Energy Musings contains articles and analyses dealing with important issues and developments within the energy industry, including historical perspective, with potentially significant implications for executives planning their companies’ future. While published every two weeks, events and travel may alter that schedule. I welcome your comments and observations. Allen Brooks

May 17, 2022

“The Drive” Confirms Much About Energy And Inflation

America is back! Read about our observations from “The Drive” and energy’s role. READ MORE

Energy Continues To Confound Investor Expectations

Energy is the only sector to increase its capitalization from January 1st Through May 10th. READ MORE

Manhattan Contrarian’s View Of New York’s Net Zero Plan

New York State’s net zero emissions plan is woefully lacking in details and cost estimates. READ MORE

Wood Returns: Not Your Distant-Grandfather’s Log Cabin

Wood has become the new clean building material and we will be seeing more log towers. READ MORE

Decarbonizing Air Transportation Is Underway

New startups are using wood chips and wood paste to make decarbonized jet fuel but at a cost. READ MORE

Oil Industry Needs Aggressive Defenders Like Toby Rice

Energy CEOs need to watch the ‘Rumble in the Jungle’ to learn how to better defend the industry. READ MORE

“The Drive” Confirms Much About Energy And Inflation

Our annual pilgrimage from Houston, Texas to Charlestown, Rhode Island, referred to by many Energy Musings readers as “The Drive,” was just completed. It was a two-and-a-half-day sojourn across the Gulf Coast to Slidell, Louisiana, then turning north to Harrisburg, Pennsylvania and east to New York and north to Rhode Island – an 1,800-mile trip.

We can summarize our observations in a few words: America is back! Road traffic was high; trucks were ubiquitous; energy inflation is real; and labor shortages remain. Personally, we get to experience a second spring with trees and flowers budding and a pollen season redux.

Despite timing our departure to follow the peak in Houston’s morning commute, we still encountered heavy traffic, which accompanied us all the way to Slidell. In fact, when we reached Louisiana’s Atchafalaya Swamp, the largest wetland and swamp in the nation, all we could see coming at us was a line of trucks. The line was broken only occasionally by a few SUVs and pickup trucks. As we were amidst a long line of trucks, we expect drivers heading west were seeing a mirror image of eastbound trucks.

The swamp also had a very high water-level – something we have not seen for a while. We remember when water levels were very low due to drought conditions. Clearly not the case in 2022. Fortunately, we were enjoying beautiful weather – warm and sunny. We enjoyed that beautiful weather for the two longest days of our trip, only experiencing rain the final day, but fortunately with only a few hundred miles to travel.

Trucks were everywhere! In front of us. Behind us. And beside us. They were filling the parking spaces in every rest area, often overflowing and parking on the entry and exit ramps. We were amused in Tennessee where, on the other side of the highway, there were a few trucks parked on the entrance ramp to a closed rest area. The rest areas on both sides were closed, and we had been warned about the closures by earlier signs. A few miles past the rest area, we saw a Pilot truck stop where trucks were overflowing their parking lot. We figured many of those truck drivers had seen the signs warning of the rest area closures, so they used the truck stop to rest. We wondered whether the trucks parked on the entrance ramp had missed the closure signs, maybe they did not care if the area was closed; or merely could not find a spot in the Pilot truck stop.

It did not matter the time of day when we passed rest areas, welcome stations, or truck stops – there were trucks always present. It was striking in late morning or mid-afternoon to see 40%-60% of truck parking spaces occupied. More trucks, coupled with the more restrictive driving hour limits and rest time mandates, explain the large number of parked trucks. A more vibrant economy and strong consumer spending are driving the high level of truck traffic.

One way we could tell that traffic was heavier than in the past was our use of the speed control setting in our vehicle. In past trips, we would have several stretches on the route – often tens of miles long ‒ where we could employ speed control and let our foot relax. Even in traditionally light-traffic Mississippi, we found we were unable to use the speed control setting. We can further confirm the heavier traffic by the fact that when we arrived in Rhode Island, our shoulders and right ankle were stiff and sore from holding on to the steering wheel and having to keep our foot on the accelerator.

Road construction seemed to be in full bloom. We found numerous infrastructure projects underway – in several cases forcing us into one lane of traffic for miles, or even having to exit the highway for an adjacent feeder road. Surprisingly, we found several nighttime construction projects in Pennsylvania underway. We are not sure whether that work was being done in the dark when the volume of highway traffic is low to allow for opening the road during daylight hours, but we suspect that may have been the case.

Getting hotel rooms proved not to be a problem. Our usual routine of picking our stopping point at dinner time and booking a hotel reservation on our phone app worked without any issues. However, in contrast to a year-ago when we stopped at a Hampton Inns in Bristol, Virginia, where we were one of 12 guests in a 250-unit hotel, judging from the parking lots of our hotels for the two nights, they must have been 80% full. Many of the guests were gone by 8 am the next morning, confirming the high level of traveling underway.

Where we did encounter an economy-related problem was at the Cracker Barrel restaurant in Tuscaloosa, Alabama. When we drove into the parking lot at about 6:30 pm, it was barely half-full. But as we walked toward the front door, there appeared to be people sitting and standing outside. Once inside, we noticed that much of the restaurant space was unoccupied, so we were shocked when told by the hostess that there was an estimated 35-minute wait for a table. Obviously, this restaurant was suffering from a staffing shortage. We assume it was a lack of servers, but we cannot be sure – it may have been kitchen help.

The hostess told us the next Cracker Barrel was in Bessemer, Alabama, which was about 35 miles ahead. We drove there and found plenty of space and no waiting line. The message we took away was that low-wage economic sectors such as restaurants still suffer in hiring adequate staff in a tight labor market. We were surprised that in a university town there would be such a labor shortage with presumably many college students potentially looking for part-time work. The University of Alabama Tuscaloosa is the flagship institution within the University of Alabama system and has over 38,000 students enrolled. The town itself has a population of 100,000. Solving the labor market situation at the lower end of the wage scale is still a work in progress.

The heavy traffic all along our route to Rhode Island had us paying attention to gasoline and diesel fuel prices. Our experience in gasoline purchases highlights the issue of energy inflation. Here is a listing of the locations of our gasoline purchases and the per-gallon price paid:

Houston, Texas $3.649

Lafayette, Louisiana $3.649

Livingston, Alabama $4.049

Loudon, Tennessee $3.949

Verona, Virginia $4.049

White Plains, NY $5.059

It was not until we got into the Northeast that gasoline and diesel prices started skyrocketing. We had noticed a Pilot truck stop sign in Virginia showing gasoline at $3.999 a gallon, with diesel at $5.94, nearly a two-dollar spread! That spread was sustained as we moved further north.

We were guessing that the high price of our White Plains, New York gasoline purchase was because we were in a high cost-of-living location. Could it have been price-gouging? Should we call for an investigation?

As we headed into Connecticut and then Rhode Island, we became convinced the New York price was because of the location, as gasoline prices trended lower. What were not lower, however, were diesel prices. We wondered about the disparity in state taxes on motor fuels since states layer on additional taxes beyond the federal tax on gasoline of $0.184 per gallon and $0.242 on a gallon of diesel fuel.

State taxes on fuels tell an interesting story. In New York, the gas/diesel state taxes are $0.25/$0.23 per gallon. In Connecticut, however, the charges are $0.25/$0.50 a gallon, while Rhode Island taxes each gallon of fuel $0.34/$0.34. This helps explain Connecticut diesel prices in the $6.40 a gallon range, but that was also the range for diesel prices in Rhode Island.

Our review of state gasoline and diesel prices showed that Texas, Louisiana, Mississippi, Alabama, Tennessee, and Virginia have per gallon fuel taxes in the range of $0.18-$0.21. That range is well below the fuel taxes levied by New York, Connecticut, and Rhode Island. The one Northeast state that does not fall in line with those three states is New Jersey. It taxes gasoline at only $0.15 a gallon and diesel fuel at $0.18 a gallon. However, New Jersey outlaws self-service filling, which 75 gas station owners say adds $0.20 to the price. It is the only state to do so. Thus, despite low state taxes, New Jersey’s pump prices are in-line with its neighbors.

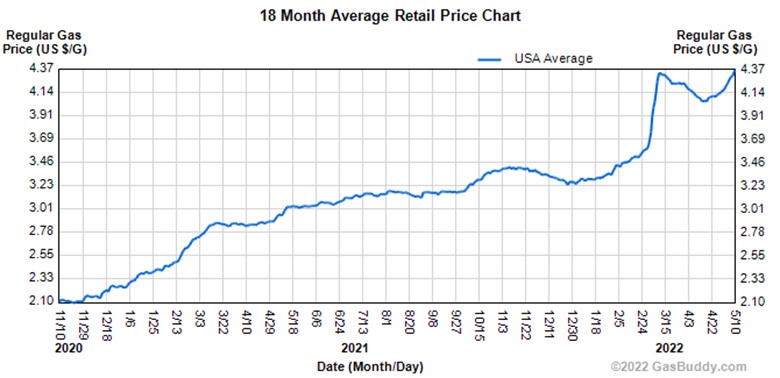

Let us start with the national fuel price situation. On Tuesday, May 10th, Gas Buddy, a fuel price monitoring organization, reported that based on Automobile Association of America (AAA) data, the average U.S. gasoline price per gallon set a record at $4.37, up 5-cents overnight! The price exceeded the March record high of $4.33 but it is still a long way from the 2008 high of over $5 per gallon (inflation-adjusted price). Diesel fuel prices last week also established a new high at $5.55 a gallon. The following chart from Gas Buddy documents the rise in national gasoline pump prices over the past 18 months.

Exhibit 1. How U.S. Average Retail Gasoline Prices Are Hitting Record Highs

Source: GasBuddy.com

Why are gasoline prices such a headache for the Biden administration? A recent survey by Convention of States Action/Trafalgar Group found that a plurality of voters (38.5%) chose “lowering inflation and fixing the economy” when asked to identify the most important issue to them in the upcoming 2022 midterm elections. No other issue was close. “Climate change” came in second with 15.9% percent of respondents concerned and 11.3% worried about “racial and social equality.” “Securing the border” was at 11% but no other issue was above 10%. These survey results suggest the Democrat agenda that has produced many of these concerns is in trouble in the voting booth. It also explains why the Biden administration is working so hard to get gasoline prices down, by doing things such as releasing 180 million barrels of crude oil from the Strategic Petroleum Reserve (SPR). They ignore that the SPR is to be used to offset weather or military disruptions of our crude oil supplies and not to manipulate gasoline prices. When election disasters are on the horizon, politicians are more than willing to ignore the rules.

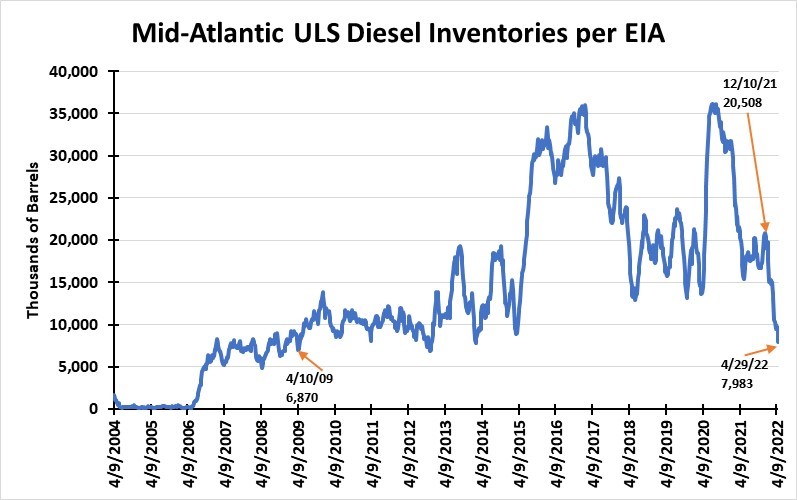

Diesel prices are soaring because of supply shortages. Diesel inventories in Petroleum Administration for Defense District (PADD) 1 are at an all-time low according to reports. On a seasonal basis, the Mid-Atlantic region’s ultra-low sulfur (ULS) diesel inventories are the lowest level they have been since 2009. The chart below shows Energy Information Administration (EIA) data available only from the week of April 4, 2004, to April 29, 2022. We have marked three points in the chart – the latest week, the most recent high (December 10, 2021), and the prior seasonal low (April 10, 2009). Between the December and April points, inventory has dropped 61%. Just during the month of April, inventories fell by 22%.

The prior seasonal low was in April 2009, with the other lows reflecting winter or fall weeks before refiners prioritize diesel output. The 2014 low was only 100,000 barrels below current inventory levels, and the 2012 low was one million barrels lower, but in the early fall when refiners were beginning to ramp up diesel production.

Exhibit 2. The Record Of Mid-Atlantic ULS Diesel Inventories Since 2004

Source: EIA, PPHB

A major problem for PADD 1 is the lack of refining capacity, besides the issue of available feedstock. Consultant ICF prepared a report in February 2016 for the Energy Information Administration (EIA) on the East Coast and Gulf Coast Transportation Fuel Markets. Based on 2015 data, PADD 1 had nine refineries, down from 17 in 2000. Refining capacity had declined 24% between 2000 and 2014 to 1,268,500 barrels per day (b/d) from 1,700,000 b/d. East Coast refined product consumption in 2014 totaled 4,935,000 b/d with gasoline accounting for 63%, distillate 25%, and remainder in jet fuel and other refined petroleum products.

The problem is that demand has grown in the region but the ability to refine oil to meet demand has fallen, exacerbating the supply chain issue. By 2021, PADD 1 had lost two additional refineries – one to a spectacular explosion and the other due to economics. As a result, refining capacity in the region has shrunk to only 817,000 b/d, a 36% decline from 2014. It has also meant a 14% decline in diesel output from 285,300 b/d to 244,600 b/d.

Increasingly, the region relies on imports of crude oil and refined products, both domestically and from international sources. Domestically, those imports come via pipelines from the Gulf Coast refining and producing operations, and internationally from Canada, Europe, and Russia. The Russia input is now cut off by sanctions, forcing refineries to find alternative supply sources. Russia has supplied diesel fuel and semi-refined oil, which local refineries finish transforming into final products.

Energy writer John Kemp wrote about how the diesel shortage was boosting U.S. refining margins to record levels. He pointed out that refiners were receiving roughly an average of more than $150 per barrel for the sale of diesel and gasoline at wholesale prices, while only paying about $100 a barrel for the crude oil. The typical 3-2-1 margin of $50 assumes a refinery produces two barrels of gasoline and one barrel of diesel from three barrels of crude oil. From that margin, refineries pay for labor, electricity, other needed inputs, pipeline transportation and the return on capital.

He further noted that distillate (diesel) fuel stocks are 23% below their five-year pre-pandemic average, while gasoline is only 3% below its average. Thus, the gross margin for diesel is almost $60 per barrel, while the gasoline margin is only $45 per barrel. With U.S. demand growing as the economy continues to perform strongly, it is likely that the supply chain issues in the East Coast refining business, and nationally for that matter, will prevent diesel supply from growing faster than demand, enabling inventories to be rebuilt. Thus, diesel prices will remain elevated and likely go higher until reaching the point at which demand is destroyed.

With Biden boasting about all that his administration is doing to get more truckers onto the road, it looks like demand will remain strong, and fuel prices will continue rising. At some point in time, energy inflation will destroy demand and cause the U.S. economy to fall into a recession. If refined product demand is driving wholesale prices toward $250 per barrel, crude oil prices will follow, and industrial America will be baking much higher inflation into their prices. This becomes the inflation spiral that requires a serious response from the Federal Reserve, much as Fed Chairman Paul Volker delivered in the late 1970s.

As we write about our observations from The Drive, we wonder what we will see during our return trip at the end of September?

Energy Continues To Confound Investor Expectations

Ask anyone about the stock market and they will tell you how UGLY recent weeks have been. That is if they can stop from vomiting. The market decline that began in January has accelerated in recent days. Recent days have been highly volatile, too. Inflation is soaring, having transitioned from “transitory” to “sustainable.” As a result, investors and traders are reacting to hourly economic and geopolitical news, as well as focusing on the impending reversal of years of “free money” and zero interest rates. The reversal is necessitated by the Federal Reserve’s mandate to assure price stability. The problem is that the April Consumer Price Index (CPI), released last week, showed no signs of a peaking in inflation, as the core inflation data shows rising prices being driven by macro financial and economic conditions well beyond the near-term impacts from the Russia-Ukraine war and rising gasoline prices.

Crude oil prices have retreated from their March highs. Despite extreme volatility, a strong U.S. dollar that typically depresses commodity prices, and growing concerns about economic growth due to a possible recession amidst China’s Covid lockdowns, prices remain around $100 per barrel. That is a healthy level for oil industry profitability, and for increasing exploration and development activity that should help the oilfield service industry. Higher E&P activity will eventually lead to lower oil and refined product prices. All these issues are depressing the stock market and led to a disappointing April. However, energy stocks did ok that month.

Exhibit 3. Another Good Month For The Energy Sector Of The S&P 500

Source: S&P, PPHB

April saw the Energy sector of the S&P 500 index generate a positive 1.5% monthly return. Energy had the second most positive sector performance for the month and was one of only two sectors generating positive returns. For the first four months of 2022, Energy has been either first or second in monthly sector performance – first in January and February, and second in March and April.

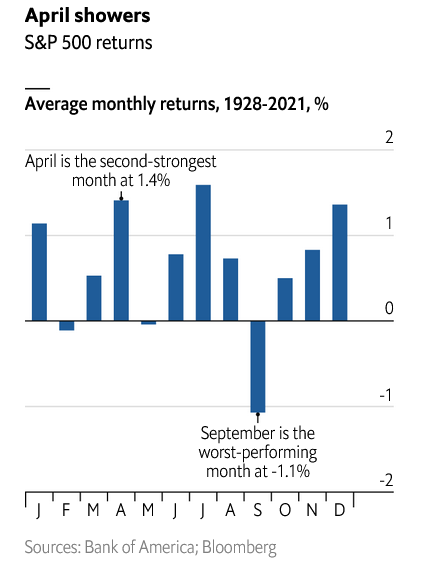

The S&P 500 index fell 8.7% during April, a month historically with the second-best monthly performance record. July is the best performing month of the year. Note in the chart below that May has historically produced a negative return, albeit small. Based on May’s performance so far, we are looking at a greater monthly loss, although there is more than half a month to go.

Exhibit 4. April Is Usually A Good Month In The Market

Source: B of A, Bloomberg

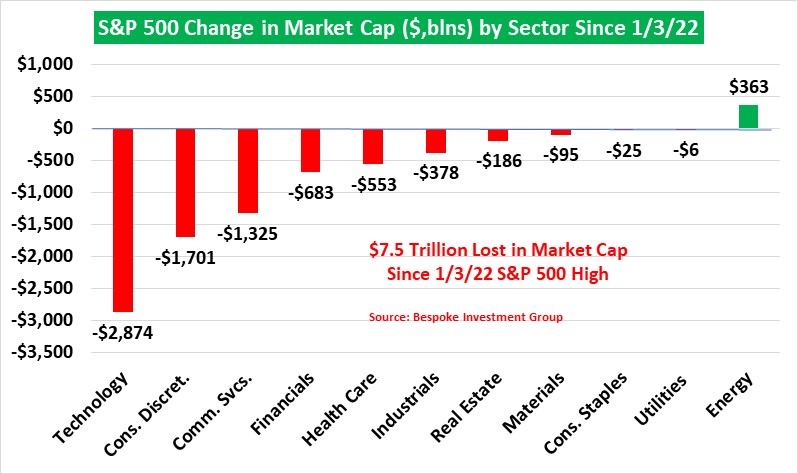

The chart below from Bespoke Investment Group shows the dollar amount of market capitalization by S&P 500 sector that has been lost, or in the case of Energy gained, so far this year through May 10th. A total of roughly $7.5 trillion has been lost, with the Technology sector losing the most. Energy generated a $363 billion market capitalization increase. It has now become a target of stock sellers worried about the economy, a possible global recession, and falling oil demand. As the only sector with a positive performance so far this year, it is subject to profit-taking by investors hoping to offset some of their losses in other sector investments. That is why energy stocks have been under pressure in the most recent days in the market.

Exhibit 5. The Brutality Of 2022 Stock Market On Sector Capitalizations

Source: Bespoke Investment Group, PPHB

It should be noted that many Energy investors realize that the traditional supply/demand dynamics of energy are broken – partly because of the Russia-Ukraine war and the western world’s sanctions against Russia and its oil and gas exports. Furthermore, the loss of a portion of the 2.5 million barrels per day of oil and 8.9 trillion cubic feet of natural gas Russian exports, is creating major problems for European countries seeking alternative energy supplies.

As the oil and gas industry is a long-lead-time business, meaning it takes months or even years to develop new supplies to offset lost production, the duration of the current high prices and limited supplies will be extended.

There are other forces at work within the industry that may cause the duration to be even longer than in the past. Capital discipline in oil and gas industry spending due to shareholder pressures for higher returns rather than relentless and often unprofitable drilling may result in slower output growth. This dynamic, criticized by politicians desperate for lower oil and gas prices, suggests a structural change underway in the industry. That change is also driven by the relentless attacks by politicians on fossil fuels and demands to end fossil fuel use to solve our CO2 emissions problem. Oil and gas executives are mandated to manage their companies’ capital allocations. Given the political attacks on fossil fuels, these executives must weigh the possibility of stranded oil and gas assets against the pressure to rapidly transition to renewable energy and/or invest in new technologies to reduce carbon emissions. For these executives, the latter option requires placing bets on immature technologies, while investing in traditional renewable energies requires accepting significantly lower returns on capital. These choices make turning away from their traditional business a more difficult decision. These decisions will be made cautiously because of the long-term implications for company profitability and investor returns. Decision-making is further complicated by the growing awareness of the operational weaknesses of traditional renewable energies and the unrealistic timelines for the energy transition imposed by uneducated politicians. This conundrum suggests energy is in the early stage of a long industry cycle. As a result, the Energy sector will likely continue to experience investment inflows.

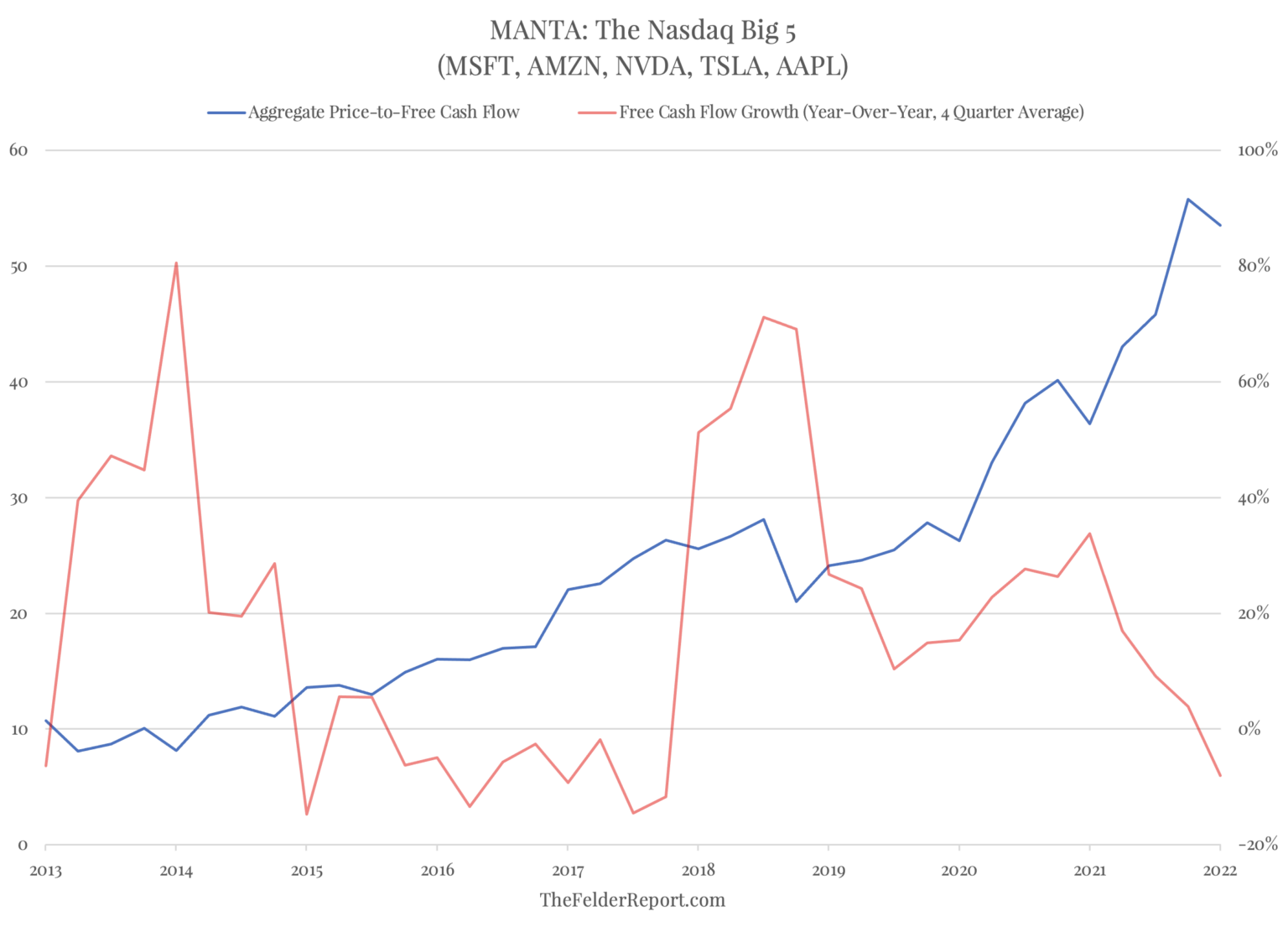

The following two charts help to explain why the stock market has experienced such a sharp correction, and why Technology has suffered so much. The Technology sector is heavily represented by stocks traded on the Nasdaq. The first chart shows MANTA’s – (the top five stocks on the Nasdaq, which are Microsoft, Amazon, Nvidia, Tesla, and Apple) – price to free-cash flow (P/FCF) ratio and the growth of their free cash flows. As the chart shows their P/FCF ratio more than doubled between 2018 and 2022, while their free cash flow growth turned negative at the start of 2022. For investors, such a relationship signals a grossly overvalued collection of stocks, ripe for a sharp price correction.

Exhibit 6. High Valuations Are Not Supported When FCF Turns Negative

Source: TheFelderReport.com

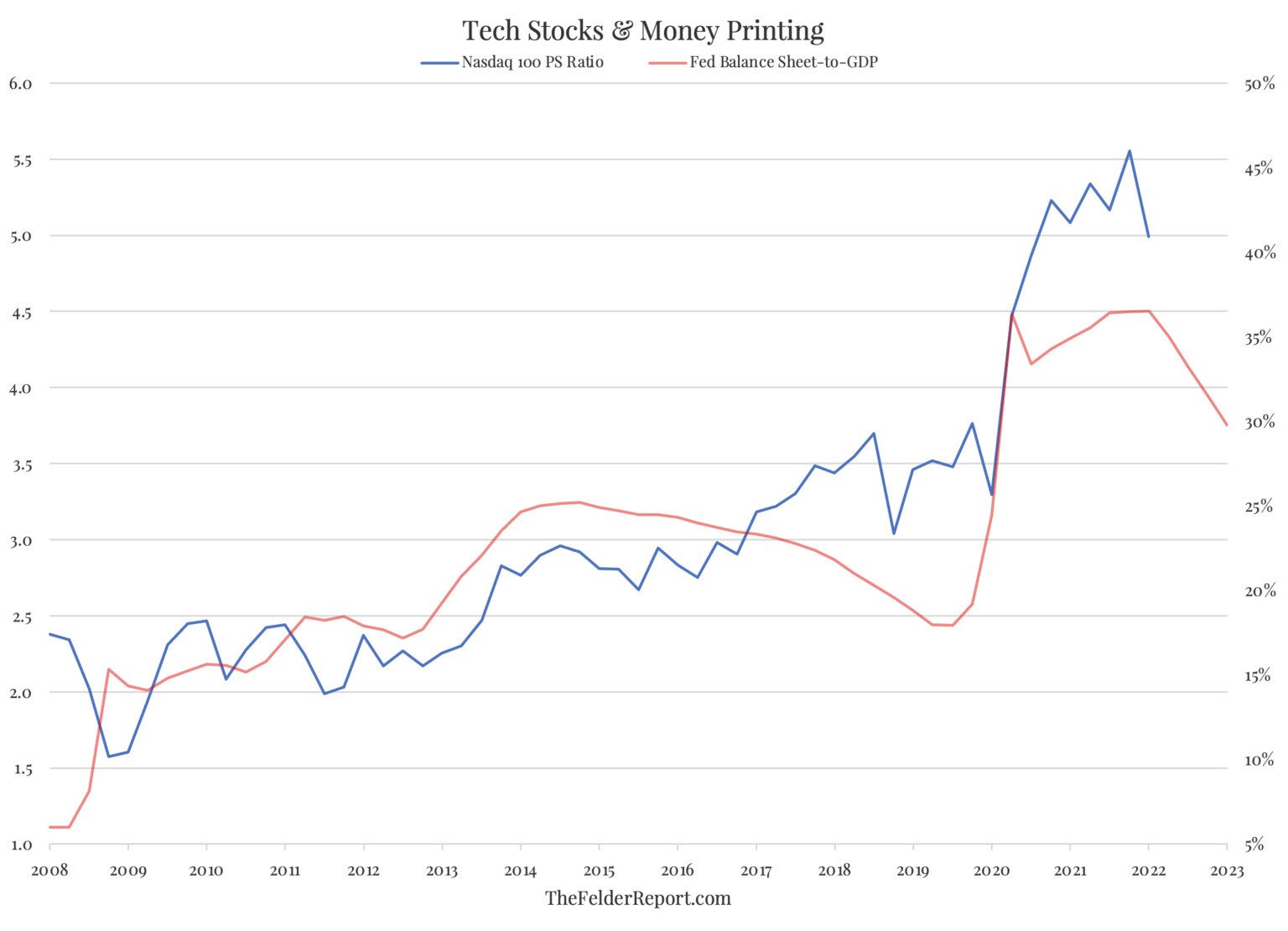

The second chart shows the relationship between the Nasdaq top 100 stocks and their price-to-sales (P/S) ratio compared to the ratio of the size of the Federal Reserve’s balance sheet to Gross Domestic Production (BS/GDP). From 2008 through mid-2016, the two ratios moved in sync. Then the P/S ratio began climbing from slightly under 3.0 to 3.5. This was while the BS/GDP ratio was declining. As that ratio began climbing from 20% to 35%, the P/S ratio soared from 3.5 to 5.5 before declining. The chart shows a projection for BS/GDP based on the stated plans for the Federal Reserve to shrink its balance sheet and the government’s projection for GDP growth in 2023. The sharp decline in that ratio was a signal that the Nasdaq 100 stocks were seriously overvalued.

Exhibit 7. Easy Monetary Policy Has Driven Up High-Tech Valuations

Source: TheFelderReport.com

The first four-plus months of 2022 have seen a significant correction in the stock market as investors grapple with high-flying stock valuations for traditional high-growth rate companies, the ending of the easy-money policies of the Federal Reserve, a possible global recession, and questions about what structural changes are underway within economies caused by COVID, the Russia-Ukraine war, demographic challenges, the global energy situation, and the potential for inflation rates well above those of the past ten years becoming embedded in our economy. Slower economic growth is likely the outcome from these forces, which translates into lower earnings growth rates for companies. Slower earnings growth coupled with higher sustained interest rates will drive down stock valuations, especially for highly valued stocks. The stock market will probably spend much of 2022 attempting to determine what the appropriate valuation metrics will be in the future. Energy should fare well in this redetermination.

Manhattan Contrarian’s View Of New York’s Net Zero Plan

Francis Menton began writing his blog, Manhattan Contrarian, in 2012, four years before retiring from a 40-year career as an attorney and partner at New York-based Wilke Farr & Gallagher LLP. His blog deals with issues of public policy. According to the CO2 Coalition website, for which Menton is a contributor, he has written over 1,000 blogs with nearly one-third of them dealing with “climate change broadly defined, including such topics as the application of the formal scientific method to what passes for climate ‘science’ in today’s academia, and evaluation of the potential costs and practical difficulties of attempting to replace our current energy systems with intermittent wind and solar electricity generation.”

We were intrigued about a recent posting in which Menton discussed his testifying at a public hearing for the “scoping plan” for New York State to achieve net-zero carbon emissions by 2050. The public hearing was held by the New York Climate Action Council (Council), an organization created under New York State’s Climate Leadership and Community Protection Act of 2019. The Council is charged with figuring out how to achieve the statutorily mandated net zero targets – the first calls for a 40% reduction in carbon emissions by 2030. That effectively means eliminating fossil fuels from the electricity sector by that date.

The Council issued its Draft Scoping Plan for achieving the emissions targets on December 30, 2021. The Plan is 300 pages of text plus 500 pages of appendices. (We have not read the plan and rely on Menton’s discussion.) The gist of the Plan is that the Council will order the private sector to eliminate emissions by various specific dates, while leaving it up to the “little people” to work out the details. The purpose of the hearing, which was scheduled for four hours, was to allow the little people to comment on the Plan.

Menton stated that the Council is composed of 21 members, but only seven attended the hearing. Of the members in attendance, judging by their titles, he believed that possibly one had any understanding of electric grids and the challenge of getting to net zero. Most of the Council members are environmental activists and political functionaries, assuring little to no knowledge of the workings of the grid.

There were over 200 people signed up to speak, but time would not permit that many presentations. Menton had to wait about two hours to speak. Each speaker was allotted two minutes. This meant that 50+ people had spoken before Menton. He stayed around for another 20 minutes to hear a few more people speak, so he estimates he heard about 60 speakers in total. He found that of the 60 speakers, only four were not fully on board with the crash program to replace all fossil fuels in New York State with a combination of wind and solar, battery storage, and/or “the magical not-yet-invented DEFR (Dispatchable Emissions Free Resource) often mentioned in the Scoping Plan.”

Two of the four speakers not on board were advocates for nuclear power, which Menton found interesting considering New York State has recently closed its huge Indian Point nuclear plant that provided 25% of the electricity for New York City. The other two speakers were representatives of the two large utilities – Con Edison and National Grid – that supply power in this part of the state. Their messages were that the companies were on board with the plan but wanted the Council to work with the companies and maybe go a little slower and possibly allow a place for “green” hydrogen.

Here is Menton’s testimony as he presented it in his blog. We have highlighted a few points. Menton commented that he had to leave out a sentence or two during his presentation to fit within the two-minute time limitation.

My name is Francis Menton. I live in Manhattan. I am testifying as a private citizen.

I feel like I am in the crowd that has come to observe the grand procession where the Emperor unveils his new clothes. The Emperor has no clothes on. He is completely naked. Am I the only one who can see this?

100% carbon free electricity or energy for New York, at least unless based substantially on nuclear, is similar to the Emperor’s new clothes. It is a ridiculous and dangerous fantasy. It will not and cannot happen. It will shortly run into the wall off physical reality.

I will briefly address three aspects:

Energy storage

Hydrogen

The global context

Energy storage.

Supposedly, we are replacing our fossil fuel generation (mostly natural gas) with wind and sun. Sun does not work at night, and there is little in the winter. Wind does not work when it is calm. Neither works on a calm night.

How do you plan to back this up when we have no more coal or natural gas? The treatment of this subject in the Scoping Plan is breathtakingly incompetent. Where is the calculation of how much storage you will need to get through a full year? The Scoping Plan doesn’t even make that calculation in the correct units, which are gigawatt hours.

You’re going to need at least 10,000 GWH of storage to back up just current usage if you replace a fossil fuel generation with wind and solar. At the price of Tesla batteries, that will run you about $1.5 trillion, which is approximately the entire GDP of New York State. If you triple electricity consumption by electrifying vehicles and homes, then you must triple the storage, and it will cost at least 3 times GDP. And by the way, you need a battery that can store electricity all the way from summer to winter without all the energy dissipating and then discharge over the course of months. No existing battery can do that.

This can’t be done. How could you commit us to this without any feasibility study, any detailed cost workup, let alone a demonstration project showing that it can be done?

Hydrogen.

Hydrogen is not the answer to this. To generate hydrogen from water is enormously costly. And then you promptly lose about three-quarters of the energy you expended, because one-quarter is all you get back when you burn the hydrogen. And then, the H2 is inferior in every way to natural gas:

H2 is only about one-fourth as energy dense by volume as natural gas. Are you planning to quadruple all the pipeline capacity?

H2 is much more a danger to explode than is natural gas.

H2 is a tiny molecule that is very difficult to keep from leaking. And very corrosive to metal pipes. Do all homeowners have to replace their internal pipes?

How much more does H2 cost than natural gas? 5 times? 10 times? Where is the detailed cost study? Where is the demonstration project?

Nobody currently does hydrogen at large scale and there are very good reasons for that.

The Global Context

New York’s average electricity usage is around 20 GW. You’re talking about building a “massive” 9 GW of new offshore wind turbines in the effort to go carbon free.

Meanwhile, do you know what China is doing? Just this year, they are building 47 GW of new coal plants. Those will produce all the time, versus only one-third of the time for our wind turbines, so China is building just this year in coal plants some 15 times our planned massive wind turbine development.

And then they have another 100+ GW of coal plants in the works for just the next couple of years.

And then there’s India. They have about the same population as China (1.4 billion, which is 70x our population). India is way behind China on electrification. They explicitly say they are going to do it with coal. That will be well over 1000 GW of coal capacity by the time they are done.

And then there’s Africa. They have about 1 billion people — and 2 billion projected by 2100. And most of those people have no electricity at all. They’re also going to do it with coal.

Who are we trying to kid here? To the extent that New York is able to reduce emissions somewhat, it will be completely insignificant in the global context.

The whole project for New York is completely unworkable, wildly expensive, and utterly meaningless in the global context. People, this emperor has no clothes.

Thank you.

Our energy writer friend Robert Bryce has followed and written extensively on the role of the Indian Point nuclear plant in meeting New York State and New York City power needs. He did extensive analysis of the relative economics of the proposed renewable energy sources that would replace Indian Point’s electricity. We covered much of this in a recent Energy Musings article.

In the near-term, more fossil fuels have been needed to offset the loss of the nuclear power, which has contributed to an increase in the state’s CO2 emissions. The energy transition plan and rising fuel prices is driving Con Edison to ask for a huge rate increase for New York City power customers. In addition, Con Edison is asking for a higher allowed rate of return to help the company finance the infrastructure investments it must make to accommodate the power supply shift. Eventually, adding to the utility’s cost pressures is the likelihood of extremely high electricity prices that will come from the recent Bight offshore wind lease sale that resulted in astronomically high lease costs per acre and per megawatt of power planned to be installed. Companies that partnered in Bight projects are looking at withdrawing due to the high lease prices paid and realization of how high electricity prices must be for positive investment returns to be earned. They question whether the projects will be able to secure such high prices, thus facing the prospect of uneconomic projects. Several European offshore wind developers elected to drop out of the Bight bidding because of the bidding prices being offered.

We will be interested in following future Council hearings and what, if any, modifications are made to the scoping plan. Maybe more people will begin to complain about the future for electricity prices from the closing of Indian Point. Are we watching a slow-motion disaster in the works?

Wood Returns: Not Your Distant-Grandfather’s Log Cabin

The picture below is of a 20-story hotel and cultural center in Skellefteå, Sweden. The building’s floors, ceilings, and support beams are made almost entirely of spruce and pine harvested from nearby woods. This is part of the sustainability building movement designed to reduce the emissions from the use of more traditional building materials such as steel and cement. It is known as “mass timber” construction and utilizes trees that are selectively cut rather than clear-cut. Building with mass timber creates less waste and can be quicker and quieter than other construction modes.

Exhibit 8. The 20-Story Wooden Sara Cultural Centre and Wood Hotel in Sweden

Source: WSJ

The Wall Street Journal recently had an article that discussed wooden skyscrapers and highlighted the Swedish hotel and cultural center. The reason wood is being used more is because of concern about greenhouse gas emissions. Instead of creating emissions, as when steel and cement are used, wood keeps trapped all the carbon it absorbs while growing. Producing steel and cement is estimated to generate 15% of the world’s CO2 emissions. Buildings are responsible for about 40% of emissions with a quarter of the volume coming from the production and use of building materials, so wood offers an attractive way to reduce emissions.

Recently, an international building code change meant that mass timber buildings can rise to 18 stories, unless a variance is secured to go higher. Taller structures are being proposed or are under construction. For example, an 80-story wooden tower, River Beech, is proposed for Chicago. This summer, Ascent, a 25-story apartment building in Milwaukee, will become the world’s tallest wooden structure at 284 feet. It will surpass the 280-foot tall, 18-story Mjǿstårnet tower in Brumunddal, Norway. Like the Swedish unit, Mjǿstårnet contains office space, residential units, and a 72-room hotel, along with a penthouse apartment for Arthur Buchardt, the project’s developer.

A recent European study claims wooden buildings have the potential of sequestering 420 million metric tons of CO2 over the next 20 years. That is the equivalent of the carbon emissions from 108 coal plants or 71 million homes in a year.

There are a variety of issues with mass-timber building that must be analyzed, but most offer financial and sustainability plusses. According to the WSJ, the number of multistory mass-timber buildings being built in the U.S. increased by 50% between July 2020 and December 2021 to more than 1,300 according to WoodWorks, a wood trade group. In the U.S., projects ranged from a five-story office building to a 25-story residential-retail complex. Internationally, a Japanese builder has proposed a 70-story wood building for Tokyo, while a U.K. architectural firm has plans for an 80-story office building in London. In France, the housing minister stated that new public buildings should incorporate wood or other biological materials such as hempcrete – a composite of hemp, water, and lime. In Amsterdam, starting in 2025, 20% of all new buildings must be constructed mainly with bio-based materials.

To meet the mass-timber demand, 18 manufacturing plants have been built in the U.S. and Canada since 2014. The global market for mass-timber was estimated at just under a billion dollars in 2020, and projections call for it to grow at a13.6% annual rate between 2021 and 2028, according to a report by Grand View Research.

These are not log cabins or even stick-built homes, these high-rise buildings use cross-laminated timber. That is essentially large-scale plywood, made by gluing two-by-fours together into a sheet, then flipping the sheet 90-degrees and gluing more two-by-fours on top. This produces a sheet of wood that is much like a slab of concrete but weighs 80% less. The wood is kiln-dried, a process that can take weeks, but the manufacturing process enables computer imaging to cut pieces precisely to size before they are transported to the building site reducing construction time.

To replace steel, glue-laminated timber can be made to resemble beams rather than sheets. These beams can support buildings, and they can be bent allowing design options such as domes.

The advantage of cross-laminated and glue-laminated timber is that they leverage the pound-for-pound strength of wood while getting rid of some of its organic weaknesses. During the manufacturing process, each piece of wood is scanned for imperfections such as knots that could weaken the unit. They can be removed before the pieces are glued together.

One issue that must be managed in building with wood is its moisture content. If it is not dried to the moisture content of the building’s anticipated environment, the wood may absorb moisture and swell. Alternatively, it might shrink and crack if it is too moist. The moisture control aspect of building with wood can be leveraged during construction. Beams of one wood composition can be secured with dowels made from a different wood. For example, beams of spruce can have holes bored in them and dowels made of beech inserted. The spruce is dried to 12% moisture content, while the beech dowel is dried to 6%. Once the dowels are inserted, they will absorb moisture from the atmosphere and swell to secure the beams. Therefore, no metal screws are needed.

The strength of wood – it is lighter – provides numerous advantages, as well as creating some critical disadvantages. A skyscraper made from wood will be lighter, reducing the number of pilings or the thickness of the concrete slab it is built on. If the wood pieces are manufactured close by the building site, significant time savings can be obtained. The prime construction advantage of building with wood comes from not having to wait for poured concrete floors to cure before walls can be built, nor do steel beams need to be welded. This time savings could eliminate significant construction time, thus saving money. Not having to pour concrete can translate into a 75% reduction in the labor force needed when building with wood.

Building with steel and concrete means a building will weigh two to three times as much as a wooden version. That means wooden buildings must be made stiffer the higher they go. All buildings must sway in the wind or during earthquakes, but they cannot sway too quickly, or occupants could become seasick. Lighter wood buildings sway much faster in the wind compared to steel and concrete ones. Therefore, they need to be stiffer, but not too stiff or they will fail in the wind.

Another drawback to wood construction is that it is a resonant material. This requires sound-deadening material to be placed on walls to reduce the sound-transmitting qualities of wood.

Lastly, there is the issue of fire with wooden buildings. We know how fires have devastated major cities in their early years when everything was built from wood. However, the use of cross-laminated and glue-laminated timber makes the components much larger and thicker, more like logs. When they burn, they usually char rather than burn to ashes. Studies have shown that the charring only goes to a depth of one or two centimeters. Steel is also susceptible to fire, and concrete can be a conductor of heat and cold, which must be offset. Thus, every major building material has some drawbacks. Will wood overtake steel and concrete in building our future cities? The significant carbon emissions savings will certainly open more opportunities for wood to gain market share. We doubt it will completely revolutionize the high-rise building sector. But stay tuned.

Decarbonizing Air Transportation Is Underway

In the discussion about transitioning to a net zero carbon emissions world, one of the stickiest impediments needing to be overcome is transportation fuels. While much of the debate about transportation fuels centers around eliminating internal combustion engine vehicles and replacing them with battery powered ones, much less attention has been directed to air transportation. One idea is to use ethanol blended with jet fuel to reduce the carbon footprint of jet planes. That is a less than satisfactory solution because it still needs jet fuel produced from oil.

Batteries are being tried as a carbon-free way to power airplanes. The problem is they weigh a lot, counter to the historical trend in making airplanes lighter so they can carry greater payloads and travel longer distances (more fuel for longer flights is the fulcrum of the weight issue). We recently watched a 60 Minutes segment on battery-powered single-seat planes for traveling/commuting. So far, they have yet to fly for very long given the weight to energy challenge of their batteries. But we were assured that this was only a minor hurdle that would be overcome, although no one ventures a date when we would witness electric planes flying for hours.

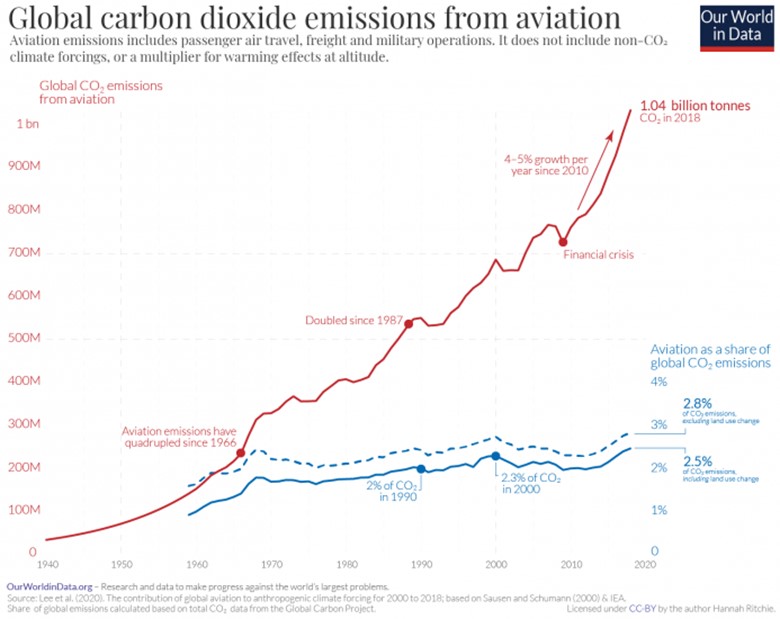

While aviation only accounts for about 2.5%-3.0% of global carbon emissions, the use of planes has become a highly contentious issue. The issue is driven by the hypocrisy of Hollywood elites and wealthy virtue-signaling politicians and businesspeople who harp on the need for everyone to adjust their lifestyles to achieve net zero emissions but then climb into their private planes to jet off to some luxurious vacation spot. Cleaning up aviation emissions is desirable and will happen in time, especially as people seek new technologies. The questions become when might breakthroughs happen and at what cost?

Exhibit 9. Aviation’s Carbon Emissions Some Call Critical For A Clean Future

Source: Our World in Data

A major U.S. government research effort is underway to develop sources of Sustainable Aviation Fuel (SAF). The issue is how to get the most energy from low-carbon fuels. A recent Houston Business Journal article highlighted the efforts of two startup companies, including one in Texas, developing SAF based on wood chips and wood paste. Arbor Renewable Gas LLC is building a renewable fuels plant in Beaumont, Texas. In their case, the fuel will be renewable gasoline, in which the plant will turn 1,000 tons of wood chips into 1,000 barrels, or 42,000 gallons, of gasoline a day. An Arizona-based startup is planning a fuels plant about 60 miles north of Arbor’s new facility. USA BioEnergy is planning to produce SAF from its plant. The game plans for both of these startups – one will be operating in 2024 and the other in 2026 – is to produce sustainable fuels that will be sold into the California market where the state has a Low Carbon Fuel Standard (LCFS) in place that rewards suppliers of low carbon density fuel (below the standard, which increases over time) with LCFS carbon removal credits that can be sold to fuel suppliers that sell fuels with ratings above the standard.

California data from the Energy Information Administration (EIA) based on Department of Transportation (DOT) information shows that in 2019 the state used 587.1 trillion British thermal units (Btus) of aviation fuel. There are 135,000 Btus in a gallon of jet fuel. This meant that for 2019, California uses 103.5 million barrels of jet fuel, or approximately the equivalent of one day’s worldwide crude oil consumption.

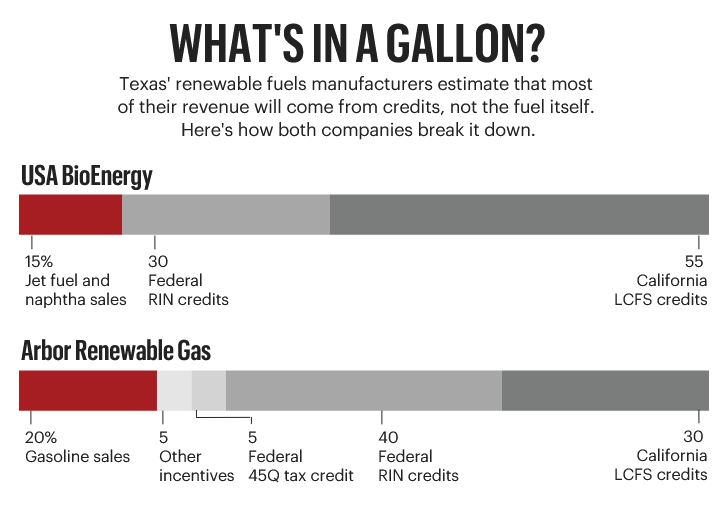

These sustainable fuels will not be particularly cheap because their economics are based on the carbon credits created, which are subsidies. As the chart below shows, the companies will generate most of their revenue from the credits and not the value of the fuel they produce.

Exhibit 10. The Economics Of Renewable Fuels Based On Wood Start-Ups

Source: Houston Business Journal

The renewable fuels made from waste wood emit very little CO2, which automatically gives the companies low Carbon Intensity (CI) scores. Arbor found that the biogenic CO2 by product from its production process contains about the same amount of carbon emissions as wood rotting on forest floors. By sequestering this stream of CO2 emissions underground for permanent storage results in the fuel receiving a negative CI score, meaning the entire process results in removing carbon from the atmosphere. By doing so, Arbor can earn valuable Federal 45Q tax credits.

If you have not been paying attention, there are several small to mid-size refineries that are being converted into renewable fuel plants, designed to capitalize on the push for renewable gasoline, diesel and SAF. The subsidies and tax credits play a key role in their economics, but the goal of society for a cleaner atmosphere, with the support of government policy, will drive these ventures. Determining their long-term success is speculative absent sustained government subsidies. The ultimate answer is whether their costs can be reduced and if less-costly alternative fuels arrive. We will be following these renewable fuel projects closely.

Oil Industry Needs Aggressive Defenders Like Toby Rice

The oil and gas industry looks like it has been in a ten-round heavyweight fight. Eyes blackened, cheeks bruised, eyebrows cut symbolize how industry CEOs are being beaten up by the media, politicians, and the public over high gasoline prices and being the source of substantial carbon emissions. There is little love lost for anyone associated with the fossil fuel industry. For politicians on the left and for many people in America, oil company CEOs are the scourge of the earth. They not only poison the planet, but they ignore the financial pain people are suffering as they are being price-gouged at the pump. But this is not 1974. We are not in the Republic of the Congo. It is not the “Rumble in the Jungle,” when challenger Muhammad Ali used his “rope-a-dope” plan against world heavyweight champion George Foreman to capture the title. Maybe oil and gas CEOs should adopt that strategy, especially in dealing with the political class.

For those not familiar with that fight, or the rope-a-dope technique, Ali allowed himself to be pummeled by Foreman while lying against the ropes that helped him to absorb the energy from the blows. As Foreman wore himself out with his punching in the early rounds, Ali came back and knocked Foreman out to win the title. As the oil and gas industry is beaten up by climate activists and politicians, we wonder if it has the resolve to come back like Ali and knock them out. Why is this important? Because there are few industry leaders who are willing to make a full-throated defense of the business and aggressively present the positive case for fossil fuel’s role in improving the lives and well-beings of the eight billion humans on the planet.

Nearly every day we hear demands from Washington and blue-state capitols for laws to penalize the industry for making “outsized” profits, while ignoring the larger profits of “woke” technology giants. These critics forget (or ignore) the record losses the oil and gas industry experienced during the past few years, while still producing cheap energy. The critics, who now demand more oil and gas output from the industry they have been attacking, ignore how their very policies have hampered the increased production they so desire.

Toby Rice, the CEO of EQT Corp., America’s largest natural gas producer, might become the industry’s Muhammad Ali. He learned the business literally from the ground up (starting work on a drilling rig). He and his two brothers built a gas producing company leveraging fracking technology and then sold it to EQT. When EQT’s management proved inept in managing capital, the Rice brothers waged a proxy battle and won control of the company. Toby became CEO and began redirecting the company’s exploration and development activity. More importantly, he has been unafraid to challenge the misguided policy logic of those Washington politicians who are intent on appearing virtuous by attacking the “price-gouging, excessive profits earning” energy companies and their CEOs. Let us hope the industry can find more leaders like Toby Rice – we certainly need them to combat the uneducated views of politicians who can either help or hinder the future of this socially and economically critical industry.

Contact PPHB:

1885 St. James Place, Suite 900

Houston, Texas 77056

Main Tel: (713) 621-8100

Main Fax: (713) 621-8166

www.pphb.com

Leveraging deep industry knowledge and experience, since its formation in 2003, PPHB has advised on more than 150 transactions exceeding $10 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.