. In investigating this fee saga, we learned that the Block Island Wind farm, the nation’s first operating offshore wind project, earns a 2.75% annual fee for the utility customer. Based on the annual wind farm’s output, we estimate the fee earned National Grid, and now RI Energy, anywhere from about $650,000 to $900,000 per year in 2016-2021.

Ørstad, the owner of the Block Island Wind farm, slurps out of the federal production tax credit (PTC) trough. Based on the output from the wind farm, we calculate it earned roughly $1.5 million last year at the current PTC credit of 1.5-cents per MWh of power generated. The initial developer of the wind farm, Deepwater Wind, a subsidiary of hedge fund D.E. Shaw, besides earnings PTC income up until it sold the project to Ørstad, also received a 30% investment tax credit on the estimated cost of $300 million to build the wind farm, or $90 million when the farm began commercial operations in 2016. All offshore wind farms constructed (at least 5% of the cost spent, according to IRS rules) by 2025 will earn this 30% investment tax credit.

Last year, although output from the wind farm was depressed by unexpected repairs and maintenance, Ørstad still generated $23.6 million in revenue based on the estimated rate for the power of $0.28 per kilowatt-hour (kWh). For 2022 the power price is 29-cents/kWh under the terms of the contract’s requiring 3.5% annual increases. This contracted wind farm rate compares with National Grid’s reporting to ratepayers that its Energy Charge (fuel cost) is in the 9- to 10-cents/kWh range. No wonder Ørstad is happy to own Block Island Wind.

We were recently reminded of the wind industry’s piggy bank for developers funded by the PTC and Investment Tax Credit. Robert Bryce’s recent Forbes.com column about the legal battle being waged in Iowa by wind farm developer Invenergy, the world’s largest privately held renewable energy company, touched on the issue.

With respect to the PTC, Bryce wrote:

In March, I estimated that if MidAmerican Energy goes forward with building 30 more wind turbines in Madison County, it will collect about $81 million in PTC. According to Berkshire Hathaway’s latest 10-k filing, Berkshire Hathaway Energy (BHE) has collected about $2.7 billion in tax credits over the past three years. A note to the financial statement says that the $2.7 billion “includes significant production tax credits from wind-powered electricity generation.” In 2021, BHE’s pre-tax earnings totaled $3.18 billion. But thanks to $1.17 billion in tax credits, the company’s after tax-profit totaled $4.35 billion, an increase of about 37% over what it would have been without the PTC.

Those results supported Berkshire Hathaway’s chairman and CEO Warren Buffett’s comment in 2014, after purchasing MidAmerican Energy, that “the only reason” to build wind projects is to collect the PTC. “They don’t make sense without the tax credit,” he said. Bryce also pointed to a comment by Charlie Munger, vice-chairman of Berkshire Hathaway, to “show me the incentives, and I’ll show you the outcome.” That was a play on the words of Lavrentiy Beria, the head of Russia’s secret police during Joseph Stalin’s post World War II reign of terror in Russia and Eastern Europe, who said, “Show me the man and I’ll show you the crime.”

The PTC is a dumb incentive that enables wind developers to sell their power at negative prices, undercutting the price of electricity from dependable and dispatchable energy generators, often forcing them to close because they are no longer profitable businesses. This trend has made our electricity grids fragile and increasingly subject to brownouts and blackouts because they lack this steady power when renewables fail to deliver. Eliminating the PTC should be the first step in improving the reliance of our electricity grids and protecting the health of our citizens.

Contact PPHB:

1885 St. James Place, Suite 900

Houston, Texas 77056

Main Tel: (713) 621-8100

Main Fax: (713) 621-8166

www.pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.